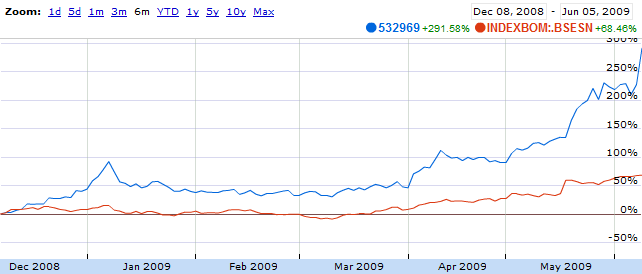

CHI Investments has hit an another upper circuit closing at Rs.44.25. What a wonderful ride it is going on.

We recommended CHI Investments on 15th May on this blog, when its price was Rs.25.

CHI Investments may reach Rs.70 in near future and the old investors should start reducing their average costs (and enter into other value picks). However, we still recommend in holding a major part of the stock for a long term.

The real beauty of the stock is that it is still discounted at around 85% as KEC (forming 50% of its portfolio) too has seen a similar price rise. Seeing the recent trend, it wont be hard for the stock to reach the optimum levels and reduce the discounting.

Keep circuiting up CHI Investments!