We are always in search of undervalued and under-researched mid/small caps. Pondy Oxide appears to be one!

Pondy Oxides and Chemicals (POCL) is one of the India’s leading metallic oxides and plastic additives producers. Its products are Zinc Oxide, Litharge, Grey Oxide & Red Lead. These products are used in battery industries and automobile sector. India has been witnessing a steep growth in the usage of Lead consumption due to sharp rise in use of Lead acid batteries in automobiles, invertors and UPS. POCL specializes in refining of Lead and related metals.

POCL extracts lead and other metals from scrap batteries and re-uses the same after refining. POCL has been able to refine Lead to 99.99% purity through its R&D department. This form of lead is being imported in India for manufacturing of VRLA batteries.

POCL has a impressive growth track record – the company has been grown from just 20 Cr turnover in 2001 to 230 Cr in 2010. Still the company is available at a M Cap of just 30 Cr.

POCL has 3 business segments – 1. Metals 2. Metal Oxides 3. Plastic Additives

The company is one of the major player in the Metal Oxide Segment. It ranks among the top 10 players in India.

The company claims to be having a 30%+ market share in Plastic Additives segment in India. POCL has been innovative and develops new products through it’s R&D department to stay ahead of the competition.

POCL caters to the top players of the battery industry – Exide Ind, Amara Raja, HBL power etc.

Trigger:

POCL has a subsidiary Lohia Metals Pvt Ltd. The company holds 51% stake in it. In FY 2010, the company did about 75 Cr of turnover and posted a NP of 6.50 Cr. Therefore on the consolidated basis POCL is having an EPS of 12.25 vs EPS of 5.74 on standalone basis.

Valuations at CMP of Rs 30:

- The company has been growing at a CAGR of 30.69% for last 10 years. Turnover has grown from 20.81 Cr in 2001 to 232 Cr in 2010.

- The stock is available at 1.2 times standalone BV of about 25 and 1 times consolidated BV of 30.

- The stock is trading at a PE of 5 on standalone earning and a PE of just 2.5 on consolidated earnings.

- POCL has a fantastic track record of consistent high dividend. The stock is still available cum dividend of 12%. Giving a high dividend yield of 4%

- The company has posted a very strong Q1. The standalone turnover has increased from 26.51 Cr to 60 Cr. If the company is able to repeat the trend, POCL may be able to do a turnover of 250 Cr vs 150 Cr last year on standalone basis.

So here is a strong growing company available at cheap valuations.

Risks:

- Being a metal sector company, it is prone to risk of high volatility in metal prices. For eg in 2008-09 when the metal prices tumbled sharply, the company had to suffer inventory losses and the profits were wiped out for the year.

- As per FY 10 Annual report, company has raised loans for expansion hence Debt Equity ratio is high at 2:1.

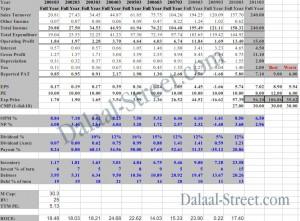

Yearly Consolidated (Valuation Sheet)

Yearly Standalone (Valuation Sheet)

I had a question, I really like the ideas which you guys come up with. I am a newbie investor, wherever I read, people say you shouldnt have more than 10 stocks in your portfolio, now i like all your ideas, my question is if you are coming up with some idea you must be investing in them too, so how many stocks will you keep in a portfolio ? I am not sure if its a silly question to be asked.

From your ideas and my budget, I really like BNK, Welspun, Harrisons Malayalam Limited.

Regards

NP

There you have given two types of EXPECTED best price viz. CONSOLIDATED and STANDALONE.

Which one is the future TARGETTED price for the scrip?

Hi Madhu,

the prices given there are just an indicator as to the potential of the

share and the margin of safety. They are NEVER THE TARGET price.

Also, our purpose is long term investing, so it may take (and usually does

take) time to reach those levels. Thus by that time, the new results are out

and those sheets get updated with new price ranges (again not the targets).

As given in the “Damodaran on Valuation” that Value of a Stock is never a

particular price, but a range.

Best regards,

Pratyush

Sir,

Out of the many stocks discussed by you, which are OPEN and which are CLOSED at present? i.e. have you advised EXIT in any of the stocks discussed so far as at the time of recommendation these were long term BUY?

the nos look quite good. how did u ascertain the market share for the company? From the balance sheet perspective this company doesnt seem strong. Also whether having 30% market share help thhem keep competitors at bay. I mean can it be said that it has the competitive advantage of scale in its niche market.

