We earlier talked about some developing ideas for 2013. This post is to discuss them in more detail.

Caplin Point (BSE: 524742)

This seems to be a very interesting pharma company at an early growth stage. We have been tracking it for some years but it really caught our interest when we received its FY12 annual report few months back. Few snapshots:

Balance Sheet

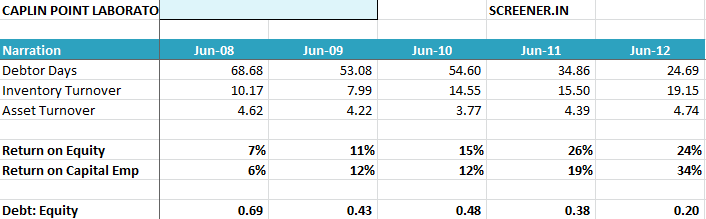

The interesting thing was that the company’s topline had grown by almost 35% in 2012, and yet the efficiency improved. The inventory and debtors remained at very low levels, debt reduced and the cash on balance sheet increased. The company has been getting efficient over the last few years:

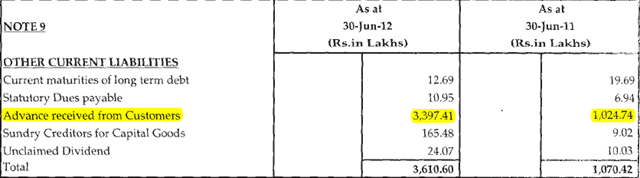

The most intriguing part was the major increase in current liabilities. Going to the schedule we noticed that the company is getting substantial advances from the customers:

So for a 110 Cr turnover company, getting a 30 odd Cr advance is extra-ordinary. If this can be maintained then this could be a very interesting story.

The company’s business model is that it has created a niche for itself by offering a basket of products and by having a high number of product registrations in small markets in South/North America. Due to its product range, the company is able to get advances from the distributors there. However, the risk is that these are small and unregulated markets and hence things can change over a period of time. The company is trying to mitigate the risk by undertaking a new expansion in the area of “sterile specialty products” and “hormone ineluctable” in line with US, EU & UK-MHRA requirements.

The projects cost is estimated to be about 75 Cr and if the company is successful, it can go to a new level. Here are the details – http://www.caplinpoint.net/cpIV.htm

Risks:

1. The valuations are not cheap and hence if things don’t pan out as expected, corrections can be sharp.

2. The company is at an early stage and hence things can change quickly.

Poddar Pigments (BSE: 524570)

Poddar is one of the largest company in the masterbatch industry. Masterbatches are additives used to impart color or additional properties to polymers.

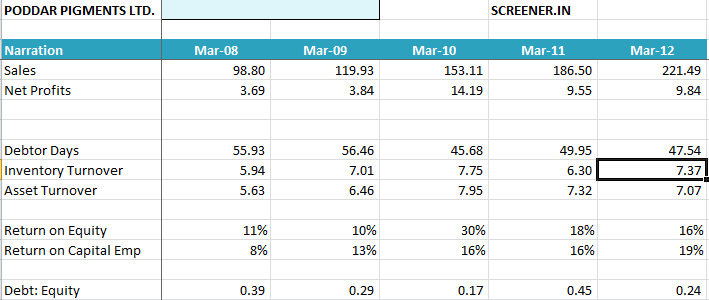

If one looks into the track record of the company, it has been delivering a consistent growth and has developed a good balance sheet.

It seems to be a safe value pick at these levels of Rs 52, due to attractive valuations:

1. The company has been delivering a consistent growth of 20% in topline and much better bottom-line growth.

2. The stock is trading at just 5 PE.

3. The stock is offering a dividend yield of 3.90%.

4. The stock is trading at 0.80 times FY12 book value of 63.

Brief Quarterly Updates

Ajanta Pharma (BSE: 532331, NSE: AJANTPHARM):

We discussed about Ajanta Pharma recently and the company has come out with fantastic Q3 results. We feel the company is moving into a new orbit and due to improving performance, companies of this size and quality can get re-rated further. Also, its not easy to get good growing pharma companies with brands etc. below 15 PE multiple. We feel one should continue to hold the stock and try to buy on declines.

MPS Ltd (BSE: 532440, NSE: MPSLTD):

We also discussed about MPS Ltd recently. Capital market too has covered the stock in its latest issue and gives a good insight. We feel the stock could provide positive upsides and on the other hand be a good defensive stock too due to high dividend payouts.

