“Don’t judge a book by it’s Cover”

This seems to be an apt quote in the case of Piccadily Agro (PAL). I had a look at this stock idea about a year back and was stupid to give it a go thinking it to be just another Sugar company. Since then the stock has tripled and yet looks to be a very interesting stock idea with lot of potential.

Piccadily Agro Limited started off as an Sugar company in Haryana and the performance paralleled to the cycles of Sugar Sector. In 2008, the company ventured into Country Liquor business and the same seems to have done wonders for the company. Have a look at the financial performance till 2007 and then since 2007:

Financial Performance till 2007:

Financial Performance since 2007:

Since 2007, turnover has been increasing at CAGR of about 33% and Operating profits have increased at a CAGR of about 68%.

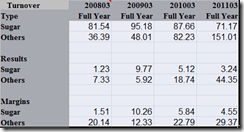

To understand the reasons for sharp increase in profits have a look at their segment results:

Since 2007, PAL has restricted itself on the Sugar Business, which wasn’t creating money for them. The growth has been coming from the Alcohol business which has been growing at about 100% p.a. for last 3 years. It’s remarkable that within 5 years, PAL has been able to achieve 150 Cr turnover in the Country Liquor business starting from scratch in 2008.

Another notable thing is the operating margins the company has been getting in the Country Liquor business. If the Operating Margins are to remain at around 20-22%+ levels then the business will become extremely attractive and a hue PE re-rating might happen.

Valuations at CMP of 46:

- For FY 2011, the company has reported a turnover of 220 Cr vs 170 Cr last year; Net Profit of 27.67 Cr vs 9.85 Cr last year.

- The stock is trading at PE multiple of just 4 based on 11.73 EPS of FY 2011.

- PAL has proposed a dividend of 20% for FY 2011. At CMP of 46, dividend yield is attractive at about 4.3%.

- The company has a BV of about 25.

Company Financials:

I hope you know that Piccadily is promoted by Jessia Lal’s convicted killer Manu Sharma’s family.

Hi Amkain,

Thanks for sharing your view.Yes, its a negative point. On the positive side – he has been convicted with life imprisonment and the matter seems closed now.

Talking about business, the company seems to be actually doing well.

Even though Manu Sharma did a really heinous thing. But investment and personal feelings are different. the same political connections that were tried to save Manu, would also work well to protect the “almost Unknown” business. So this might be, in a fiendish way, a very positive thing.

So is it a buy or not

but actually i hold this stock at cmp 35 of 700 shares with a price tgt of 250-300 in 2-3yrs

is it possible to achieve the tgt?

If the company is able to repeat the growth rates and operating margins like now, then trgts are very much possible.

Regards,

Hi Pratyush,

It might not be relevant to

valuations but it sends shiver down the spine to know who owns

Piccadily. Siddharth Vashishta alias Manu sharma owns 16% stake. He is

the son of Venod Sharma, the promoter of Piccadily.

Manu Sharma is the same man who killed Jesicca Lal.

Out of a universe of 8000 odd listed companies, there are some, where

one might not want to be a partner with the promoters no matter how

cheap the valuations look. This company will figure in my ” not to

invest” list.

Regards

Ankur Jain

Hi Ankur,

Thanks for sharing your view. I agree that due to the promoter thing, it will remain a negative point while investing in this company.

Regards,

You should bring these points upfront in your note itself as a background check on the management (which I believe is of utmost imp in todays time). Nice overall blog thou. Cheers.

Hi Aaroosh,

Thanks for the suggestion. I have been wrong on this one. Learned a lesson on the importance of mgmt.

Ayush

Have u done analysis on whether the other players are making these

operating margins in distillery business and whether they have been able

to do it over the cycle. From what I recollect distillery wasnt so

profitable for the other guys in the business over the last couple of

years.

Also the distillery busines is a by product of the sugar business.

So even if u make money on it, u tend to lose money on sugar which is in

a very bad shape both in terms if input costs going up and prices of

sugar remaining depressed.

Ninad

Hi Ninad,

I had looked at the nos of GM Breweries and Globus Spirits. Long term OPM for GM Brew has been at about 9% and for Globus it has been at about 15-18%. So it seems margins are higher in Haryana. Haven’t been able to figure out as to why margins of Piccadily are much more lucrative at about 22-25%. May be its to do with having a sugar mill along.

