Sree Sakthi Paper (SSP) is the largest kraft paper producer in South India. The company is part of the Sree Kailas Group. Incorporated in 1991 with an installed capacity of 4,500 tpa the company has been growing steadily and now has a installed capacity of 1,00,000 tpa i.e.. 20 times in 20 years.

SSP has a impressive client list – ITC, HUL, WIMCO, Godrej, Mc Dowel etc.

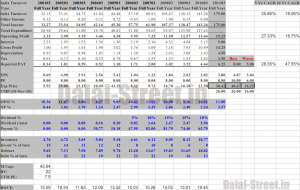

What we like here is the high dividend yield of 7%+ and regular growth in the company. This stock might be offering the highest dividend yield in the market.

Snapshot of the dividend track record

| Year End | Dividend % |

| March 2010 | 18.00 |

| March 2009 | 15.00 |

| March 2008 | 15.00 |

| March 2007 | 10.00 |

| March 2006 | 5.00 |

At CMP of about 25.50, if the company maintains the dividend of 18% declared last year, one will get a dividend yield of 7.05%. This is much better than FDs etc cause dividend is tax free in the hands of investors. Also as SSP is a growing company, one can expect a good capital appreciation.

Company came up with the IPO in January 2006 at Rs.30 when turnover was approx. 60 Cr while today the fundamentals are much better yet the stock is available below the IPO price.

Why the dividend of 18% may be maintained?

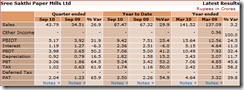

Very good half yearly results:

Company has already reported 30% growth in sales and 55% increase in profits for the first six months and the second half is expected to be better. So there is a high chance of the company maintaining the past dividend track record or improving it further.

Strong Fundamentals:

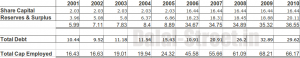

- Over the last 5 years, sales have grown at a CAGR of 26% from 57 Cr in 2006 to 143 Cr in 2010. This year, the sales are expected to cross 175 Cr.

- Stock is available at PE ratio of 7.25 based on trailing twelve month earning.

- Company has a good BV of 22.20.

- Co has already announced a 8% interim dividend. Stock is trading ex-dividend.

Conclusion:

This stock idea may be used as a safe bet to balance cash portion of the portfolio or to park the profits.

Company Annual Report @ reports.dalal-street.in

happy new year guys

will surely check out sree sakthi

wot r ur thoughts on money matters? sure appears overblown

https://www.blogger.com/comment.g?blogID=7004453&postID=6076962351348425232&isPopup=true

Hi,

Thanks for the wishes and all the best to you to.

Regarding money matters, as the promoters are in jail, its better to avoid such co. The future seems tough for the company as nobody might want to get associated with them. I may be wrong but I think its better to be safe.

Regards,

what is the target can i see for long term, holding Harrmalaya, Sunflag and ABC Bearings, please tell the target prices at what price can we exit

what is the target can i see for long term, holding Harrmalaya, Sunflag and ABC Bearings, please tell the target prices at what price can we exit

Hi,

If one is investing for long term, one shouldn’t look too much into targets. Just keep track of the performance of these cos and their stock price. If both are in sync….continue holding 🙂 Think about getting out – when you have a better idea or the co is not doing as expected earlier or if the stock runs up faster than fundamentals.

Regards,

Anyways i couldnt help noticing the money matters situation…the co. Is selling at a p/e of 3 , b/v of 1.8 and has zero debt(which means, i believe that i can hold riskier assets as well as hold them for longer period with less severe consequences than an average nbfc/financial institution).it will not be too much of a stretch 2 consider dat it effectively rules the debt market.it is involved in bond trading, debt syndication etc and was about to launch a home loan division.Due to the recent LIC scam, it ‘s board has ( showing great presence of mind and the fact that despite key officials in jail , money matters has a shot at surviving), blocked the money receieved from the recent QIP in term deposits (445 crore), while the company trades for 417 crore approx!(note:it had issued quite dilutive warrants which seem pretty unlikely to be exercised before the due date in march hence i’ve not entered them in2 d analysis)

In short, i believe this is an oppurtunity worth investigating subject to a few key questions-

Q.will the company be able to continue the activities which fuelled its spectacular growth? (most likely, whoever heard of a co. Being banned from the securities industry?)