Among new ideas, we are working on Orbit Exports. It seems to be an interesting company having a niche in high end fabrics. The company is one of the largest exporter of jacquard fabric from India and they have doubled their capacity last year.

Resources

Caplin Point Annual Report for 2012 (highlighted and annotated):

https://www.dropbox.com/s/8i14dkmglkw9zhg/Caplin%20Point%20AR%2012.pdf

Poddar Pigments Annual Report for 2012 (highlighted and annotated):

https://www.dropbox.com/s/puer5nxhqxqpmhu/Poddar%20Pigments%20AR%2012.pdf

Screener Links:

Caplin Point, Poddar Pigments, Ajanta Pharma, Orbit Exports & MPS Ltd.

We look forward to the discussions and comments from our readers on the above stocks.

Ayush- have you looked at Innoventive Indus? how do you find it? seems good (according to me)..the interest costs comes out to be around 20% for the company? isnt it too high? or its common for co’s to have such interest costs?

Hi,

Not tracking it closely but looks to be an interesting idea.

One must surely explore the reasons if the int cost is consistently high at 20% or so. It could be a negative and may give insight on debt higher than being reported.

Hi Ayush, Just a small educational query on Orbit. I was looking into the idea and was not getting comfortable due to the High Operating Profit/Cash Flow from Operations Ratio. It has more or less been around 2. My limited understanding seems to suggest that this is not a nice situation when company is not generating Cash sacrosanct to profits. Could you please guide, if I am missing something ?

Hi Ashwini,

What I have seen is that its not easy to have good cash flows from operations in small growing cos. In orbit, the cash flows seem decent as they are near to the reported profits.

A better way would be to look at debtor and inventory days over the years. In the case of Orbit the debtor days seems comfortable at less than 55 days. Inventory has also remained stable and low despite growth in business.

Thanks Ayush !!

Hi Ayush Bhaiya,

Do you track force motors?. The company seems to be having some strange financial. The company is trading at .70 PE with EPS of 630.Also, the book value is 867. Currently, the stock is trading at 440+..

Hi Sankalp,

I don’t track the same, but it seems some extra-ordinary event has taken place in the co resulting in one time income and hence the low valuations. Please look into the announcements and check the same.

Hi Ayush,

Thank you for the update!

Was waiting for this for sometime now.

Your call on Ajantha Pharma was very timely. After the excellent

results, the stock is now up more than 35% from its previous levels

(pre-result)

Interesting to note that you still maintain a buy at this level !

MPS quarterly results are due on Feb-14th and that would be a good indicator of future performance.

Still waiting for your analysis on Lumax Auto Technologies.

Caplin and Poddar are definiltely good ideas and i’m tracking them after your analysis.

Ayush, have you looked at Bliss GVS Pharma?

Seems to be another good pharma company growing at a good pace.

Hi Prashanth,

Yes, Ajanta has done very well 🙂

Lumax does look interesting and would try updating soon.

Bliss Pharma looks interesting on quick look however high debtors is a concern. Would like to know more.

Hi Ayush If you could come out with a detailed opinion on the business model i think it would be of great help. Also i was going through their AR, it is mentioned that all their facilities are still in process or needs approvals/certifications. Do you perceive any risk in case the approvals are not in place?

Also i was seeing their product lines, they are mainly into analgesic dosages (ie all the anti-products 🙂 ) although one particular product that interested me was their Biotech & LYOPHILIZED Products which is a niche area….

I was thinking of another small company that has been into existence for quite a long time Jenburkt Pharmaceuticals. If you could do a comparative analysis with Caplin would appreciate it. (I will also let you know my views once your views are out )

Hi,

Yes, the approval for the new facilities is important for the company to grow and get good margins. Till they get the approvals, I think they would be doing contract manufacturing etc.

Jenburkt has been a paying out a very good dividend and that is a good thing…however the growth rate has been pretty slow.

Hey Ayush,

Great post once again.

I had a general question on how you go about evaluating management of a company? What are the qualitative aspects that you look into or try to measure? I think you can look at numbers and metrics but good management and strong business tailwinds usually lead to higher earnings and hopefully the price of the stock.

Thanks and hope all is well.

Hi Tony,

The ways to evaluate mgmt of a company are:

1. Read atleast last 3-5 yrs of annual reports and see the actions of the mgmt during different business cycle, Also have they delivered on promises?

2. Look at the capital structure and efficiency of balance sheet over the years

3. Dividend policy

4. Remuneration and related party transactions.

5. Vision and way forward.

Hi,

Thought of adding few more thoughts:

A very important thing is to look at the past performance focusing on growth in past, ROE & ROCE over last few years, handling of debt and debtor days, inventory management. These usually give good insights on the quality of the business and the management.

