IST Ltd is little known and highly undervalued real estate story.

The company has 28.41 acres of land at Dundehra (Udyog Vihar), Gurgaon, at a distance of 5 Kms from New Delhi International Airport.

The company had tied up with Unitech Developers & Projects Ltd (‘UDPL’) to develop an IT SEZ. The project is designed to have total leasable area of approx 3.75 million sq ft. As per the arrangement, UDPL will develop and market the property and incur all the costs while IST will get 28% of the total rentals.

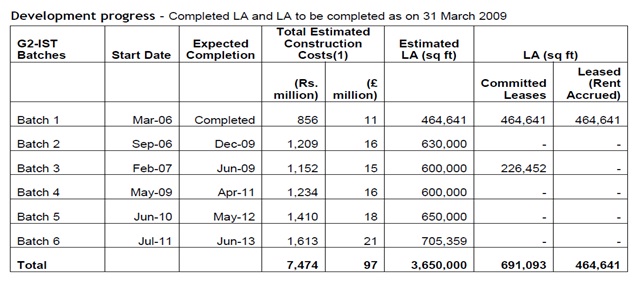

The highlights of the project are:

- It is one of the first IT SEZ in Gurgaon

- The location is good and the early occupants are Amdocs, Bank of America etc.

- 12-15% of the project is already leased out and the next phase of construction has started.

- The funding is already in place, so execution is not an issue. IST is also a debt free company.

- As the project is a SEZ, the incomes are tax free.

- For details visit : http://www.unitechgroup.com/commercial/infospace-sector21-gurgaon/index.asp

Project Progress and plan ahead:

Risks:

- The SEZ project is being executed through the co’s wholly owned subsidiary Gurgaon Infospace Ltd.

- The stock is highly illiquid.

Current Valuations:

As the company has already leased out 4.64 Lac sq ft, IST has been already receiving close to 10 Cr as annual rental income. Co is in process of constructing another 12 Lac sq ft by mid of next year. If things go as per plans, IST would be earning a rental income of 35-40 Cr in next 1-2 yr.

At CMP of 100, the company is available at an M Cap of less than 60 Cr. Even on conservative valuations, the company has potential to earn 60-75 Cr of Net Profit every year once the project is totally leased out. So if things play out as per plans, this company has all the potential to be a multibagger in 3-5 years.

Hi Aysuh,

I had followed this company in past.

Couple of questions –

1) 10 Cr is this 28% of IST share of the rental income?

2) Is this number in some way reflected in the Sep 09 results?

3) They do have a term loan of 40 – 60 Crs. http://www.bseindia.com/qresann/news.asp?newsid={6FE9EDE6-6E3B-461A-9D11-F317E8BFD57A}¶m1=1

4) If company is generating so much cash why it is not doling out dividends. As per AR – “In Order to conserve the resources for the modernisation and

upgradation of Plant of the Company. Your Directors express their

inability to recommend payment of dividend for the year 2007-2008.”

5) What is IST Power and Steel Ltd? Is it a subsidiary of IST Ltd?

Thanks,

-Puneet

Hi Aysuh,

I had followed this company in past.

Couple of questions –

1) 10 Cr is this 28% of IST share of the rental income?

2) Is this number in some way reflected in the Sep 09 results?

3) They do have a term loan of 40 – 60 Crs. http://www.bseindia.com/qresann/news.asp?newsid={6FE9EDE6-6E3B-461A-9D11-F317E8BFD57A}¶m1=1

4) If company is generating so much cash why it is not doling out dividends. As per AR – “In Order to conserve the resources for the modernisation and

upgradation of Plant of the Company. Your Directors express their

inability to recommend payment of dividend for the year 2007-2008.”

5) What is IST Power and Steel Ltd? Is it a subsidiary of IST Ltd?

Thanks,

-Puneet

Hi Puneet,

Yeah, 10 Cr is the current share of IST from the current rental income of the project.