Q.the kind and extent of penalties to be imposed on the company(i mean ,yeah it was a 2000crore scam but co. Have gotten away with paying much less for much more. Also as a soon-to-be rusticated first year law student, i’m quite sure majority of the pain will be borne by the persons involved,i dont think the court is going to penalise the shareholders?)

Hopefully i havent missed out anything important(if i have please tell me)

Eagerly awaiting ur views and also the views of the readers of this blog.

P.s you might have heard of geoff gannon’s international value investing post by now. Please please please send a post and for once let there be an indian entry for once !

Hi,

I think one should avoid dubious cos until and unless margin of safety is too good.

Thanks for pointing towards Geoff Gannon…will keep a tab.

Regards,

TIME 4 AN UNWANTED MONEY MATTERS UPD8..LOL

saw the bse filings yesterday .there has been a major shake up with several directors and the company secretary “resigning” and 2 new independant directors coming on board who dont own any shares.

MONEY MATTERS IS SELLING BELOW CASH WITHOUT TAKING IN THE OUT -OF- MONEY WARRANTS IN TO THE CALCULATION, ALSO AS STATED EARLIER IT AINT GOT NO DEBT

P.S WHAT WOULD BE A SUFFICIENT MARGIN OF SAFETY IN THIS CASE FOR U ?

REGARDS

Hi,

It could be that its a great opportunity but I remain skeptical as one needs to understand that if a business will be there or not? The day Money matter was mentioned as tainted all the business houses had refused their connection with the co. So who will like to transact with them in future??

Have a look at Riddhi Siddhi…the co has announced a deal wherin French co is taking over their plants for 1250 Cr. Conservatively 755-800 of cash/share should come to the listed co in a year….but still the stock price is trading at just 350.

Regards,

THANKS 4 riddhisiddhi idea…will surely chek it out once these stupid xams r ova

how bout a post on empire anytime soon?

I had mentioned about Riddhi Siddhi just as an example. We are not recommending the same.

Regards,

dont worry …i do my own research (atleast try to…lol) and i wont blame u if it turns out badly

PLEASE HOW BOUT AN EMPIRE INDUSTRIES POST ANYTIME SOON?

Hi,

No plans on posting on Empire as of now. We need more detail and need to be convinced.

Regards,

hey ayush…heres a gud article

please have a look …..sorta resembles the riddhi siddhi situation

http://neerajmarathe.blogspot.com/

Yeah, we have already gone through the article. Neeraj is a close friend 🙂

Regards,

Hi Ayush

Any update on this stock? I didn’t see this in your tracking sheet..

regards

Hi,

Its a good safe stock for the portfolio over a long run. Q2 has been bad for the paper sector and on similar lines Sree Shakti has also reported soft nos.

Have updated the tracking sheet.

Thanks & Regards,

ur views on sree sakti now 21% dividend

We feel that performance of the co has been quite good and with the liberal div pay-out, the downside should be limited.

Going forward, the co’s expansion should help them in posting growth and perhaps higher dividend in coming years.

Hi Ayush,

Sree sakhti recently passed postal ballot to diversify into infrastructure and trading in forex. For infrastructure it is clearly mentioned that projects will be part financed by internal accruals and debt. I see this as reversal of fortune, at least for minority shareholders of Sree Sakhti. What are your thoughts? have exited this stock now?

Hi Pravin,

Yes, the recent postal ballot seemed concerning however, if one looks at the group level, the promoters are big and successful players in the warehousing/logistics area. It may be that to grow this company faster, they are including that business into Sree Sakthi.

But yes, as the infra business is capital intensive, it may take time to deliver fruits and be negative for the minority for short term.

Disc: We continue to remain invested

Thanks Ayush for ur inputs.