Same questions i would ask for gujarat reclaim???

Dear NP,

As you are a newbie investor, we would recommend you to lay your hands on various ideas. Do invest in what you like. Increase your exposure as and when you develop more comfort.

We also keep more than 50 stocks in our portfolio though 10-15 of them form the core portfolio.

As WB said – a new investor should try to read as many annual reports as possible…then only one will understand what is better and what to avoid.

Regards,

Madhu,

We have been planning to put up an excel sheet where all the updates can be provided. But it is taking some time.

There are few ideas where the stocks have done quite well and profit booking was done – CHI, Albert, Siemens Healthcare, Ahlcon, Fresenius Kabi, Asian Hotels, Majestic Auto.

Regards,

Hi Guys – Again an excellent job. I am doing my own check before putting money on this idea.

I am also checking HBL Power systems and just finished 09-10 annual report. I am looking for negatives about the company, particularly about the management. Have you ever researched this company? Any comment / view on this company?

Thanks in Advance

Prashant

Ayush,

Thanks for the info on this stock. I am taking a small position in this stock and plan to track it from now. Thanks for sharing this idea.

By the way, I am interested in your view on the following stocks which I currently hold – Educomp, Shriram Transport Finance, Finance Technologies.

Hi Prashant,

Yes, I have tracked HBL Power. Though their past track was very nice but the company hasn’t been doing well since last 1-2 yrs.

The margins are falling…debtors are increasing etc etc. May be all this is due to tight margins in telecom sector.

Also I came across an ad of Exide where they claim to have introduced new kind of batteries which are much more efficient and cheaper than the ones used currently. If so and if HBL is not able to fight the competition the long term can be negative.

Regards,

Ayush

Dear Ayush,

Thanks a lot for the inputs for the company. I still have some concerns like:

1) Company is Overleveraged. For a small size company i see that as a very negative sign.

2) Promoter holding 38%. Dont you think that should be a concern?

3) It is more of a family managed business. All 6 Bansal’s are Executive Director. Bit of a concern?

Would love your thoughts on the same..

Hi Ayush/Pratyush,

As i have joined your blog few months back and really love the way of analysing the stocks.

While going through the Archives i found one idea which attracted me is ‘IST ltd’.

My query is can i still enter this stock @ CMP ?

Regards,

Vikas

Hi Ayush,

One more question…i need your guidance on Bharati Shipyard.

I currently hold 200 shares @ 300rs of the same…..Shall i accumlate/hold/book loss.

I bought this because of great offshore accusation by the same.

Regards,

Vikas

Yeah, IST still holds value.

Sorry, I haven’t been tracking Bharati Shipyard.

Hi Viraj,

Yeah, the concerns are there. But our main logic is the deep undervaluation and the possible growth ahead.

We came across a business standard article wherin the co is targeting a 500 Cr turnover by 2012. So it may be the co has taken the debt route for the expansion.

Regards,

Hello,

Is is possible for your guys to create a latest performance update for all the stock recommended and their status, like you did here https://dalal-street.in/update-on-q3-nos/

It would be helpful to make decision.

Regards

NP

My small caps picks are Ankur drugs quoting at 3.5 x expected EPS of Rs 40/- and P/b of less than 1, BNK cap 75% discount to its holding in CESC + broking business free, Uflex a fast growing company below expected P/E of 5, Accurate transformers at a P/E of lessthan 5 and p/b value of lessthan 1. My actively tracked stocks stocks like Tide water , SBT, SBBJ, Jindal poly have just delivered near 100% profits in a months time.

Reply to rareinvestor:

Lot of stocks mentioned except Tide water , SBT, SBBJ have serious corporate governance issues. Uflex and Accurate are also linked to market operators. Be careful. They might give good return in high markets, but can lead to steep losses in inevitable downturns.

Will try to post the same.

The better way to discuss your ideas will be to email them to us or give your logics while discussing the ideas. In bull runs many cos manipulate nos to show low PE ratios etc and trap investors.

Regards,

Hi,

I would like your inputs on “Natural Capsules”.

Its a very simple business to own with long term view. Capsules have been there for generations and should be there atleast for a decade.

It operates in a sector which will have huge potential in future.

