A week back we had mentioned about Facor Alloys as one of our Mahurat Picks. The stock was in action today and up by about 16% to Rs 7.73. As the stock is crossing the level of Rs 7 after about 6 months, the action may have just begun.

First of all, I’ll like to thank Rohit for bringing to notice the merits in this company at his blog. He had discussed the stock about 6-7 months back, since then the company has posted much better than expected numbers.

Facor Alloys is in the business of chrome alloys, which are used in the steel industry. The industry is highly cyclical and the fortunes are linked to the steel industry cycle. South Africa is worlds largest producer of Alloys (60% share), over the last few years, India’s alloy industry has gained importance and is growing rapidly due to acute power shortage in South Africa.

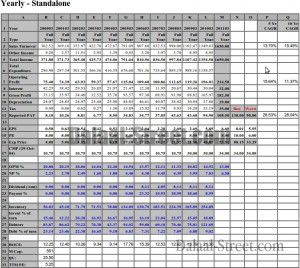

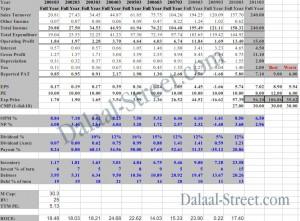

Over the last few years, the company has very well re-structured itself. The debt has been wiped off, preference capital paid off + the company now has excess cash on balance sheet of about 35 Cr + Investments of 15 Cr in unlisted group company. Hence excess cash + investments is almost 40% of Current M Cap of about 130 Cr and provides a lot of comfort.

We feel the stock is a valuepick at these levels of about 7-7.50 and a re-rating may happen in the stock. Several positives are:

- The chrome alloy cycle seems to have turned positive.

- Co has been growing steadily by generating cash from internal accruals. This year expected revenues are 400 Cr+

- Co has posted excellent Q2 numbers.

- Cash Equivalent on Balance Sheet is almost equal to 40% of Current M Cap

- The company has been paying a dividend of 15% for last 2 years (FV = 1). Hence giving a dividend of 2%+ at these prices.

- Stock is available at 1.2 times BV of 5.6

- Stock is trading at just 5 times TTM PE

Risks:

- Being a highly cyclical business, the earnings are highly volatile.

- Its a commodity natured business.

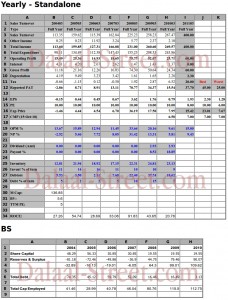

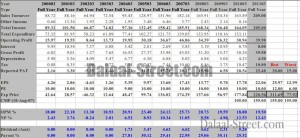

Company Financials: