When I first looked at this company 3-4 years back, I couldn’t believe that selling doors could be a highly profitable and organised business.

Yes, SML is a Hyderabad based company which specializes in Special steel Doors & Windows. The company has quickly scaled up from about 7 Cr turnover in 2002 to 80 Cr in 2010. SML caters to diverse industries like Pharma, IT, Hotels, Construction sector, embassies etc. Do make a visit to their website and one will instantly feel the quality and difference the company has. Visit to their Gallery section, speaks highly about their association with leading architects and contractors like L&T etc. They have experience of handling large prestigious projects like – Hyderabad Airport, Reliance Petroleum, TCS IT Parks etc.

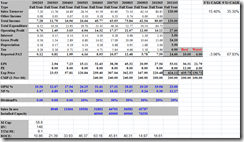

A look at the numbers and other ratios between years 2002 – 2008

- Was growing rapidly @ 47% CAGR

- Had excellent operating margins consistently > 25%

- Has had an track record of excellent ROCE in the range of 40-50%+

- The business doesn’t involves lot of investment in Fixed Assets, Inventory and debtors.

- The company has mostly carried moderate debt.

To repeat the above growth the company had carried out an ambitious plan to triple it’s production capacity and introduce new products. The expansion was funded through internal accruals and debt. To scale up, the company also opened offices in every metro. Year 2009 & 2010 were tough years for the company as capital expenditures and opening of new buildings had slowed down…hence the nos of these years don’t look good. Yet the company was profitable in these two years.

If one looks at the last two quarterly numbers of the company, the company has done 23 Cr for Q3 & 34.33 Cr for Q4. The sales seem to be coming back and company seems all set to reap the benefits of the expanded capacities.

In last few months the promoters have increased their stake through an open offer @ 180.

As per a latest announcement on BSE, the company has intended to delist the shares from BSE. Currently the promoters are holding 56% share and would need to buy 44% of additional shares. It won’t be an easy task and if promoters are serious to de-list, lot of value-unlocking may take place.