MCF (Mangalore Chemicals & Fertilizers) is the largest manufacturer of chemical fertilizers in the state of Karnataka. MCF is part of the UB group and Dr. Vijay Mallya is the chairman of the company.

MCF has been a steady performer over the last few years and has been growing regularly at about 20% with stable margins.

The fertilizer sector as such is not a very attractive sector for investors as there are lots of Government policy influences and hence the returns are very much capped in this sector. But over last one year, the government has been bringing some changes and making better policies. There is also a small probability of Govt. decontrolling the urea sector.

What has aroused our interest in this stock? – the attractive valuations at which the company is available and the spectacular Q2 result by the company (though it may be a one time thing also).

Attractive Valuations (CMP 37):

- Stock is trading at just 5 PE based on trailing twelve month results

- Stock is available at 1.2 times FY 2010 BV and at equal to BV on expected FY 2011 results.

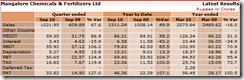

Stellar Q2 results:

IF the first 6 months of performance gets repeated, the stock will give excellent returns but a repeat of Q2 might not happen. A more likely scenario is – MCF might end up doing 2900-3000 Cr+ turnover with a Net Profit in the range of 75-85 Cr for FY 2011.

The interest cost have also reduced significantly and hence the company is in a very stable financial position. There is also is a possibility of the UB group selling out to a more serious player and may help in unlocking of the under-valuation.

In all, it seems to be a good low risk stock with high probability of better times ahead.

Financial Statements:

Company Website | Get the Company’s Annual Report @ reports.dalal-street.in

Hi Ayush,

Interesting pick, i had a quick look & observed a few concerns :

1. Promoter Holding is less at 30% & they have pledged about 65% shares . Any idea about this.

2. Debt in 2010 came down drastically to 100crs from about 300cr+ in previous year. Also interest cost in 2010 was about 23crs which translates to very high interest rate.

3. The company has very low margins of 1.5-2.5% btw 2006-10 . also ROCE has been on lower side though its improving.

4. Cash flow is quite erratic & -ve quite a few times.

Have you ever looked at GSFC ?? It looks interesting to me .

Hi Siddharth,

Yes, promoter holding is on a lower side hence there is a possibility of UB group selling out the co to a more serious player. They are in need of funds also.

100 Cr may be just an year end figure. The good thing is that the total interest cost has been falling consistently.

The operating margins have remained stable between 5.25 – 6% in last 5 yrs and NP margins have remained between 2.25-3%. In FY 2009 there was a one-time loss of 35 Cr due to marking down in the value of Govt Bonds….if one removes this one time item, the margins remain stable.

Yes, cash flows are erratic due to Govt policies….many often the Govt gives bonds instead of cash subsidy.

Yeah, GSFC also looks good and very much like MCF.

Regards,

Hi Ayush,

I think Mangalore chemicals can be picked depending on the investor’s objectives –

1) If the investor is looking at a huge upside/re-rating on this counter, I don’t think that will happen (and mostly due to reasons laid out by Siddharth above)

2) If the investor looking at gains of 20-25% on a annual basis, sure looks like a decent buy at these levels, esp given the normal monsoon that we’ve had this year.

@Siddharth

GSFC – I was analyzing this company a while back and this news item made me abandon further valuation.

http://timesofindia.indiatimes.com/business/india-business/Sick-GSFC-shies-away-from-BIFR/articleshow/174039.cms

Especially, this part – “All this goes to indicate that GSFC’s profits were inflated in the past and the company is now paying the price for these accouting manipulations. What will be the outgo in current fiscal, FY2004, towards payment of past dues ? This information is vital as it will have a strong bearing on the GSFC’s stock price movement. But, GSFC’s managing director was not even willing to listen to any questions posed by TNN.”

Although the article is a little dated, am not too sure whether the management/people behind the management have changed or not. I thought this was quite a red flag. Your take on this?

I thought Deepak Fertilizers looked pretty good. Although Fertilizers account only 40% of its total revenue (the rest coming from Chemicals), it works as a proxy for the Fertilizer sector along with the un-seasonal Chemical sector. Fairly good margins too. However, am not too sure of the trigger for a huge upside/re-rating from these levels.