We are happy that Summit Securities is getting listed today after a lot of persuasion.

Summit Securities is part of the RPG group and is a finance company holding shares of group cos of RPG group. The company got created on the merger of five similar finance companies – CHI Investments, Summit Securities, Octav Investments, Brabourne & RPG Itochu (unlisted).

We have been tracking Summit Securities as we had recommended CHI Investments, which got merged on 2 February 2010.

So what is the value in the company:

Post re-structuring the equity of the company is 10.90 Crore.

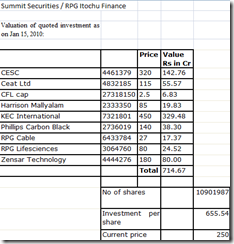

Some of the major investments held by the company as per consolidated accounts are:

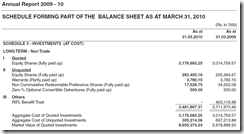

As per the FY 2010 annual report of the company, here is the extract of their investment schedule (consolidated accounts)

As per the FY 2010 annual report of the company, here is the extract of their investment schedule (consolidated accounts)

As per above, the Market Value of Quoted Investments was 865 Cr as on 31st March 2010. Hence the market value of investments per share would be close to 800/share.

So what could be the listing price?

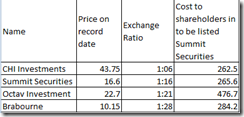

It would be important to calculate the cost to the existing shareholders of the company based on the stock price as on record date of the arrangement. The stock prices of the 4 listed cos on the record date of arrangement was:

The record date was 2nd Feb, 2010. The Sensex at that time was 16170.

Most of the other holding cos trade at a discount of atleast 50-60% of the Market Value of the investments they hold. Existing shareholders may take exit if the listing is at say 350+

For investors looking to buy into this stock, I think they should look for a deep discount to Market Value of investments otherwise they can ignore.

Closed at 186 today.

We have to consider what investment unlisted company was having RPG Itochu (unlisted firm).

Any Idea.

It would be tough to get exact detail…but the major investment in RPG Itochu was shares of Spencer & Co.

Thanks for such research.

1-Do you see this as a buy at current levels ?

2-Another thought -are there any buys from past that you may want to recommend at their current levels?

3-I see that some of stocks in recent past have stayed put or moved little in past few months, so may be a good chance to add more. I have already bought Sunflag, Facor ,ABC bearings and intend to buy Sree shakti today.If not what is your wisdom on persisting with these ?

Quite a few qs 🙂

Hi,

Summit Sec has been witnessing lower circuits post the listing day…the stock is down to 140 levels now. For fresh buying investors may wait more.

There are other stocks like – Gujarat Reclaim, Balaji Amines etc which you may consider for buying.

Regards,

thanks Ayush .how about persisting with the stocks mentioned in #3.

I had bought at levels when these were recommended here and they have gone down since.

Couldn’t get your query

hi ayush,

q1.any thoughts on evaluating companies in turnaround/restructuring situations?

( interesting possibilities include indage vintners and dhandapani finance)

q2.any ideas on how to evaluate financial companies ?(like nbfcs and banks)

eagerly awaiting ur thoughts

rayhaan

Hi,

Safety of capital is very important to us. Hence we won’t bet on a possible turnaround case until and unless the logic is very strong and downside risk is limited.

We had invested in Welspun Syntex which is a sort of turnaround case….have a look.

It isn’t easy to evaluate NBFCs etc.

Regards,

Hi Shravan , can you elaborate on stocks in q1.I quite like restructuring situations .good idea to get these vetted by dalal-street people.thanks.

hi avinashkool,

sorry 4 d l8 reply, im kinda short of ideas despite the market dropping.

anyways situations worthy of investigation include indage vintner ( great brands, a big player in a small wine market but loads and loads of debt, also promoters seem to have confidence in the co.), dhandapani finance (REALLY BAD LOANS, extensive restructuring required and recent talks among lenders and shareholders indicate a WORSENING outlook for the company , also recent actions of the management like the head honcho asking for a RAISE in his salary and a very STUPID accounting method of recognizing gains on loans UPFRONT which thankfully was reversed dont inspire much confidence,, however a very cheap market price + smart shareholders( i.e db zwim who own 51 percent of the co. +the shareholders defeated a recent postal ballot which wud ve screwed them, pls chek the bsefilings for details)+a good core biz of vehicle financing have made it stay on my wait and watch list) and of course, the stock without which no turnaround list would be complete satyam. my id is shravanrayhaanpaul@gmail.com

@ ayush- hey ayush any thoughts on satyam and indage vintners?

if u ever feel like investigating dhandapani finance, feel free to ask me for the a.r( owe u 1 for teesta, thx 4 it 1ce again)

Hi,

Like you mentioned – Indage group has good brands but loads and loads of debt, I would avoid caus until we have an idea as to how things would improve…why take risk of capital erosion? I’m not comfortable with very high debt cos.

Regarding Satyam, as there are quite a lot of contingent liabilities, I haven’t looked into the stock. If you have considered those things and feel that the margin of safety is there…give a small summary….then we can look into the stock.

Regards,

Rayhaan,

Thanks for your views.As Ayush said , waiting for Satyam details.

db zwim

Dstreet – with the recent fall some large/midcaps looking attractive on valuations/.Thoughts?We wont get much time to be on the side lines I guess .Appreciate a quick replyon this part.

Could you elaborate on contingent liabilities of Satyam.

thanks

Hi,

Yes, midcaps and small caps have become attractive after the recent correction. But another noticeable thing is that most of the cos have witnessed margin pressures and hence in some stocks fall is in line with the results.

Yes, one must utilize the cash but the same should be done in phases and cautiously.

Regards,

Guys ,Dstreet –

On special situations – have you come across the recent 30 odd percent fall in mphasis s/w.I read about governance issue/differential billing rates .But 30 % fall !!…. is there something more than meets the eye.

Not checked if it has recoverd since.

comments on how do you see it as an opportunity?

best..

Hi Avinash,

Special situation is one wherein the result is almost risk free. The fall in Mphasis won’t qualify as special situation.

Haven’t tracked Mphasis.

Regards,

I was trying to value the firm based on the shares held. I noticed that your number are very different than what I am getting. Here are a few examples:

Company # of Shares Mkt Price Mkt Value Your Value

KEC International 4,967,804.00 80.75 401,150,173.00 350 Cr

Since this was the biggest I decided to highlight this. Can you confirm where you got your numbers from? I got it from information memorandum.

Thx.

Hi Rajeev,

We have taken into account consolidated nos for the above calculations.

To get to above nos – take into ac the annual report of 100% subsidiary – Instant Holding. Instant Holding has another 24.64 Lac shares of KEC International.

Regards,

I had bought at levels when these were recommended here and they have gone down since.

Hi,

The stock was recommended to be ignored. The discussion was due to our interest in CHI earlier which was merged into this co.

Hi Ayush,

What is your feedback on Summit now? It’s available at considerable discount to it’s NAV. Mcap is 92 cr. vs Investments more than 600 cr. Can you please take some time off to look at it?

Aksh

It does has value but many often unlocking may take a long long time and hence there is a significant opportunity cost. One may look at BNK Capital in the similar category

HI Ayush, How does Summit look now?