Dear Friends,

Steel Sector has been witnessing a lot of price hardening due to both input price rise and demand. Stocks of this sector are finding interest.

One company which has good fundamentals and looks interesting is – Sunflag Iron & Steel. Sunflag is part of the Bhardwaj group having presence across 6 Countries in 3 Continents. The company manufactures high quality alloy steel which finds usage in Automobile Industry and Infrastructure sector.

The company has grown steadily over the years and should be able to post a turnover of close to 1300 Cr this year- FY10. Over the last few years, company has tried to go for backward integrations – for eg: expanding of captive power plants, acquiring coal blocks etc.

Attractive Valuations:

1. Stock is available at 7 times expected FY10 earnings.

2. Stock is trading at just 3 – 3.5 times FY10(E) EBITA margins.

3. If one analyses last few quarters, it seems the effect of backward integrations are fructifying and if the company can continue the same, the company may be on its way for yearly net profits of more than 100 Cr.

Another positive is – increasing shareholding of promoters (from 42.39% to 49.03% within one year).

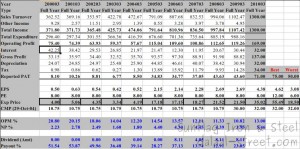

Financial snapshot: