IST Ltd is little known and highly undervalued real estate story.

The company has 28.41 acres of land at Dundehra (Udyog Vihar), Gurgaon, at a distance of 5 Kms from New Delhi International Airport.

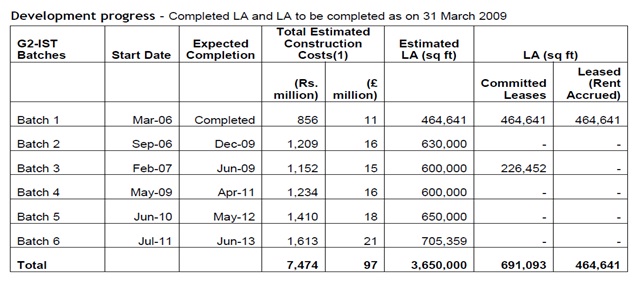

The company had tied up with Unitech Developers & Projects Ltd (‘UDPL’) to develop an IT SEZ. The project is designed to have total leasable area of approx 3.75 million sq ft. As per the arrangement, UDPL will develop and market the property and incur all the costs while IST will get 28% of the total rentals.

The highlights of the project are:

- It is one of the first IT SEZ in Gurgaon

- The location is good and the early occupants are Amdocs, Bank of America etc.

- 12-15% of the project is already leased out and the next phase of construction has started.

- The funding is already in place, so execution is not an issue. IST is also a debt free company.

- As the project is a SEZ, the incomes are tax free.

- For details visit : http://www.unitechgroup.com/commercial/infospace-sector21-gurgaon/index.asp

Project Progress and plan ahead:

Risks:

- The SEZ project is being executed through the co’s wholly owned subsidiary Gurgaon Infospace Ltd.

- The stock is highly illiquid.

Current Valuations:

As the company has already leased out 4.64 Lac sq ft, IST has been already receiving close to 10 Cr as annual rental income. Co is in process of constructing another 12 Lac sq ft by mid of next year. If things go as per plans, IST would be earning a rental income of 35-40 Cr in next 1-2 yr.

At CMP of 100, the company is available at an M Cap of less than 60 Cr. Even on conservative valuations, the company has potential to earn 60-75 Cr of Net Profit every year once the project is totally leased out. So if things play out as per plans, this company has all the potential to be a multibagger in 3-5 years.