Very insightful. Thanks much!

HI Ayush

Just came across this blog.Great work!!

Any idea of Mangalam cement ,its looks interesting at attractive valutions

Hi,

Thanks. Haven’t been tracking the cement sector hence not much idea about this one. Have heard good things from couple of friends though.

HI Ayush,

Which one you will prefer for long term investment (5 -7 years)…

Astral polytechnik

Polymedicure.

Kindly revert.

thanks.

Hi Shanid,

Very tough to say…both are our long term favorites.

Hi ayush, great work once again. I went through AR of poddar pigments and i found the management’s disclosures and way of presentation a bit dubious. They have boased their sales increase and other technology updation etc. but in their financial performance iscussiom under the head of MD&A their never once mentioned profits, i guess coz profits remain flattish. The language used by the magement makes me a bit skeptical for this company.

Vikas kukreja

Hi Vikas,

Somehow I have been having a good feeling about the mgmt. Usually one won’t find very interactive or detailed MD&A in annual reports of small cap cos. May be that is one reason.

Hi Ayush,

Do You track Educomp Solutions. I have invested @ 268 and the stock is extremely beaten down from the level of 550+ 2 years back to 128 levels currently. What is your view on this stock. Should it be held or liquidated.

Sorry, we don’t track the same.

Hi Ayush,

very informative work..

A question for you and other readers:

How do you perceive Himalaya international?- It has a tie up with J R simplot -the largest player in french fries space…..

Hi Aditya,

The co operates in a very lucrative area but somehow the actions of the mgmt have been negative for minority shareholders. The co has been continuously diluting/changing equity and that is not a good sign.

Hi Ayush,

What is your view on Torrent power?

This particular co seems to be the best among the power sector companies.

Also attractive in terms of valuation.

It appears to be a safe bet for a long term perspective as privatization in power generation/distribution will be inevitable in coming years.

Would like your views

Have been an investor in this co few years back…and fully agree that its one of the best co in the sector. However, not tracking it now…so can’t comment

Thank you !

hi ayush,

I have a small concern regarding lumax auto tech . Not sure if it is valid. Saw a report that the heavy increase in salary in maruti is spilling over as trouble for honda . Analysts say this may also affect component manufacturers as well. Would Lumax be affected with a steep hike in prices ? Morover auto demand being weak due to economy is it the best time to accumulate,,,,

Hi,

Yes, if the OEMs are in major trouble, it will affect the entire chain. Lets see how things shape up.

Hi Ayush,

Request your views on money matters financial services Ltd. I am sure you know about the company’s past but the current valuations(0.65 times the book value) seems too good to miss.

Thanks

Ram

Hi,

Sorry don’t track the same. But why should we venture into co where there are serious issues against the top management?

Ayush,

What is your view on manali petrochemicals. What is the reason for the bad results? is it tempraray? can we still hold it for the medium term.?

Regards.

Nishanth

The results have been quite poor and hence one should exit. There haven’t been any details on the reason for the poor performance.

Ayush,

I have 55 shares of Indiabulls finanace@307. Stock is sitting currently at 284. Should I hold onto the stock or sell it?

Sorry, we don’t track the same and hence can’t comment.

Thanks. Do you track Apar Industries & Magma Fincorp? What is your view on them for 2013.

Don’t track them too. Have heard good things for magma though

Ayush,

Do you track or have any views on Granules India?

Sorry, we don’t track the same

Hi ayush

Caplin results are out today… Your valuable feedback is awaited on this and also polymedicure

Caplin’s results are decent. Though would liked to have much growth.

Poly Medicure’s results are good.

Hi,

Whats your view on Innoventive industries and Technocraft Industries

Sorry, we don’t track the same

Is this a good time to add Caplin?

We feel that first of all one should be convinced about the co and the prospects and if so then, one may buy gradually on dips.

hi ayush,

your view on pidilite industries and cera sanitaryware ? Is this good time to accumulate this stocks ?

Both are very good cos. However, as we are not tracking closely, we can’t suggest on timing.

Hi Ayush

What are your views on Ramsarup industres now that its in BIFR and quoting at 3.3 rs Should one wait buy or sell?