To verify this no, you will have to look at their consolidated FY 09 nos ;-). As this project is being done through their 100% subsidiary.

They don’t have a term loan on their B/S. They have provided corporate guarantee for group co.

No idea.

IST Power was a subsidiary earlier.

Regards,

Ayush

Hi Puneet,

Yeah, 10 Cr is the current share of IST from the current rental income of the project.

To verify this no, you will have to look at their consolidated FY 09 nos ;-). As this project is being done through their 100% subsidiary.

They don’t have a term loan on their B/S. They have provided corporate guarantee for group co.

No idea.

IST Power was a subsidiary earlier.

Regards,

Ayush

Thanks for your reply. Do you have a soft copy of their AR 08-09?

You are right it is a corporate guarantee for a loan taken by the subsidiary (Steel & power). It seems they are putting money in this company. Is it because it is easier to siphon off money through capital intensive companies or may be it is genuine investment? In Mar 09 they they sought further approval and ratification of additional Corporate Guarantee for further investment in securities of IST Steel & Power Ltd.

Thanks for your reply. Do you have a soft copy of their AR 08-09?

You are right it is a corporate guarantee for a loan taken by the subsidiary (Steel & power). It seems they are putting money in this company. Is it because it is easier to siphon off money through capital intensive companies or may be it is genuine investment? In Mar 09 they they sought further approval and ratification of additional Corporate Guarantee for further investment in securities of IST Steel & Power Ltd.

Puneet,

I can forward their latest annual report to your email id. Plz email me your ID.

Don’t have clarity over their corporate guarantees. The liability will arise when IST Steel will do some default. Till then there is no liability.

Regards,

Puneet,

I can forward their latest annual report to your email id. Plz email me your ID.

Don’t have clarity over their corporate guarantees. The liability will arise when IST Steel will do some default. Till then there is no liability.

Regards,

this site is 1 km from my home in sector 22 gurgaon.your estimation of construction is correct.spoke with the company officials at unitech.no response from IST.their chairman no. is 9810067041.no pick up.my apprehension is will shareholder value increase?how is management of IST.?no news on anything concerning this on their website.this all appears hush-hush.

this site is 1 km from my home in sector 22 gurgaon.your estimation of construction is correct.spoke with the company officials at unitech.no response from IST.their chairman no. is 9810067041.no pick up.my apprehension is will shareholder value increase?how is management of IST.?no news on anything concerning this on their website.this all appears hush-hush.

Dear Amit,

Thanks for taking interest and doing the ground work.

Yes, there are risks to the minority shareholders in such undervalued unknown small cap stories. But some favourable points are:

1. Promoters already hold 75%+ shares in the listed entity.

2. The above details are already mentioned in their annual reports and other documents.

I believe that by creating awareness among investors, we will be able to protest any possible wrong doing by mgmt in future.

I’ll surely get in touch with you in a couple of days. In the meanwhile please give a few details about yourself, background and interest in stock markets, over my email

Regards,

Dear Amit,

Thanks for taking interest and doing the ground work.

Yes, there are risks to the minority shareholders in such undervalued unknown small cap stories. But some favourable points are:

1. Promoters already hold 75%+ shares in the listed entity.

2. The above details are already mentioned in their annual reports and other documents.

I believe that by creating awareness among investors, we will be able to protest any possible wrong doing by mgmt in future.

I’ll surely get in touch with you in a couple of days. In the meanwhile please give a few details about yourself, background and interest in stock markets, over my email

Regards,

At what level we can accumulate IST stocks ? Another Q. Kindly give me details of small cap co. Doing buss. in power saving equip. Manufacturing & only one indust. doing this buss. Thank you

At what level we can accumulate IST stocks ? Another Q. Kindly give me details of small cap co. Doing buss. in power saving equip. Manufacturing & only one indust. doing this buss. Thank you

Dear Kirit,

If one has still not made an entry into IST, he can still do so.

Couldn’t understand the second half of your post.

Regards,

Dear Kirit,

If one has still not made an entry into IST, he can still do so.