If you look at the Sugar business, they have managed it well. Over the last 5 yrs, the profitability has come down from Sugar segment but they have been in profit despite all the negatives in the industry. May be its due to controlled operations in the sugar space.

Another though at my end is – There could be under reporting of nos in this industry but nobody would inflate reported nos in this business – reasons – heavy taxes. If you agree, then we should try understanding the reasons behind so good margins of Piccadily.

If one looks at their liquor business – then they have been growing at 100% with increasing margins. They are paying their taxes and paying decent dividends to shareholders.

Views Invited

Regards,

HI,

Even GM Breweries (largest country liquor of Maharashtra) is selling at a PE of 5. Market is clearly saying growth ll be -ve in future. What is the reason for this saying? Is it wrong? Why are country liquors selling at so low PEs?

Hi J K,

There are few major differences between Piccadily & GM Brew:

1. Growth rates for GM Brew has been around only 10% over last 4 years. Most of the cos must had done better. While Piccadily has been growing its liquor business very quickly at about 100% p.a. over last 3 years.

2. OPM of GM Brew is at about 9-10% while OPM of Piccadily is at about 20-25%.

Both the above factors are based on past history. Returns will also depend on growth in coming years.

Regards,

Hi Ayush,

A few queries…

1) No doubt growth rate and margins have been really good for piccadily. Will it be nearly same in future? If yes, Why?

2) Do they have liquor brands in Haryana? If yes, can you please name them. (No website makes me ask this).

3) Do you have previous annual reports.. prior to 2010?

4) Management, i feel is positive thing in long term for this company. After some years, market ll forget that Manu sharma story. What ll remain is management’s contacts. Agree/ Disagree?

5) Have you talked to the management/ attended AGM?

Thanks.

Hi JK,

Its impossible to predict the future. One can only make some expectations based on the past track record. Over the last 4-5 years, the company has had consistent strong margins and robust growth. Add to it, the co paid dividend of 10% in 2010 and then 20% in 2011. So the co seems confident on the business model.

Yes, have gone through annual reports since 2008. If the business can be scaled up with current ratios and profitability then markets should give weightage to earnings.

No, haven’t spoken to the Mgmt.

Regards,

Hi Ayush,

Can you please mail me the annual reports for 2008 and 2009. Will be highly thankful to you. My mail id is jkalra1@gmail.com.

@gmail:disqus Thanks

A few concerns Ayush,

1) Growth in country liquor is slow.. how long will piccadily be able to maintain such high growth?

2) 60 klpd is installed & licensed capacity i.e 24.33 lakh cases per annum (1 case= 12 bottles of 750ml). Company is selling more than that since 2009. How?

Hi JK,

1. Till now the growth of the company in the country liquor has been fantastic. Yes, there is a limit to which they can grow in this segment. But then, if they have a good business which is generating cash, they can move up the value chain also..like IMFL etc.

2. A google search will throw results that the co has expanded capacity to 90 KLPD.

Regards,

Hi JK,

Few more thoughts:

As the valuations seem to be cheap at current levels, we aren’t banking on high growth rates for future.

Look at the valuations – stock is trading at a PE multiple of about 4, P/BV of less than 2 and div yield of about 4%.

As the data on the co is limited, its tough to have clarity on future.

Regards,

Hi Ayush,

Check AR 2010, page 26, Distillary licenced capacity is wriiten as 60klpd and production cases is 37.95 lakh cases. 1 case= 12 bottles of 750 ml each. That means they operated at more than 150% even assuming all 365 days working. Producting more liquor can land them into trouble. No?

http://food.industry-focus.net/index.php/breweries-and-distilleries/124-piccadily-agro-industries-to-expand-its-distillery-at-bhadson.html

This link says capacity now increased to 90klpd but also says operating days of 270.

Am I wrong somewhere? Views please.

Hi Anubhav,

We need to have industry knowledge also to understand the significance of the installed capacity. It would be quite un-probable for someone to continue production at higher than licensed levels for long period.

The inference from this data could be-

1. The company is witnessing demand stronger than they expected. This would be a positive sign.

2. In near term, the growth may slow down due to capacity constraints.

Regards,

moving towards IMFL wont be a problem since they already are in sugar industry, they will have benefit of getting molasses at lower cost.

Hi ayush,

any chance of getting management views on PAL ??

as per their site they comment…

The company is planning to set up a 10 KL per day Malt Spirit plant to produce Malt Sprit made from Barley. The company is setting up a food grade CO2 plant supplied by Wittaman of USA. Co2 will be recovered from fermentation process and compressed in cylinder.

