It is important to re-evaluate the portfolio and weed out non-performers, or the stocks in which the story is not developing as expected, or switch to new ideas which look cheaper or have more value than others. We have exited from couple of our ideas over last few days:

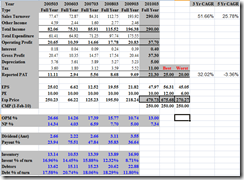

1. Jocil – Initially discussed @ 265, it is a good company with good fundamentals. The company has also rewarded with a bonus in the ratio of 1:1 and the stock is cum-bonus @ 285. Yet, we are switching out as we feel better ideas are available. Also a couple of negatives are – 1.) The company hasn’t been growing over last few quarters while the debt has increased. 2.) Company is import dependent and due to strong rupee weakness, they may get a hit.

2. Balaji Amines – Initially discussed @ 48, though the stock seems cheap at 4 times PE multiple @ 35, but the negatives are – 1.) The debt levels are too high to be comfortable with. 2.) Being in chemical sector, stock usually get low PE ratios due to lumpy earnings. At this time, there are several companies which are debt free, domestic business and showing growth, yet available at 4-6 times earnings. Eg: Indag Rubber, IFB Agro etc.

Some new ideas which we are studying and look good are – AMD Industries, Oriental Carbon & Chemicals and GIPCL. Continue reading Portfolio shuffling…