Couldn’t understand the second half of your post.

Regards,

I WAS JUST ASKING ABOUT THE COMPANY MANU. POWER SAVING EQUIP. LIKE L.E.D.BULBS ETC. Thanks for your kind responce

I WAS JUST ASKING ABOUT THE COMPANY MANU. POWER SAVING EQUIP. LIKE L.E.D.BULBS ETC. Thanks for your kind responce

Hi Ayush,

I have just registered on the website for any updates. My father has been investing with you guys for a very long time, apprx 20 years now.

Is there anything I need to do for the registration. I have not been able to spend much time adding knowledge in this area but then I invest in equities for sure.

Please let me know about any due diligence.

Regards,

Vikas Malhotra

Hi Ayush,

I have just registered on the website for any updates. My father has been investing with you guys for a very long time, apprx 20 years now.

Is there anything I need to do for the registration. I have not been able to spend much time adding knowledge in this area but then I invest in equities for sure.

Please let me know about any due diligence.

Regards,

Vikas Malhotra

Hi Vikas,

came to know about your father, Mr. V.K.Malhotra, who is our very old client of dad and has a good knowledge on stock investing.

Most of our clients got good success by having a long term prospective and investing saved spare money on good investment ideas provides by us.

To begin with, start with a token amount, and one can keep increasing the investing amount as the time progresses. Also, whenever you find some spare time, do come to our office and have the discussions. While at other times, a regular reading of The Economic Times and annual reports (along with the updates on blog) should be more than sufficient.

Regards,

Pratyush

Hi Vikas,

came to know about your father, Mr. V.K.Malhotra, who is our very old client of dad and has a good knowledge on stock investing.

Most of our clients got good success by having a long term prospective and investing saved spare money on good investment ideas provides by us.

To begin with, start with a token amount, and one can keep increasing the investing amount as the time progresses. Also, whenever you find some spare time, do come to our office and have the discussions. While at other times, a regular reading of The Economic Times and annual reports (along with the updates on blog) should be more than sufficient.

Regards,

Pratyush

Dear Vikas,

Thanks for getting in touch. Like my brother mentioned, it would be nice to meet you at our office sometime and explore things further 😉

Ayush

Dear Vikas,

Thanks for getting in touch. Like my brother mentioned, it would be nice to meet you at our office sometime and explore things further 😉

Ayush

Thanks for your response. Yes, Papa knows Uncle since 1984-85, I guess.

I have some holdings with me as of now.I will come to Lucknow only after July.

Will keep abreast with your blogs.

Regards,

Vikas

Thanks for your response. Yes, Papa knows Uncle since 1984-85, I guess.

I have some holdings with me as of now.I will come to Lucknow only after July.

Will keep abreast with your blogs.

Regards,

Vikas

1. In the books of IST, the land was given to its subsidiary Gurgaon Infospace Ltd at around 300 cr. This amount is shown in the B/S of IST. Now the Gurgaon Infospace is getting the rental income and paying back the loan to the parent co.,i.e. IST.

2. Consolidated EPS for FY08-09 is Rs.16/-.

3. Promoters hold more than 90%. If you check the BSE website, some shareholding was offloaded by the promoters to its unrelated companies so that SEBI guidelines (restricting promoters to hold only upto 75% equity).

4. The company is promoted by Shri Prem Chand Gupta, former Corporate Affairs Minister. Mr. Mayur Gupta,MD, is his son. You can make this out from the name of promoter companies as well.

1. In the books of IST, the land was given to its subsidiary Gurgaon Infospace Ltd at around 300 cr. This amount is shown in the B/S of IST. Now the Gurgaon Infospace is getting the rental income and paying back the loan to the parent co.,i.e. IST.

2. Consolidated EPS for FY08-09 is Rs.16/-.

3. Promoters hold more than 90%. If you check the BSE website, some shareholding was offloaded by the promoters to its unrelated companies so that SEBI guidelines (restricting promoters to hold only upto 75% equity).