Besides this the company has also obtained a license for setting up a Brewery with a capacity of 3,00,000 HLPA expandable to

5,00,000 HLPA.

Hi Jatin,

Please give link to their website.

http://picagro.com/

Hi Jatin,

Thanks for the link. I tried understanding about the future expansion etc…it seems the co has ambitious plans for the IMFL sector. Though risky but if they are successful, it opens up a big market for them.

This is a very exciting and growing sector and good players will be rewarded.

Regards,

Have you received 2010-11 AR????

No. Awaiting for the same.

This stock seems to perform better. Management is taking all right steps since last 2-3 years. Still grossly undervalued compared to its peers.

This stock was recommended by couple of websites too as a Hidden Gem stock.

http://www.saralgyan.in

results out ,

Interests eating lot of pft !!eps 1.16 vs 2.5 yoy

Hi Jatin,

Yes, this qtr has been a bit weak. As topline is steady, I would suggest looking at next qtr results to get better idea.

Regards,

Dear Ayush Sir

I have gone through the results of PAL and realised that sales have rose by just 30% but the total expenditure have rose by 52% . Hence there is erosion of profit.Let me know your views.

Hi Vipul,

It could be a seasonal variation also. The last qtr was too good to be true and hence it might be a balancing thing.

In small caps, there can be high volatility in earnings on a qtr to qtr basis.

Regards,

Hi Ayush

Do you recommend accumulation at the CMP 33. The stock has corrected heavily.

Hi,

Not an accumulate at current levels as the latest qtr result hasn’t been good and we can wait for more clarity. But yes, some buying can be done. The stock is cum-dividend of Rs 2.

Regards,

what is the record date ?

The record date hasn’t been announced

hi did u recieve their annual report ? only 10 days left for their AGM !!

No, haven’t received the same. But its the same with most of the other cos also.

Waiting for a soft copy of the same.

I am very bullish on stocks because of not only nearly 1% stake hold but these sector good prospectus knowing 50 % Indians are under 30 . Presently stock is avaialble very cheap value. I did not find any stock on BSE at 28 which has declared dividend 20 %. Presently I am in US and last year dividend returned due to lock on home .But I called company when my mother returned back to India and company send Exchequer by courier ASAP.I am trying to say that Corporate Governance is satisfactory which is currently big issue for us as investor. Thanks !

Thanks for sharing

Dear Ayush

What do you suggest for this stock after Q2 results?

Can we accumulate more during these corrections with the view that expansion will bear the fruit by next quarter?

Hi,

I haven’t come across the results. Please provide the details.

Hi Ayush

I try t search but couldn’t find the result.I thought today correction may be due to the Q2 results.It seems someone know already the q2 results and thats why stock is down.

Here is the result

http://www.moneycontrol.com/livefeed_pdf/Nov2011/Piccadily_Agro_Industries_Ltd_141111_Rst.pdf

Hi Ayush

Any comment on the result of future of this company?

Shall we buy on dips and if yes at what price?

Results are bad. Stock price has already reacted in line.

We should try to find if this decline is due to some temporary reasons or not. If yes, then its a good opportunity for long term.

Hi Ayush,

How to play with this on current scenario.

Hi Vivek,

Yes, the stock has taken quite a beating. The way to invest in such cases is – have patience and nibble into the stock from time to time. Wait for a positive clue to come in like – turnaround in nos etc, before increasing the exposure.

At current levels it does seem to have value as the stock is trading at 40% discount to BV itself.

Hi Should we re-visit this stock now. I have 1000 at 46-47 . Is it wise to average it below 17-18 and wait for 1 year for a price of 50+

Hi,

Yes, one should average in parts (like SIP). Perhaps keeping a close watch on quarterly nos will help in timing it better.

Hi Ayush, Piccadilly agro has declared very good result for mar 12 quarter. Net profit increase to 1220.97 lacs from just 34 lacs last quarter.

Do you suggest to add more at these levels?

Yes, the nos are good and one can aveg down at these levels. But these nos may not be repeatable as the sugar division has contributed 50% of profits.

Thanks Ayush.

Considering 50% contribution from sugar division for this quarter isn’t these good news as we can expect good turn around for the sugar sector companies as such in near future.

Yes, sugar cos have started doing well and may be the sector will do well in coming times also but as its a highly cyclical sector one shouldn’t bank on the contribution from the same.