I think one should avoid cos which have crashed until and unless one has a very strong understanding of the co and the business

Hi Ayush,

Any updates on GRP post Q3 results. Results were ofcourse bad…but the reaction seems to be way overdone? Any thoughts on why revenues dropped sequentially and on any other operational challenges

regards

Madyam

Hi,

Have provided the update here – https://dalal-street.in/update-on-quarterly-results/

Hi Ayush,

Regarding Poddar Pigments – have you had the chance to delve deeper? It seems that Plastibends India is currently about 5 times the size of Poddar and has a major chunk of the organised market for Masterbatches through an established customer base. Any clue on the customer profile of Poddar Pigments? The other organised player appears to be Clariant chemicals – but it was difficult to get any separate information about their masterbatch capacity since its clubbed with their Intermediates and Colours segment in the fin. statements. Came across a couple of reports (a bit old..)from Crisil and HDFC both recommending Plastibends. In fact HDFC preferred Plastibends to Poddar. It may be worthwhile looking at both companies.

Hi Mr. Pinto,

Had taken a look at Plastibends, it does seem good and stock seems to be offering value. However one negative observation is – that profit growth has been very slow recently and there is lack of clarity on growth prospects ahead.

Would be great if you could share your thoughts on these points.

Ayush,

I have a question related to screener variables that I’d like to pose to your team. Could you please let me know the email address to which I can email my query?

Thanks,

Anant

Hi Anant, you may send in you queries using the feedback form: http://www.screener.in/feedback/

Hi Ayush,

I remember you saying caplin point offers value between 65 to 70 levels when it was around 76. I notice, the stock even though was falling from 92 levels, did not go below 65 level. So how did you give the call so correctly?. Did you give the call based on technicals or fundamentals. Did you arrive at the range based on projected PE multiple on projected EPS ? or Is it just that you are great stock market operator ? 🙂

Hi Ayush,

I remember you saying caplin point offers value between 65 to 70 levels when it was around 76. I notice, the stock even though was falling from 92 levels, did not go below 65 level. So how did you give the call so correctly?. Did you give the call based on technicals or fundamentals. Did you arrive at the range based on projected PE multiple on projected EPS ? or Is it just that you are great stock market operator ? 🙂

It seems to be mere co-incidence, Sir. Also its too short a time to say that one was right.

Ok. That’s an honest answer. I was getting ready to catch it on every fall, but realised may not go down beyond 65 just seeing the buying interest. If next qtr results are decent, may not go below 65 is what the guts say. But as you say its too short a time to say that one was right 🙂

hi, do you track kaveri seeds ? they have done very well last year and the management is saying they will grow atleast 25% this year. looks like a good stock to own for 6 months atleast

Hi,

Yeah, kaveri has done quite well and the management expects to maintain 20% growth going forward.

Poddar pigments seems to be listed in Illiquid scrips of BSE. (http://www.bseindia.com/investors/illiquidscrips.aspx)

Do you think that is something to be worried about?

Hi Mukesh,

SEBI recently came out with a new rule and classified almost 2000 stocks as illiquid. Because of this hardly any trading is happening in these stocks. We have raised the issue here – http://alphaideas.in/2013/04/25/day-long-call-auctions-hurting-the-indian-markets/

We feel the order is wrong and detrimental to investing, we should protest against the same by writing an email to SEBI.

Oh. How do you suggest we can go about it?

One should write a complain to chairman@sebi.gov.in

Finally got around writing a complain about it 🙂 I’ve taken liberty to cite your article at http://alphaideas.in/2013/04/25/day-long-call-auctions-hurting-the-indian-markets/ for putting forth the argument. I have also posted my letter in that article as comment. Hope my letter was factually correct.

hi Ayush,

Poddar Pigments has posted a decent set of fourth quarter numbers. Have you evolved any opinion on this stock yet?

Hi Lloyd,

The co has been very much consistent in its performance. We like the current valuations of less than 4 pe and decent dividend yield on the stock. We already have positions on this one.

Ayush

Ayush,

I found orbit exports interesting but at the same time not sure if the current run is sustainable going forward. The business seems to be available at a reasonable price even with normalized earnings. What is your current view on this? Other than the currency and international macro risk what other risks do you foresee on this one. I cannot pin point a fault but somehow reluctant to make an entry on this one. Looking for some bear case scenario for this one to guage the worst case returns.

Hi Ravi,

Orbit Exports has been a very interesting co…they have scaled up beautifully from a very small base and the margins etc, have increased almost every year. They operate in a niche area of novelty fabrics and cater to some of the big designers globally.

The only negative is – the story is evolving and its at early growth stage. One cannot say with confidence as to how things will be going forward.

Ayush

hi, do you have any idea on Kei Industries ?

No, no idea.