“Its’ the work on your desk…It’s the work on your desk. Do well with what you already have and more will come in.” – Charlie Munger

Dear Friends,

This post is to bring an update and review of all the stocks discussed till now.

Performance till now:

| S.NO |

SCRIP NAME |

Date of Recommendation |

Price of Recommendation |

CMP |

Percentage Returns |

Remarks |

| 1 |

CHI Investment |

11-05-2009 |

25 |

45 |

80.00 |

Exit was advised earlier at higher price |

| 2 |

Shilpa Medicare |

26-07-2009 |

93 |

239 |

156.99 |

Hold |

| 3 |

Jaihind Projects |

02-08-2009 |

95 |

173 |

82.11 |

Hold |

| 4 |

Albert David |

25-08-2009 |

75 |

119 |

58.67 |

Book partial profits |

| 5 |

Siemens Healthcare |

14-09-2009 |

1100 |

1270 |

15.45 |

Exit was advised earlier |

| 6 |

Ahlcon Parentals |

28-09-2009 |

37 |

47 |

27.03 |

Hold |

| 7 |

Fresenius Kabi |

28-09-2009 |

80 |

120 |

50.00 |

Book partial profits |

| 8 |

Majestic Auto |

22-10-2009 |

68 |

62 |

-8.82 |

Hold |

| 9 |

Suprajit Eng |

26-10-2009 |

90 |

155 |

72.22 |

Hold |

| 10 |

IST Ltd |

16-11-2009 |

100 |

140 |

40.00 |

Buy |

| 11 |

Manjushree Technopack |

18-11-2009 |

32 |

46 |

43.75 |

Hold |

| 12 |

Asian Hotels |

01-12-2009 |

425 |

508 |

19.53 |

Buy on declines |

Individual Updates:

1. Shilpa Medicare: This stock has been a wealth-creater. The company has yet again posted excellent Q3 nos. Based on the same, the future looks bright and the stock is getting the attention of bigger investors (Read: ICICI Prudential mutual fund 🙂 ). On repeat or better financial performance, the stock has potential to reach 350 levels.

2. Jaihind Projects: The company has been doing well. As per a recent ET article, the co has to complete major projects by mid this year. One should continue to hold.

3. Albert David: This stock was picked as more of a value pick to park idle funds. One can consider booking partial profits.

4. Suprajit Engineering: The company has come out with excellent Q3 nos. The stock has also done well. To reward the shareholders, the management has proposed 45% interim dividend, 1:1 bonus and stock split. Though a bit aggressive than required, all these developments can take the stock to higher levels.

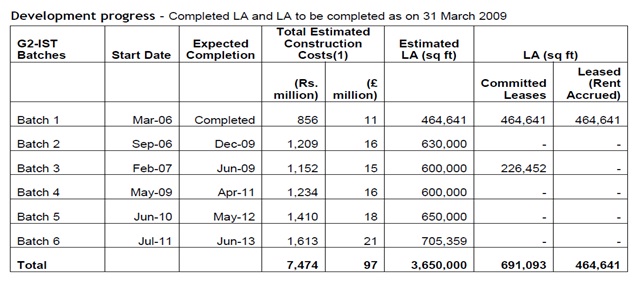

5. IST Ltd: As per the recent updates, the construction activities are going at good pace and co has built almost 10 lac sq ft of space. Leasing out of the same in due time will be a very positive development. If things keep going as per the plans, the stock has all the potentials of becoming a multi-bagger.

6. Manjushree Technopack: We have been providing updates in other threads.

7. Asian Hotels: Usually demergers create lot of shareholder wealth. So one should remain invested and look forward to buying on declines.

We are trying to bring some new picks from the Q3 nos. In the meanwhile some of my other favourite cos have come out with very good numbers and investors can consider them for investing: Balkrishna Industries & Poly Medicure.