Riddhi Siddhi Gluco Biols is the largest producer of Starch & starch derivatives in India. The company has a market share of more than 25%.The most interesting thing about the growth of this company is – the promoters have build everything in just 20 years. They started from scratch in 1990 and today they control 25% market share and do a turnover of 750 Cr+. They now have three strategically located plants spread across different areas so that they can cater to customers across the County in the most efficient manner.

Starch & starch derivatives find application in diverse industries like – Paper, Textile, Pharmaceuticals, Adhesives, and Confectionery etc. Hence the characteristics of this industry is more like FMCG industry i.e.. the demand is ever increasing. The industry is expected to grow @ 15%+ for next few years. Riddhi Siddhi has been growing consistently with CAGR of 30% for last 5 years.

In India the per capita consumption of Starch is quite low as compared to the developed nations. The consumption is picking up every year. Another opportunity area is – as of now only 40 types of applications are done with Starch in India, while worldwide more than 1000 applications are there. So the company has a potential to do lot of value addition and grow.

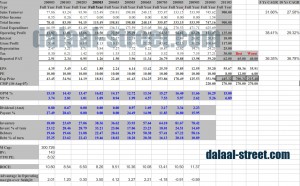

If one analyses the past 10 year track record of the company, the company has had a wonderful CAGR of 27.58%. Very few companies can claim such growth rates. Operating profits & Net Profit CAGRs are even better.

A close look at the Balance Sheet of last ten year also gives some interesting insights –

- The company had been growing by way of debt till the year 2005 and the balance sheet was quite leveraged. Debt equity was as high as 3.62.

- In 2006, the company got equity participation from one of the biggest company in this business – Roquette. The French major took a 15% stake in the company.

- Since then the debt problems reduced and the debt equity ratio has been steadily decreasing. The debt equity ratio is now expected to be close to 1 now.

In year 2008 & 2009, the company had a couple of tough years. Since then the company has been witnessing strong topline and operating margin growth. They have been using the cash flows in expanding the swiftly reducing the debt to make the Balance Sheet stronger. In 2009 & 2010, due lower interest costs, the increased operating profits are making direct impacts at Net Profit levels. This trend is expected to continue.

People feel that this business is cyclical. But a closer analysis of P/L for last 10 years reveals that the margins remain between 13-16%. So we should use these margins for calculating the fair value.

Valuations:

- For Year 2011, we expect the company to do a turnover of close to 900 Cr.

- At operating margins of close to 15%, the company may be able to post a Net Profit of 60-65 Cr, resulting into an EPS of 53-58.

- At CMP of 285, the stock is available at a forward PE of less than 5.50

- The company has a strong BV of 175.

- Company has paid a dividend of Rs 5/share.

Trigger:

There were recent articles in media that the French partner of the company – Roquette (already holding close to 15%) wants to increase its stake to 51%. If so, it could lead to value unlocking and better future prospects.

Oh how I wish you had posted this yesterday!

Do you it is good to buy now too or can we hope for it fall a bit in the near future?

Dear Manish,

Timing is a tough thing. If you agree on the long term prospects and see the value much higher…then do buy some even now and try to accumulate on sharp declines, if any.

Regards,

Ayush

ayush..good work i hope you had picked it up yesterday or earlier 😉

Oh!. Last two of your picks are flying away, One in 20% UC, another 15%up today. I had bought some of the Riddi Siddi in april, After seeing your post today thought of accumulating it. Alas, It is locked in UC.Anyway good to see your picks flying away like this .I am sure you will pick another gem sooner or later.

dr.nelogal.

The credit goes to the good performance by the company and better sentiments.

Regards,

Hi Ayush,

great contents. very timely too !!!

since i missed the riddhi bus, would like to know when your next reco analysis would be out?

rgds

Jaya,

Its never to late to participate in a good company if the price has risen by 10-20%. Try to evaluate a fair price for the co and buy if available at a discount.

Do look at other stock ideas mentioned at our blog. Many of them still offer a lot of value.

We don't have any fixed time frames for posting stock ideas. We post them as and when the opportunities come.

Thanks & Regards,

Dear Ayush,

Do you think Riddhi Siddhi still a buy ?

Hi Naresh,

Yes, the company has been coming out with better nos…stock still has good potential.

Regards,

Hi Ayush,

What will be the impact of the restructuring announcement made by the company ?

Hi,

As of now based on the limited details available, it seems that the French Co – Roquette has bought out the operations of Riddhi Siddhi Ltd.

The structure of deal is:

1. Riddhi Siddhi will t/f the current plants to subsidiary

2. Roquette will acquire a majority stake with an option to buy-out the subsidiary.

3. For the above, Roquette will cancel its current stake of abt 15% in listed Riddhi Siddhi.

Hence the operations are going to be bought by the French co and the cash should flow to the listed co. Also the current equity of the listed co will get reduced by 15%.

There are indications that the deal has been valued at 1000-1250 Cr. If true, then it seem to be a good deal for the current shareholders of Riddhi Siddhi. Though on the negatives – there won’t be a starch business left also cash won’t be coming to the shareholders directly.

We are also waiting for more details on the deal. Just in case the deal has happened at valuations lower than expected above then it will be a negative.

Regards,

Hi Ayush,

How more it can tank ?I am holding it from higher levels 450.

Should i exit or do you feel it can regain these levels again ?

Hi,

We have provided our view here – https://dalal-street.in/riddhi-siddhi-french-roquette-deal-impact/

Regards,

hi aam still interested to know more about the demerger of riddhi siddhi corn processing pvt ltd. have the formalities been completed would be great if someone had some news thnx ykukreja