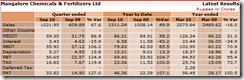

We had discussed about Mangalore Chemicals at our blog about in December, 2010 @ 37. Our interest was due to good results in first half and expectation of better times ahead. After a weak quarter of March (due to annual closedown and higher depreciation on impairment), the company has posted good set of results for June Quarter:

| Particulars | June 11 | June 10 | % Variation | FY 2011 |

| Sales | 583.45 | 489.29 | 19.2% | 2520.11 |

| PBIDT | 43.73 | 26.85 | 62.9% | 159.07 |

| Tax | 2.75 | 6.23 | -55.9% | 34.51 |

| PAT | 29.70 | 12.54 | 136.8% | 77.54 |

| EPS | 2.51 | 1.06 | 6.54 |

If one looks at the whole fertilizer sector, there is a lot of interest in these stocks as major reforms are expected. Agri related sector is doing well and with upcoming reform, investments should increase and better results should be seen.

We feel that Mangalore Chemical is one of the cheapest stock in the sector and stock at CMP of 32 provides a very favorable risk reward ratio due to strong fundamentals:

- Stock is trading at 5 times FY 2011 EPS of 6.5. For FY 2012, the company may do better than last year.

- Company has a good Book Value of 33. Stock is trading at less than Book Value.

- Co has raised dividend from 10% last year to 12% in FY 2011.

- Mangalore Chemicals is part of the Vijaya Mallaya group and M Cap of the company is just about 380 Cr.