4. The company is promoted by Shri Prem Chand Gupta, former Corporate Affairs Minister. Mr. Mayur Gupta,MD, is his son. You can make this out from the name of promoter companies as well.

With this background it is surprising that the co does not want to keep shareholders in confidence. The annual reports are never sent no question of dividend etc

Is the association with a former minister entitles them to this irregularity or is this a licence of being a politician’s

protege

In the transparent govt of Manmohansingh and Soni this is surprising

With this background it is surprising that the co does not want to keep shareholders in confidence. The annual reports are never sent no question of dividend etc

Is the association with a former minister entitles them to this irregularity or is this a licence of being a politician’s

protege

In the transparent govt of Manmohansingh and Soni this is surprising

With more and more investors understanding this company and buying into this stock i.e.. with better discovery, the chances of any major flip flops should decrease.

The promoters have an incentive in keeping this company listed – they can approach REITs to raise more money at later stages.

Lets see how the story unfolds. If it remains like it is – major gains may be seen.

With more and more investors understanding this company and buying into this stock i.e.. with better discovery, the chances of any major flip flops should decrease.

The promoters have an incentive in keeping this company listed – they can approach REITs to raise more money at later stages.

Lets see how the story unfolds. If it remains like it is – major gains may be seen.

Hi

Do you think it is a good time enter this at current levels.

Rs 185-190.

Hi

Do you think it is a good time enter this at current levels.

Rs 185-190.

The project is intact and due to policies, SEZs will be back in demand in next few months.

Yes, you may consider entering at these levels.

The project is intact and due to policies, SEZs will be back in demand in next few months.

Yes, you may consider entering at these levels.

Please e-mail me the annual report of IST Ltd.

Thanking You,

Abbas Momin

Please e-mail me the annual report of IST Ltd.

Thanking You,

Abbas Momin

To,

Ayush Mittal

Please e-mail me the annual report of IST Ltd. to my e-mail ID : abbsmomin@yahoo.co.in

as it will be of great help before i start accumulation the stock.

Regards,

Abbas Momin

To,

Ayush Mittal

Please e-mail me the annual report of IST Ltd. to my e-mail ID : abbsmomin@yahoo.co.in

as it will be of great help before i start accumulation the stock.

Regards,

Abbas Momin

Standalone EPS for FY2009-10 is Rs. 3.03.

Consolidated EPS for Fy 2009-10 is Rs. 25.09 as against Rs.16.92 for Fy 2008-09.

Good going.

Dear Ayush,

Do you have any updates on this. especially if the 12 lac sq feet – that was to come up by mid of the year – has come up or not.

Sorry, no updates at my end.

Standalone EPS for FY2010-11 is Rs.7.72 against FY2009-10 EPS of Rs.3.03.

Consolidated EPS for FY 2010-11 is Rs. 46.49 as against Rs.25.09 for FY2009-10 and Rs.16.92 for FY 2008-09.

Very Undervalued scrip.

Yes, the co has posted good consolidated nos this year

IST Ltd’s ‘Public Shareholder’ companies viz. EDGE INTRATECH P LTD. and ABC WEB DEVELOPMENT PRIVATE LIMITED who collectively hold 8.37% shares are also controlled by Promoters, as is evident from the details available on MCA website. The email-address of both these companies is same i.e. istgroup@sify.com. Only to circumvent the SEBI directive that the promoters should bring down their shareholding to 75% or less, the promoters have transferred there excess shareholding to their own controlled companies and have resorted to such mal-practices. Such companies are not likely to give any shareholder any return.

Thanks for the info.

Please check FY 2010 annual report of IST on BSE website. The annual report contains Balance sheet and P&L of Gurgaon Infospace Limited. After having disclosed the numbers there is no reason why promoters should get into mal practices. This share would probably rise either if a real estate rental focused fund like Milestone picks stake or the promoters start giving dividend

Hi,

Yes, IST has been giving the details and making due disclosures about its subsidiary in its annual report for last 2-3 years.

