Ajanta Pharma ranks among the Top 50 Pharmaceutical companies in India (IMS ORG MAT March 2012) with sales growing at 27% CAGR over FY06-12.

Link to company financials – http://www.screener.in/company/?q=532331

Main Generic Brands:

- Ophthalmology (Olopat, Diflucor, Zaha, Unibrom, Nepaflam)

- Dermatology (Melacare, Pacroma, Salicia KT, Sunstop)

- Cardiology (Atorfit CV, Met XL, Rosufit)

- Anti-Malarials (Artefan – Artemether & Lumefentrine)

- Gastroenterology (Lafutax – Lafutidine)

- Male Erectile Dysfunction (Kamagra – Sildenafil Citrate)

In the Dermatology segment, the company ranks 18th and has 34 generic brands – with 4 leading brands and more than 10 first-time products. In the Opthalmalogy segment, the company is ranked 7th and has 30 generic brands – with 9 leading brands and more than 16 first-time products in India. In the Cardiology segment, the company ranks 31st and has 51 generic brands – with 3 leading brands and more than 6 first-time products in India.

Over last 3 years, things seem to have really changed for the company. Ajanta is growing at about 25% CAGR now and at the same time its improving its operating margins, reducing loans and bringing working capital efficiency. Hence the ROE has improved from about 15-16% in earlier years to about 24% in 2012. The markets have noticed the same and the stock has been re-rated from usual 5-7 times PE multiples to about 10 now. However, we feel that given the strong branded formulation play and good rankings in several segments, the stock is available at a reasonable valuation considering the high multiples enjoyed by the pharma sector (Industry PE 26).

Here is a snapshot of improvement in key ratios:

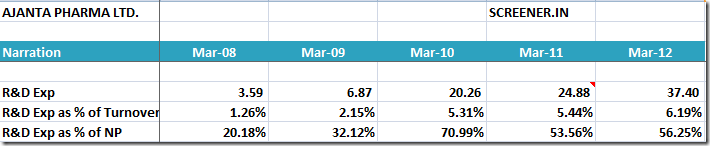

Another very noticeable thing in the company over last few years is the huge outlay on R&D. The company is now spending close to 6% of its turnover on R&D expenses:

Usually a R&D spend of 2-3% of turnover is considered good and anything above it in the right direction can be very positive.

As per FY 2012 annual report of the company, the company expects the current capacities to peak out in 2 years and hence they would be needing fresh capacities. Co has chalked out an expansion plan of 400 Cr. They have planned two separate manufacturing facilities – one for regulated markets & other for domestic and emerging export markets.

Hence considering the growth prospects and leadership position of the company in several segments, the stocks looks attractive at CMP of 385 for long term investing.

MPS Ltd:

Other stock idea which we have been working on and looks interesting is MPS Ltd, formerly known as Macmillan Ltd. MPS is a provider of publishing solutions – they handle everything from production of book, journal, or magazine right through to subscription management and BPO services. The company was sold to a new management a year back and the new management has done a superb job of delivering a quick turnaround. The interesting thing is that the company is paying out very liberal dividends (MPS has declared an interim dividend of Rs 5/share in Q2FY12 results) and hence the story will be very interesting if they can grow from here.

At CMP of 111, the stock looks good to create positions and do more homework.

One of our favorite stock Astral Poly is doing lot of branding work by partnering with Dabaang 2. I’m sure most of us must have enjoyed the same. If not then here is the video:

Hello Ayush,

First of all I want to say Thanks a million for helping us in saving and making a lot of money. I have followed 4-5 stocks after being recommended on your blog and to be honest I am having some profit in stock after a long time. you have recommend MPS Ltd. now and there is another company called Repro India Ltd. it shows on 6th position in similar stock category. what do you think about it? it also does the same kind of business and from the first glance at screener the valuations looks better in case of Repro India.

also is Ajanta Pharma and Aarti Drugs good buy at CMP for long term investment?

Many thanks for all the effort you are putting in this Good work.

Hi Max,

Repro is also doing well however its more into publishing and that space has become highly competitive. As MPS is more of a turnaround story, any growth by the new management can make it a very good idea.

Yeah, we like Ajanta Pharma and Aarti Drugs

Hi Ayush,

If I am correct, classification of certain expenses as r&d expenses seems to be issue with the IT.

so if they change their classification to comply with IT the r&d expenses as % of sales might come down and tax expense could go up.

Regards,

Excel

Hi Excel,

As you are aware, there was some flash news of IT issues with the company however nothing was confirmed. If the issue is there and unresolved then it can be a negative.

However looking at the size of the R&D exp being done, I don’t think its just for IT benefits.

Hi Ayush,

First of all congratulations to you for doing such a great Job ! For a retail investor your site is really helpful.

These days almost everybody is talking of media as sector to look forward in 2013 because of digitization. Please let me know if you track these sector . It would be great if you can share your thoughts on this and also throw light on some of the scrips that we should track closely.