Its the leader in this sector. I found out only one listed player – “Medi Caps”. Would like to know if there are others.

Clearly in comparison to “Medi-Caps”, “Natural Capsules” does better which have maintained a Return on Long Term funds of more than 25% consistently for 5 years.

Natural Capsules is available at around 4PE which is usually not the case in this type of market.

Management does not say much. I like such managements. No propaganda.

Most unique is the simple business model. As Peter Lynch said – “Its better to own a business which even a idiot can manage, since sooner or later an idiot will manage it.”

It has a debt but negligible.

Please let me know your inputs on the same.

Hi,

We had bot natural capsules at around 23-25 and booked profits at around 45 levels.

These can be valuation gap or re-rating plays but not strong long term picks caus the entry barriers to this industry are Nil and also it is a very high volume but very low margin business. It would be tough to have any competitive edge….also scalability would be an issue.

Regards,

hey ayush, thanks for making the bizness of investing sound fun again!!!

i recently came across this potentially undervalued t-group stock called teesta agro

cash per share-rs.50

free cash flow per share-rs70

income per share-241

p/e -5 (if u use the adjusted cash earnings per share)

cmp-rs20

promoter holding-36%

1 negative development-preferential issue of 5,30,000 shares to the existing 40 lakh shares

1 positive development-it will start paying a dividend this year

would love to hear ur thoughts on this…..in case u r able to find the annnual report pls dont think twice before emailing it to me at shravanrayhaanpaul@gmail.com(sorrry for this, but im a bit desperate)

eagerly awaiting ur rsponse,

rayhaan

p.s. if u can pls check out waterbase too, loooks reallly cheap by free cashflow (cmp-4 fcf -9 acccording to 4stocks)

Hi,

I do track Teesta Agro and like the stock. May be the change in govt policy for the fertilizer sector should be a major positive for the stock.

The cash on B/S may be a one time thing in FY 09. Still the co has a very high BV of 70.

I think the BV keeps rising but not the EPS due to their accounting policy. They have been crediting the Govt Subsidy directly to the reserves instead of routing through P/L.

One should make entry to understand the co better. I’ll email the annual reports.

I don’t track Waterbase.

Regards,

Hi Ayush,

This sounds like an excellent opportunity. Can you tell what are the possible risks. Is there there is any uncertainty about the stock – some unresolved issue impending event? or is there a possibility that something in the books is not clear which could be misinterpreted s making this stock look so good?

Can you also please send me the annual reports

Hi,

The risks are – the reported NP is not much as the co is not routing the subsidy through P/L statement. Also as the co is still traded in lot of 100…hence it doesn’t catches attention of investors easily.

Regards,

Hi!

But that still means that the company is earning well though not reporting it as profit. And it is still fundamentally good.

The subsidy would still show up as cash at bank right?

Yes,

It may show as cash or may get invested back in the business.

Regards,

Hi,

I bought a small position in Pondy Oxide. When I tried to get their results after the recently conculded GM, the links on BSE and Moneycontrol don’t work. Do you guys have any info?

The POCL.CO.IN website doesn’t open for me. I think SEBI should have rules around having proper website with mandatory financial information for investors section. What do you think?

I think you are not able to view the results on bse website due to some problem on the bse website itself (it seems they are making some changes)

Alternatively you can download the results from the company announcement section on bse website.

The co’s website is : http://www.pocl.co.in/ and it is very much working at my end. They have provided the March nos at their website.

Regards,

ayush your comments on pochiraju industries.it is debt free .trading less than half book value.

also had vimal oil.debt high.but appears to be good.dividend given is good

Hi,

I don’t track Pochiraju as had some concerns. Took a look at Vimal…though the co is doing well but the co is quite leveraged.

Regards,

Ayush

hi,

Can you explain the rationale behind using a PE of 10 for all historic periods.

Also the reason and logic for assuming such high PE of 8 , 12, 6 given the current PE which is around 6, dont you think the PE what you have assumed is very high and you being very optimistic in your calculations and because of that the expected price is shooting up.

Thanks

Hi Yogesh,

The PE mentioned for years till 2010 is not relevant. Its a constant figure which we fill up while preparing the excel sheet. May be we will modify it in future.