Its quite possible that a real estate fund may pick up a stake at some point of time.

But still there will always be some risk from the promoters side. Hence limited exposure should be made.

Regards,

Is there a way to find the quarterly profits of Infospace, the IT SEZ subsidiary of IST Ltd.

What is role of IST Ltd. in Facility/Building Maintenance of Infospace, Gurgaon.

what i mean to say that some thing going wrong in same.

Sorry, couldn’t understand your query.

I don’t think IST has any role in facility management.

What is the latest information regarding completion of whole project covering five phases. How much lease rental income will be received by the company for FY12 & FY13 @ 28% for IST.

As per the last update, more than 65-70% of the project is complete and let out as on Dec, 11.

Lets wait for the consolidated FY12 nos….we will have much clarity after that. I expect the earnings to inc 15-20% over last year.

IST Ltd has declared Rs.65/- consolidated EPS for FY2012-13 against Rs.45/- in previous year. Good show again! However company is very conservative and has not rewarded it’s shareholders despite consistently high performance. There in no capex lined-up either. More than 90% shareholding is with promoters only.

Sorry! Rs.65/- EPS for FY2011-12.

Not declaring the dividend is the biggest negative and perhaps this is why the stock is trading at cheap valuations. But yes, it has value though its tough to say how will the same get unlocked

Book value of consolidated entity is around Rs 365/-

As per Business Standard today, Unitech Corporate Parks is selling Inforspace Dundahera SEZ with a total valuation of Rs.3000 cr. IST Limited holds 28% of the SEZ thu valuing its shares to Rs. 840 cr or Rs.1440/- per share of IST Ltd. Price of IST Ltd is 200/- only. WOW!!

Hi Rajan,

Yes, the project has lot of value. The article doesn’t highlight if IST will also sell its share but anyways if deal goes through, it can be a trigger for listed IST Ltd

Hi Ayush,

Usually such “rental income based” properties are taken by Pension funds such as CALPERS. As interest rates are nearly zero in many foreign countries, it makes sense for them to investment in India. Moreover, no Indian entities are likely to be buyers. In such a scenario I feel Indian company IST LTD Willa not sell its stake.

Blackstone is vying with other global investors Mapletree and Xander

Group for a potential buyout of Unitech’s IT park at Dundahera, near

Gurgaon, as foreign capital laps up rent accruing real estate assets in India. – as per Times of India 21.12.2012.

IST Ltd has again given good performance on consolidated numbers for FY12-13. EPS is 79.61 viz-a-viz 65.58 for FY11-13. Mainly the income is from its share of rental income from its subsidiary’s SEZ in Gurgaon. Its a 21% increase despite challenging environment in infrastructure space. The company has again disappointed shareholders by not declaring any dividend.

Yes, we should try to take it up with the co, to declare dividends and report consolidated performance on quarterly basis too.

IST Ltd. is passing a resolution wherein Shweta Gupta and Priyankaa Gupta are being appointed as Manager (Operations) and Manager (P.R.) in Gurgaon Infospace Limited, its wholly-owned subsidiary @ Rs 2 lacs per month each (i.e.Rs.48 lacs annually for both). There are few observations : Firstly, both ladies are promoters close relatives. Secondly, what are they going to do in a company which has no work? Gurgaon Infospace has a contract with Unitech to receive its share of rental income for its SEZ in Gurgaon. All the work of managing SEZ is done by Unitech. Is it a way to extract money from the company by promoters. Yet again no dividend/bonus is being given to shareholders. All the surplus funds ( and it is a lot of money -more than 100 crore !) has been invested in promoters unlisted entities or in 15-year bonds or liquid funds. If the company is not having any opportunity, it should return money to shareholders who have been patient for so many years. What are the views of readers on this?

Hi Rajan,

You have raised valid points. There is lack of corporate governance in this co….and hence such low valuations by the market.

One needs to take up these issues.