BSE: 532796 | NSE: LUMAXTECH

It is usually rare to find a good company in the auto-ancillary business. The reason is that they are capital intensive and usually the margins are low and hence they provide low return on capital. However, there are always some companies which do much better than the indutry. Lumax Auto Tech seems to be one such company. The company has had a an excellent growth in past along with good profitability and strong balance sheet.

The company manufactures “automotive parts like sheet metal parts, fabricated assemblies, tubular parts, for two wheeler and three wheeler industry.” That includes parts such as chassis, silencers, petrol tanks and handle bars for motorcycles and scooters. They also manufacture head and tail lamps.

VALUATIONS:

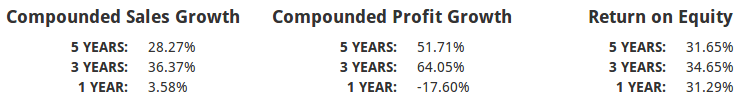

The company has a market cap of 200 Crores and is trading at a PE multiple of just 4.4 times. Company has a consistent dividend track record, and is providing a dividend yield of 4%. Price is almost equal to its book value.

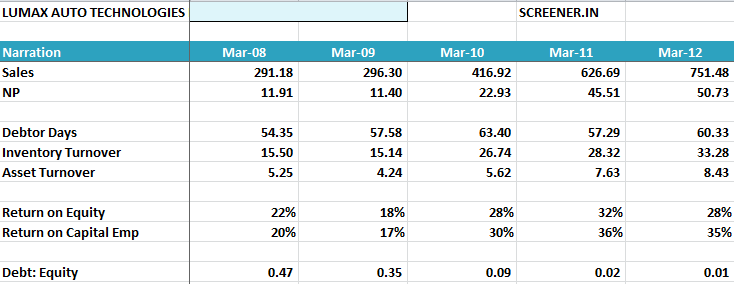

However, what excites us even more is the company”s beautiful balance sheet. The company is debt free (and mostly financed form trade payables); the inventory turnover ratio has doubled from 15 to 33 times in 5 years; while the outstanding debtors have been maintained at ~50 days. The growth and return ratios spielautomaten online are also quite good.

The company came up with an IPO in 2007 at Rs. 75/- per share. At that time, the company had 7 functional plants, sales of ~200 Crores and net profit of 6 Crores. Now the company has 12 plants (plus one in progress), sales of ~750 Crores and net profit of 45 Crores.

TRIGGERS:

As the auto sector is going through a major slowdown, not many people are expecting growth in the company. However, if one looks at the recent Honda announcement, there is a high chance that the company may deliver decent growth for next 2-3 years.

Other Triggers:

- There have been many insider trades recently and the promoters are increasing their stake – check recent announcements.

- Revival of auto-sector.

RISKS:

- The auto sector slow-down can continue for some time.

- Imports from China.

- Company currently enjoys the benefits of tax-free zone and thus the effective tax rate is 24%. However, going forward, the effective tax rates should come to 33% as the tax benefits expire with in an year or two. Thus the forward PE is at around 6 times.

- Company made a preferential allotment of 20 lac shares in 2011 to acquire the shares of a group company, Lumax Industries, worth 20 crores. Such preferential allotments can take place in future too.

Overall, at current valuations, the stock appears cheap and the risk reward ratio looks favourable.

OTHER UPDATES:

Our long discussed stock, Poly Medicure, has got mentioned in the recent Vadra issue. Though it seems the company is not directly involved in the transactions but still it throws up some question marks and the premium valuations may get impacted.

Among new ideas, we are studying Accelya Kale Solutions and Kovai Medical Center and Hospital.

Resources:

Check out Lumax Auto Technologies on Screener.

Annotated and Highlighted Annual Reports for 2012 and 2011.

Company”s recent newsletter.

We had earlier mentioned about Lumax Auto Technolgies in the developing ideas for 2013. We invite the views of our readers through comments.

Thanks Ayush

I am too tracking this company for last couple of month. I have some queries. As the list was long, I have sent you mail. Thanks

Replied, Anil.

Can you please post QA here as welll

HI Ayush,

Thanks for the idea. One clarification – you have listed preferential allotment under risk category. Should all cases of preferential allotments be viewed in that sense??

I was under the impression that if the money received out of preferential allotment is pumped into business and the business is able to churn out more profit, it will eventually more than take care of reduction in EPS due to preferential equity dilution. Please help me understand how preferential allotments impacts a business.

Hi Nabendu,

We see this preferential allotment as a risk because the money was utilized to buy shares of group company rather than apply them for business purpose.

Even otherwise, we should be careful on cos which are frequently doing preferential allotments or equity dilutions.

Hi Ayush,

I guess HMSI is no way related to Hero. Correct me, if I am wrong.

Having invested in this company in the past, it looks like an under priced gem but remained so over longer period. Do we have a scope of P/E re-rating here ?

Hi Rudra,

Sorry it was typo in the initial draft and forgot fixing the same. Correcting it.

Rudra, I think PE should be a function of free cash flows and their visibility. Most of the auto ancillaries get low PE due to lumpy margins, regular re-investments and cyclicality. However, the same is not apparent in Lumax till now. They seem to have had good cash flows. Co’s like this should get a PE multiple of above 8-10 in my opinion.

Hey Ayush

The other two group companies’ balance sheet and performance seem way below par – Just wanted to know you view on the management of this company (in terms of integrity, competence)?

Only Lumax Ind seems to be directly related. Yes, the performance of Lumax Ind is just ok, nothing special there, though, they have also been growing well.

The management seems quite competent as they have scaled up well.

Hi Ayush,

I was looking at Accelya Kale in Sep 2012 and did not show courage to buy the stock 🙂 It has given significant return from there on.

Well, what is your opinion on Greenply ind. The stock has come down from recent highs and I guess they will report good no for Mar and Jun. As the housing sales will be more during this time and people would look for some interior work using greenply.

Got to know from one of the dealer that the ply board rates will be hiked soon. Please share our views.

Greenply is a good company and the MDF segment is contributing quite well. However the ply and laminates segment is highly competitive and they don’t make much money there.

Hi Ayush,

” Very nice and informative ” these are really words will look cheap if I have to utter it for your this writeup .

You are Seacrhing the GEMS and DISTRIBUTING among all of us.Thanks for

sharing all the things you have written,

Must have taken your good amount of time for this research ,

Kudos Ayush

with due respect

Vakharia M J

Dear Sir,

Thanks a lot for the appreciation and encouragement. Look forward to more participation from you.

Ayush,

Thank you for your analysis on Lumax.

I’ve been tracking this since you mentioned this for the first time and looks to be a very interesting idea!

One point that I noticed: Lumax Auto stock P/E is 4.26 on screener, where-as the same is more than double on Moneycontrol website!

You might be looking at the standalone financials on moneycontrol and hence the higher PE.

At screener.in , it automatically picks up consolidated data if the same is more relevant.

Also, Screener shows the PE on TTM basis, while other sites often report the PE based on the annual profit and loss earnings.

Even I have been tracking Accelya. Before I could buy the required quantity it had a huge run up.

In the last 3 quarters, the company has derived a lot of revenues from product sale. These are one time revenues. Going forward, it has an assured annuity ( lower amount that product sales ) in the form of maintenance and upgrade revenues. So it may not repeat stellar performance of past quarters unless it adds many clients / launches a new product.

Look forward to your views.

Hi Shankar,

Do you have any details on the break-up of the revenue between product sales and annuity sales? If the major contribution is from one time product sales, then its concerning.

However, its interesting that the co has bagged several new contracts over last few months.

Ayush tamilnadus edition of the Hindu had cover page fully covered with award of best hospital going to kovai medical centre today, the same was conferred by icici Lombard and cnbc…. Any correlation??

This is interesting…thanks for your insight

This increases my inquisitiveness to see your kovai medical centres report as early as possible…

Hey Ayush,

This question is not specific to this post, I am a kepe follower of your blog and wanted to know if its a good time to further accumulate/average stocks such as Atul Auto, MPS, Caplin Point etc. Would like to know your thoughts.

Thanks

Its always good to accumulate stocks of your like whenever they are on discount 🙂

We remain optimistic on the above cos

Thanks so much for your response.

Ayush, following your blog for last 4 months and was waiting to enter at right time for 2 years time frame ,

Planning to allocate

5 percent each of my cash to following stocks before march expiry,

Poly Medicare

Lumax auto

Sri rayalseema

Poddar pigments

Gujarat reclaim

Kovai medical

And 7 percent to Caplin la

Atul auto

Your views needed as the panic is tempting me to buy,

I can comfortably wait. For 3 years for returns on my investments…

Please guide me as I feel it’s a wonderfull oppurtunity when everyone in street is panicing

Yes, panics are best time to build one’s portfolio. However, the buying should be done consistently in a phased manner. One never knows how long or deep the correction could be hence be consistent in your buying and try to do it on declines.

The above co’s look good to us.

I would like to take a bit of risks if you suggest some other stocks also which can fall into accumulate mode , cos of correction;

Need your valuable guidance

Also want views on Kaveri seeds

I think one should wait on Kaveri. We have already exited from the same – also reported in performance sheet.

Thanks Ayush for the guidance a particular position will be done as a starter with sure

Shot

Consistency if fundamentals remain intact ..

Ayush your specific views on

P I industries, to add in portfolio

Also considering it hasn’t corrected at all Inspite of heavy mid cap correction …

Used to track PI Ind earlier and the co has done very well. However, not tracking it closely now given the higher PE ratio

Ayush, any idea why sree rayalseeema has fallen so much. Their last quarter wasn’t good either.

The last quarter was weak also due to some one time items. We feel the co has value at these levels

Dear blogger,

I am writing you on behalf of a client who would like to appear in your blog by means of an advertorial. Your task would be to write and publish a post in your blog.

If interested, please write me back and I will tell you more about the project.

Best regards

Hi Ayush,

Like to know your view on Avanti Feeds after small cap carnage.

Hi Vinod,

Avanti Feeds seems to have corrected due to un-certainty in the shrimp market after possibility of imposition of anti-dumping duty by US.

We feel the stock has value at current levels.

Hi Ayush Isn’t Vendor Concentration a key risk factor that needs to be highlighted as a part of business risk considering the business derives revenues from BAL and HMSI only?

Hi,

Yes, client concentration is a risk but it seems the co is addressing the same by getting new customers like HMSI and also targeting after sales market.

True…but just because of the concentration i thught it might fare low on valuations… Btw another stock Bharat Gears from ancillaries looks interesting

Yeah, with the strong correction in Bharat Gears, it does look interesting. However, on the negative, the co has had volatility in earnings and mgmt hasn’t been a wealth creator for minorities.

Hi Ayush,

Request your views on Manali, Mazda & Mayur.

Thanks

We have exited from Manali.

Continue to be optimistic on Mazda & Mayur

Hi Ayush,

I am sure you got the postal ballot by now. Given that the management has shown poor corporate governance of paying medical bills of managing director with shareholders fund, what is your take on this. I was adding to this position but after getting this ballot, I have stopped adding and infact looking for a right price to exit. While I am happy that management is asking the consent instead of just stealing the money directly, mixing personal problems with company and using up shareholder capital for personal treatment does not sound good. They could have instead declared a one time dividend to all shareholders and use that money. Just wanted to hear your thoughts on this whole episode.

ayush can i have your email, have some ideas and some queries? praful.kumar@gmail.com

Hi Ravi,

Yeah, this is a concerning thing and points to the corporate governance part.