Hi Subhash,

Thanks for the encouragement 🙂 Have started tracking this sector and TV Today looked interesting. Have a look and share your views

Hi Ayush,

Do you expect growth in sales as well in MPS. Have you had a word with management regarding future outlook, as to how they plan to increase sales?

Hi,

As of now there are not much indications of growth. However the company has recently set up a centre in Dehradun and trying to expand headcount. So after fixing the initial problems, growth should be on their agenda.

Hello Ayush,

I was following your posts. Very useful and also screener is a great effort. I was trying to follow some food/spirit stocks. What is your take on Globus spirits for long term investment. Is it well placed for growth and how is the promoter holdings ? Please do provide your inputs on this stock as long term investment

Thanks

Alegs

Hi Alegs,

We don’t track Globus closely but the issue here has been that the co has quite under-performed vs the expectations. Going forward also, there is not enough clarity on the growth.

Do share your logics/notes.

Ayush,

Thanks for sharing light Ajanta Pharma. Stock looks good for a long run.

Some points to add to your analysis:

Recently in May 2012, Promoter acquired almost 1% stake in the company through open market purchases.

60% of company’s revenue comes from exports.

They have 2 USFDA approvals. Their first product will be launched in the US market in Q1 of next financial year.

I am however skeptical of the future growth story of MPS Ltd.

Hi Prashanth,

Thanks for highlighting the other important points. Promoters have been continuously increasing stake for sometime now. The growth from US will take atleast a couple of years.

Yes, as of now there is not much clarity on growth prospects of MPS. However, do look at the profile of the new top mgmt.

Hello Ayush,

First and foremost, kudos for bringing out this ingenuous and yet simplistic tool.

1. I have been using some custom ratios for last few days. Could you provide an option to delete a custom ratio, as i would like to consolidate.

2. Trade Payables variable is missing, while the Trade Receivables and Inventory is available currently. Could you include this variable?

3. In the Ajanta Pharma snapshot, you have used R&D expenses. I could not find any variables related to these. Are the figures shown, as part of manual input post the excel export?

hello ayush

do you track gei industrial, ib power and entegra. i feel these could double from present levels in 2013 as they are going cheap and the value must unlock in a year or so.

Hi Ayush,

How does UNICHEM Labs look in comparison to Ajanta Pharma?

Hi,

Unichem is also a good co but we are not tracking it closely.

Is Screener.in down. I can’t access it

Hi Deepak,

The servers had a problem. The site is back online now.

Thanks for reporting,

Pratyush

tx

Hello Ayush,

What is your opinion on Poddar Pigments? The numbers look reasonably good. Conservatively financed, reasonable growth, good FCF. They have reduced the date and D/E is not o.24. Ratios are very good. Any idea about management quality? Also is this company has any Moat really? Looks like a commodity to me with intense competitive pressure. Will that impact future profitability. There has to be a reason for such low multiples (even assuming market inefficiency). Trying to figure out a market opinion for this stock.

Hi Girish,

Poddar seems to be a good steady company available at attractive valuations. Till now, the ratios and everything looks good. Doesn’t seem to be a commodity with intense competition. I think the low PE is due to the low pe given to the pigment sector in general.

Hi Ayush,

Very good call on Ajanta. See the run up in the last one week. Almost 50%!!!

I have been invested in both Ajanta and Poddar. I calculated intrinsic value for both and found significant margin of safety and hence invested in them. My very conservative assumptions on discount rates, growth rate etc gave close to 60-70% discount to value for Poddar even at this market price.

Coincidentally I was reading F Wall street by Joe Ponzio where he describes the valuation method used by Warren Buffet to value steady growing businesses. I must say that I applied that method to value both these companies. No need to say I had very high return on my investment made on this book 😉 I recommend this book to all the readers of this blog. Its message gels well with the investment philosophy of this blog.

Hi Girish

I would like to know how to calculate intrinsic value do u have any weblink or video or resouce where I can understand this process. Thank you very much.

Regards

Vinayak

Hi Ayush,

do you track Granules India which is also a good pharma company and has fallen down from recent highs..

Do you see a value in investing in this company?

Sorry, don’t track the same.

Hi Ayush, Great write up and thoughts.

MPS looks like a great story since the new management take over.

There is a lot of scope in it with the new age of digitization and e-books. MPS is a step in the right direction with a good growth. Industry wise it has less competition and in certain segments it is class apart.

Still to calculate on the valuations front.

Cheers,

Mokhtar

What’s your take on latest Ajanta results? It’s been an amazing discovery by you n Hitesh. Fantastic returns for your followers. Can one make an entry now in Ajanta n what’s your expectation on EPS estimates for next 2 years. Any triggers for the co?

Thanks for the appreciation. Ajanta has been a superb story and stock has already given multi-bagger returns. The Q2FY14 nos have once again beaten everyone’s expectation by a wide margin…in such case the stock is likely to continue doing well. But as the returns have already been great, the margin of safety might not be there at these levels….so please take your own call.