Its results season again and a good time to monitor and shuffle your portfolio. Like we used to have exams earlier, similarly its result time for the stocks we invest into.

In the mid/small cap space hardly 10-15% of the companies have come out with their numbers. Till now the results have generally been on the softer side. The companies are growing but there is lot of pressure on the margin side due to inflation and other factors. Some of our companies which have come out with numbers are:

ABC Bearing – Company has posted very good numbers and it seems the expansion we had talked about in our initial post has finally kicked in. At current market price of Rs.150, the stock is trading at about 6 times FY 2011 earnings. Continue holding.

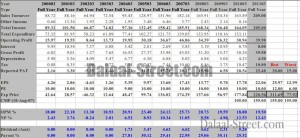

Balaji Amines – The numbers are below expectations. Though the topline and operating profits have grown inline with the expectation, but margins have gone down + interest cost have increased + company has provided for a lot of taxation. For the full year the turnover has increased from 262 Cr to 355 Cr and Net Profit has increased from 20.64 Cr to 25.40 Cr. At current market price of about Rs.41, stock is trading at 5 times FY 2011 earnings. We advice a hold at current levels.