Usually most of our discussed stocks are mid-caps whose merits are generally unknown to the masses. Whenever there is coverage of these stocks by Media…they get due attention and often do well. Some of our stocks got wide coverage in last few days:

1. Asian Hotels:

Will Asian Hotels’ shareholders gain after its demerger into three separate companies? Recently, the company split into three different entities — Asian Hotels (North), Asian Hotels (West) and the Asian Hotels (East). Right now, only Asian Hotels (North) is being traded on stock exchanges, and going by its current market capitalisation, the gains to shareholders look uncertain. The other companies are awaiting regulatory approvals to list next month

http://economictimes.indiatimes.com/articleshow/5829815.cms?frm=mailtofriend

We had covered the demerger story at our blog here and covered the demerger impact here. One of the demerged company – Asian Hotels (N) has already got listed and given better than expected returns.

Our View: The above economic times article is very well highlighting the reasons why this demerger is creating value. We do expect the other to companies to list well and provide better gains than the calculations done at our blog earlier.

2. Shilpa Medicare:

The bulls have taken fancy to the Shilpa Medicare — a small-sized pharma company. Its price made a record intra-day high of Rs 362.50 on Tuesday after rising by more than eight times over the past one year. News of financial institutions buying a small stake in the company along with a dilution by the promoters has fuelled the recent rally in the stock.

http://economictimes.indiatimes.com/markets/stocks/stocks-in-news/Shilpa-Med-appears-fully-priced/articleshow/5814072.cms

We have covered Shilpa Medicare several times at our blog. Initially it was covered at Rs 80 here.

Our View: As the article points out – the stock is not cheap, yes we agree but we also believe that good stocks don’t trade cheap 🙂 It would be tough to find a company having leadership position in Oncology segment, having operating margins of 30%+, growing at 45% CAGR available at less than 20 times PE. Infact if one takes a close look at last two quarterly nos of the company, the stock is trading at just 15-16 times annualised earnings.

Also if one increases the outlook to more than 1-2 years, the company has a good future. They are putting up new capacities and plan to double their turnover in 2 years.

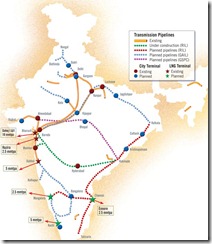

3. Jaihind Projects:

We had first covered this company at our blog at about Rs 90 here. The stock has done exceeding well and has created a new all time high of 265 today. The company has been getting coverage on various business channels and people our discovering the underlying story.

4. Balkrishna Industries (Update):

Balkrishna Industries Limited (BKT) specialises in the production of tyres for off-road applications, including agriculture, industry & construction, earthmoving equipment, ATV and lawn & garden vehicles. http://www.tyrepress.com/News/77/19257.html

Our View: This is one company which has a fantastic track record and aims to be a 1 billion dollar company by 2015, which is quite possible looking at the business model of this company. In long run, the stock can give superb returns if they continue to grow as per their plans.

We believe that for better wealth creation investors should keep looking for undervalued and growth oriented stocks and invest in them at an early stage. This is the place where maximum wealth is created. We have been continuously working on this area. Would request the readers to keep exchanging ideas and keep spreading the logics to other investors.