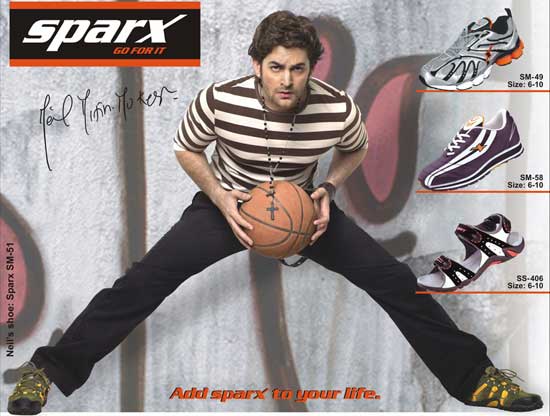

Most of us must be aware of the Relaxo brand. The interesting part is the evolution of the company from the traditional “Hawai Chappal” business to the fashionable shoes, sandals and slippers business under the brand “Sparx” & “Flite”. It’s a definite consumer play story and the company has done remarkably well over the last 5 years.

During the last 5 years the turnover has increased from 200 Cr in 2006 to 557 Cr in 2010 while Net Profits have shot up 10 times from 3.27 Cr in 2006 to 37.70 Cr in 2010.

To get a better understanding of the company, we visited the company and met the CFO – Mr. Sushil Batra. Key takeaways from the interview are:

- The growth since 2006 is real and the reason is the initiatives taken by the management to venture into manufacturing of Flite slippers and subsequently Sparx. Both the products have witnessed a very good demand from consumers and hence there is a brand pull. Continue reading Relaxo Footwear