Dear Friends,

RPG group has proposed the merger of the listed finance cos viz. CHI Investments, Summit Sec, Octave Investments, Brabourne Ent with RPG Itochu Finance. As per the preliminary analysis, I feel the scheme and ratios are unjust to the shareholders of CHI Investments.

There are two issues in this amalgamation:

1) RPG Itochu Finance Ltd shouldn’t be a blank company i.e. it should offer value equivalent to the value being offered by the merging companies. Explanation: We have been informed that RPG Itochu is having equity of close to Rs. 5 Cr without having any significant operations, assets or profitability on balance sheet. If so, it will reduce the current value of the merging companies by 50+%.

2) The swap ratios seem unjust:

The logic in all these four cos is: They are just holding cos, so the best way to value them is – consider the market value of investments they have and consider the exchange ratio accordingly, while RPG is trying to give benefit to Summit Securities which has the least value (refer column F below) among all the four listed companies.

Here is the calculation sheet:

| Merger Impact (as on 13th July) |

|

Equity

|

CMP

|

Current Mcap of Company

|

MV of Invest.

|

Ratio (MV of Invst/Mcap of Co.)

|

1 Share of RPG Itochu for

|

New Equity creation in RPG Itochu

|

Cost to shareholder in new co.

|

|

A

|

B

|

D

|

E

|

F = (E/D)

|

G

|

(A/G)

|

H = B*G

|

| Summit |

48.51

|

8.4

|

40.75

|

165

|

4.05

|

16

|

3.03

|

134

|

| Brabourne |

14.39

|

7.75

|

11.15

|

58.04

|

5.20

|

28

|

0.51

|

217

|

| CHI Investments |

11.46

|

28

|

32.09

|

258.80

|

8.07

|

6

|

1.91

|

168

|

| Octav Investments |

3.01

|

20

|

6.02

|

26.11

|

4.34

|

21

|

0.14

|

420

|

|

|

|

|

507.95

|

|

|

5.60

|

|

|

|

|

|

|

|

|

|

|

|

MValue of Investments per share in new company (436.93/5.60)

|

907.19

|

|

|

|

|

|

RPG group is trying to give more value to Summit Securities where the ratio of MV of investments to MCap of the company itself (i.e.. column F) is the lowest. i.e.. 4.05 times vs 8.07 of CHI Investments. So the company having the least value has been offered the best swap ratio (refer column H) and other companies i.e.. CHI Investments and Octave are being penalized L

The approximate damage to the shareholders of CHI is:

| Damage to shareholders of CHI Investments |

|

|

|

|

Earlier |

|

After Merger |

| M Value of Investments per share |

225.83

|

|

907.19

|

|

| Cost to shareholder |

28.00

|

(CMP) |

168.00

|

(As per merger ratio of 1:6) |

| Ratio (of Value of Investments per share) |

8.07

|

|

5.40

|

|

|

|

|

|

|

| Damage: |

33.05%

|

|

|

|

This is a clear case of unjust value erosion to the shareholders of CHI Investments. We should take the matter to the company and SEBI etc.

If the management’s intention is to just consolidate the cos into one company, why merge these into RPG Itochu?? Why not merge the other 3 companies into CHI Investments which itself is listed on both BSE & NSE.

At the bare minimum, they should revise the swap ratio for shareholders of Summit Securities to 1:56 from 1:16 (Logic: CHI holds value 8.07 times while Summit has value of only 2.31 times so swap ratio for Summit should be 2 times more than current ratio). Ideal swap ratio for Summit Securities should be 1:40, if swap ratio for CHI is 1:06, to bring the shareholders to the same level.

Management should provide details on RPG Itochu and the rationale for these swap ratios.

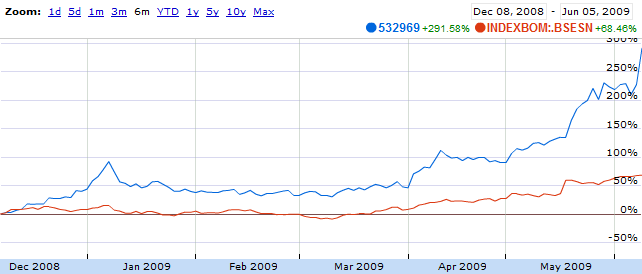

If the swap ratio gets corrected it will result into value-unlocking for CHI Investments.

Assumptions:

- All calculations have been done considering RPG Itochu finance to be a new company created for the purpose of merger or having a very small equity capital.

- I haven’t considered the value of unlisted investments in the above companies (they are less than 10% of the total investments).

- Haven’t considered the impact of merger of Instant Holdings with KEC, which is a subsidiary of Brabourne Enterprises.

P.S. There were few updates on the Value of investments in the companies the effect of which has been updated on 26th July 09.

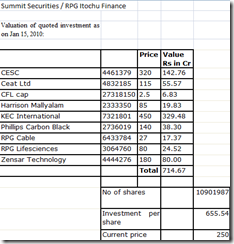

UPDATE: The most important question in this amalgamation scheme is – What does RPG Itochu Finance Ltd has to offer ?

As per recent updates, it has been known that RPG Itochu Finance Ltd is having an equity of close to 5 crores with no significant operations. If so, then this merger will reduce the value of merging companies by 50+%. The effect of the same is not reflected in the tables above.