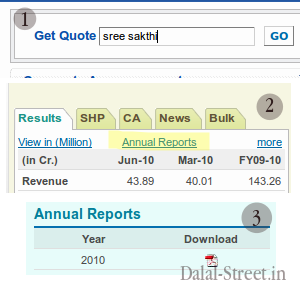

Sree Sakthi Paper (SSP) is the largest kraft paper producer in South India. The company is part of the Sree Kailas Group. Incorporated in 1991 with an installed capacity of 4,500 tpa the company has been growing steadily and now has a installed capacity of 1,00,000 tpa i.e.. 20 times in 20 years.

SSP has a impressive client list – ITC, HUL, WIMCO, Godrej, Mc Dowel etc.

What we like here is the high dividend yield of 7%+ and regular growth in the company. This stock might be offering the highest dividend yield in the market.

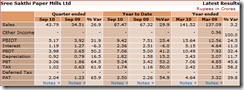

Snapshot of the dividend track record

| Year End |

Dividend % |

| March 2010 |

18.00 |

| March 2009 |

15.00 |

| March 2008 |

15.00 |

| March 2007 |

10.00 |

| March 2006 |

5.00 |

At CMP of about 25.50, if the company maintains the dividend of 18% declared last year, one will get a dividend yield of 7.05%. This is much better than FDs etc cause dividend is tax free in the hands of investors. Also as SSP is a growing company, one can expect a good capital appreciation.

Company came up with the IPO in January 2006 at Rs.30 when turnover was approx. 60 Cr while today the fundamentals are much better yet the stock is available below the IPO price.

Why the dividend of 18% may be maintained?

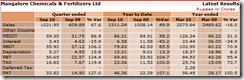

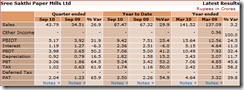

Very good half yearly results:

Company has already reported 30% growth in sales and 55% increase in profits for the first six months and the second half is expected to be better. So there is a high chance of the company maintaining the past dividend track record or improving it further.

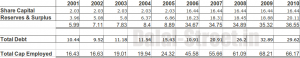

Strong Fundamentals:

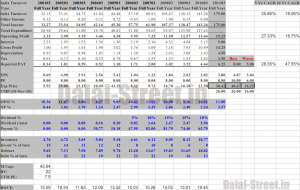

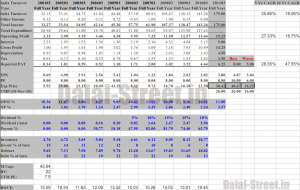

- Over the last 5 years, sales have grown at a CAGR of 26% from 57 Cr in 2006 to 143 Cr in 2010. This year, the sales are expected to cross 175 Cr.

- Stock is available at PE ratio of 7.25 based on trailing twelve month earning.

- Company has a good BV of 22.20.

- Co has already announced a 8% interim dividend. Stock is trading ex-dividend.

Conclusion:

This stock idea may be used as a safe bet to balance cash portion of the portfolio or to park the profits.

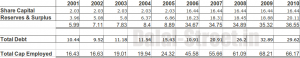

Financials

Company Annual Report @ reports.dalal-street.in