We discussed Avanti Feeds about a year back at Rs 35. The stock has been a multi bagger backed by very strong growth in revenues and profitability and is currently trading at Rs.145.

Financial Data of last 6 years (Figures in Crores):

| FY | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | CAGR |

| Sales | 121.74 | 102.83 | 73.00 | 96.16 | 207.75 | 393.41 | 26.41% |

| N.P. | 1.67 | 0.88 | (7.03) | (1.2) | 3.42 | 28.07 | 75.82% |

The reason for change in fortunes has been due to introduction of new variety of shrimps – Vannamei. Earlier Black Tiger variety was being produced which had lower density and hence higher cost of production.Vannemei is more remunerative for the farmers now.

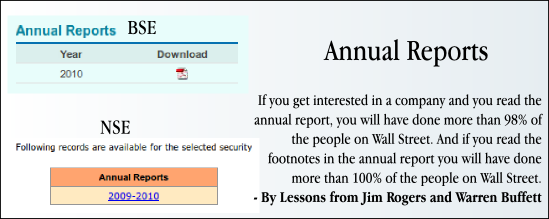

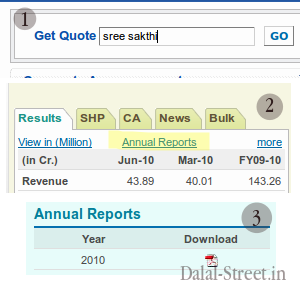

It was encouraging to go through the FY 2012 Annual Report of the company. The undertone is very positive and as per it, Industry is expected to continue growing at 20- 25% for next 2-3 yrs. Avanti is aggressively expanding its capacity in anticipation of the demand.

Key Highlights of the Annual Report – 2011-12 (Link to report):

- Thai Union Frozen Products PCL (TUF) holds 25.12% equity stake in the company. Mr.Wai Yat Paco Lee has been appointed as a director representing TUF. TUF is one of the largest seafood exporter company in the world.

- The overall Shrimp culture was very encouraging and rewarding for the company. Its the second consecutive year where the overall increase in the shrimp culture both in terms of water spread area and density of culture was by around 25%.

- The main reason being shift from Black Tiger shrimp cultivation to Vannamei shrimp cultivation.

- The improvement in the international prices for shrimps has also encouraged new farmers in taking up the shrimp cultivation.

- Strong sales growth by 125% in the Shrimp Feed segment. The processing and export division sales increased by 58.4%.

- It is the most preferred brand by the farmers due to maintenance of high quality and constant technical support to the farmers.

- The Government of India’s support and emphasis on Vannamei has also resulted positively

- First quarter of 2012-13 itself has witnessed overall growth rate of 20% of the industry

- The dividend has been increased to 65% from 10% last year.

Expansion Plans:

- It is in process of buying a land near Chennai to set up hatchery in collaboration with THAI UNION

- During the year the company has doubled its capacity by replacing old machinery with the new ones and constructed new godowns to handle increased volumes.The capacity has increased to 1,10,000 Mts p.a from 52,000 mts p.a.

- The shrimp processing capacity has increased to 8000 Mts p.a from 2720 mts p.a.

- As the demand anticipated by the company is slated for a big jump in a couple of years from now, further expansion would be needed as current capacities would be insufficient. Therefore, 4.94 acres of land near their current plant of Kovvur is already bought for expansion.

Risks:

- Dependency on climatic conditions makes it unpredictable. Natural calamities like floods, cyclones, during the culture season can have serious impact.

- Shrimps getting affected by virus and diseases also is a threat.

Our View:

The industry has had a poor past till 2008 but the recent changes in the industry are very strong and augurs well for the good players. Avanti Feeds is one of the biggest and perhaps the most efficient player with a significant tie up with worlds largest Seafood company Thai Union Frozen Products. TUF holds 25% stake in the company.

If the industry is to maintain 20-25% growth for next few years then Avanti has a good opportunity to capture a good business and make the most of it. We feel that the stock has potential and monitoring of performance is needed.