If you get interested in a company and you read the annual report, you will have done more than 98% of the people on Wall Street. And if you read the footnotes in the annual report you will have done more than 100% of the people on Wall Street.

– By Lessons from Jim Rogers and Warren Buffett

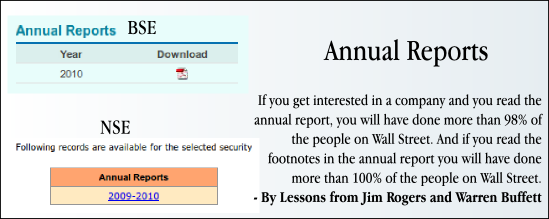

Recently the official websites of the stock exchanges have started providing the soft-copy of the annual reports for downloads. As the same has begun from this year itself, thus not all the annual reports are available on the websites, but the same is expected to be made available for most of the companies as the time elapses. At present the annual reports are available for about 30% of the companies.

The complicated way:

1) Using BSEINDIA website: Search for the stock on Bse India >> Select Annual Reports from bottom right corner (where the snapshot of financials is given) >> Select your annual report.

2) Using NSEINDIA website: Search for the stock on Nse India >> Select Annual Reports from extreme bottom of the page >> Select your annual report.

The Easier Way:

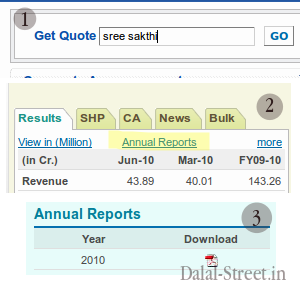

Use Dalal-Street Screener at: http://www.screener.in

To make it easy for you we have set up a small application which searches for the annual reports both at BSE India and NSE India as well as other sources and provide the download link 🙂 . Also, the search feature on both the above sites (BSE and NSE) is too buggy; to solve the same you can search for any part of the name OR even the script code (eg. 532701 for BSE Listed Company or MANGCHEFER for NSE Listed Company) on Dalal-Street Screener.

Do share any other site if any which provides free annual reports through comments. Also please leave your feedback for Dalal-Street Screener or any queries through comments.

PS: Earlier the link for the above web-application was http://reader.dalal-street.in. The same has been moved and integrated with our Screener app to provide even better functionality.