I think a PE of 6 is on the lower side and below that it will be a strong value pick. For a commodity sort of business like of Pondy, a likely PE multiple can be 8 for expected FY 2011 earning. The PE multiple of 12 is the best case scenario…that when lots of positives kick in. PE of 12 could be a possibility caus I read a interview of the MD in business standard – they are targeting to be a 500 Cr turnover co by 2012.

PE multiples are also probabilistic things one can choose a multiple as per his comfort on the company.

Regards,

Hi,

Thanks for the reply, well this stock seems to be working nicely in the recent past and congrates on that front and many other which you posted on the blog. Am sure all this is because of the detailed analysis from ur end, though u have just pasted the income statement analysis on the blog and i m sure that you also consider the balance sheet, cash flow, ratio and peer analysis before recommending it in the blog.

For the benefit of all the followers of this blog m sure everyone would like to learn and understand at the way you analyse things in the most simple way.

Thanks & Regard

P.S. : Here i am assuming that you do prepare detailes analysis apart from what you paste in your blog.

Hi Yogesh,

Thanks for the kind words. Stocks move on their own…a lot of benefit goes to the better sentiments and strong growth prospects in India.

Yes, we do a lot of work and discussions before discussing the stock ideas at our blog.

Thanks & Regards,

Dear Ayush,

If you guys track Compucom Software, could you kindly shre your views with us for better insight. I have been tracking this small Rajasthan player for quite sometime and am really amazed by their quality management and also their massive expansion plans. Would be a great help if you could share your views regarding this.

Thanks,

NS

Sorry, we don’t track the same as of now.

Dear Pratyush,

What is your opinion on Visaka Industries? Solid fundamentals and growth year on year for many years. Also it is very good rural consumption story. Govt subsidies and income generation plans should help them sell more cement asbestos roofs. Although this cannot be sole reason…the icing on cake is RJ has recently taken a stake in this company at around 1450-148. In fact all companies in this industry…Viska, Everest and Hyderabad industries are deep value pick, Interestingly none of them have big debt obligations and solid fundamentals. All are generating free cash flows and have pan India distribution network.

Hi Girish,

Yes, this sector has been doing well and holds potential. We had invested in Sahyadri Ind from this sector and got very good gains.

One limiting factor is that this sector doesn’t gets high PE ratios.

Regards,

Whats happening to shilpa medicare, Ayush? Should we hold/accumulate/sell? and when do you think their new capacities will come onstream?

The stock is consolidating well since the news of allotment to Baring Equity PE Fund. I think investors may hold on to the stock for long term gains.

Regards,

Hi Ayush,

I bought Pondy on my own instinct @ 37. After that I have searched in google for reference and found your web, where u have recommended at 30.

I have also bought shilpa @ 175 on my own instict, which u have recommended at 97.

As I came to know lil late regarding your web, please guide which stock i can enter at current levels from your ideas.

Please guide.

Hi Pulkit,

Most of the stocks which we have discussed at our blog have good value in long run. You can refer to the link : https://dalal-street.in/performance/ for scriptwise updates.

Do go through most of our other stock ideas also.

Regards,

Pondy Oxide is a very risky bet as it went as low Rs. 13 on BSE last year . It has been recently listed on BSE. Majority is owned by Public . Promoters have very low stake. Companies in India work on management perception not on fundamentals alone. Gravita India promoters will have 73% stake post issue .

Hi Guys,

I saw the recent results from Pondy Oxides. The PAT/ Total income is just 2%. Please share your perspectives on what makes this stock a good one consider this info.

Thanks in advance.

Hi Guys,

I saw the recent results from Pondy Oxides. The PAT/ Total income is just 2%. Please share your perspectives on what makes this stock a good one consider this info.

Thanks in advance.

Hi Madhav,

There are various ways of looking at things. I had been looking at valuations…i.e.. here was a company with an expected consolidated turnover of about 300 Cr+ trading at a M Cap of just 30 Cr(at the time of write up)

Regards,

Hi Ayush,

Pondy reached at 65 and came down to 47 . Can we enter at this level or wait for fall.

If you had bot earlier then one should avoid buying at higher levels and should participate in other ideas.

Otherwise one may start buying gradually from 45 levels and accumulate on declines.

Regards,

Hi Ayush,

How do you see the merger of subsidiary company Lohia Metals with the pondy?

Regards,

Manmohan

If the promoters do the valuation at a fair valuation then this merger will be very positive for the company.

Regards,

very great article.