Like you rightly said, that the only good part is they are taking consent and asking for approval otherwise most of the mid cap cos don’t even do this.

Because of these things, the re-rating may not happen soon till the mgmt gets its act together. Based on the numbers, business etc, it does has value though.

Your current recommendation of this scrip says “hold”.

So if I have bought it on higher price, I should hold thinking it would come back up from its lower price?

Or you are saying that if I haven’t bought it yet, then I should buying it as the price may go even down?

In either way, to me it would automatically become either “accumulate” or “exit” 🙂

Please suggest.

Hi Mukesh,

Stocks are evolving things…many often we can’t have binary options.

We had the view as hold as after the initial buying, we wanted to wait for the Q4 results and have better clarity. As the Q4 results are out and good, we feel one may buy more at CMP. Will change the rating on our next update.

Yes, sure. I agree things are fuzzy many times. Thanks for the reply and advice.

Hi Ayush,

I have found reading your notes an exercise in learning. Thanks for sharing.

Could you kindly answer a few queries?

1. Lumax standalone operations receive >50% of revenue from traded goods. Past annual reports indicate that the margins on trading operations are similar or in some years even better than mfg. operations. Should one value these parts separately by giving trading profits a lower multiple?

2. The new HMSI plant is into manufacturing of plastic moulded parts. This seems to me to be a low technology intensity product. Is it likely that the new operations may contribute handsomely to revenue but not to profits? How should one look at this?

3. Would you prefer this to ZF Steering Gears – where there is a technology moat though end customer (CVs. tractors) are not as rapidly growing as Lumax customers -Bajaj Auto/Maruti or providing steady revenue (After mkt segment)

Also, if possible please post your answers to Anil Tulsiram’s Q&A over mail

Regards,

Susegaad

Hi Susegaad,

1. The trading income is the income from sales to replacement market and hence we feel this is a good thing. As the margins are a bit better and demand is more stable and can grow steadily.

2. The co had been having good free cash flow and as per FY12 annual report they had decent cash on balance sheet, which would be earning low returns. I think the co has done a good thing by setting up a plant for HMSI as HMSI is doing very well and reporting strong sales growth in this dull environment. Initially it may not contribute to profits but over the longer term, it should.

3. Z F also seems undervalued however there are couple of problems – 1. The growth has been quite slow over the last few years 2. The parent co has set up a parallel unlisted co which may hamper growth opportunity.

Hi Ayush,

Is this stock still cum-dividend. If yes – then it seems attractive at a div yield of almost 6%. I picked this up near 135. I think this is a good price to add some more.

Cheers!

Yes, the valuations look attractive. However, over a short term the co may be affected due to problems at Bajaj

Hi Ayush,

I have been keenly following your blog for quite sometime and am thankful to you for the excellent recommendations that you have made which have helped me create wealth in my portfolio. I am planing to start making investment in Lumax and was hoping if you could throw some light on the current status of the company. Though valuations are attractive company has performed poorly over past couple of quarters on the financial front leading to some volatility in earnings growth. Can you shed some light on the reasons behind this because other ancillary stocks like Gabriel and Munajl have done reasonably well in such a business climate. Thanks in advance

Hi,

The earnings have been under pressure due to two reasons:

1. The expansion done at Bangalore for Honda doesn’t seem to be contributing much volumes as of now…hence the depreciation etc has put pressure.

2. The auto industry in itself is not doing well.

Regards,

Ayush

Hi Ayush, i have a small clarification. Why same lighting business done is being done in two different group companies viz Lumax industries (majority) and Lumax auto technologies (36% lighting). If you can throw some light on it, it will be useful.

Hi Suresh,

I think Lumax Ind caters mainly to the bigger lights i.e.. the ones used in 4 wheelers and trucks etc. While Lumax Autotech is in 2 wheeler lights. There may be some product overlaps thought.