Ajanta Pharma ranks among the Top 50 Pharmaceutical companies in India (IMS ORG MAT March 2012) with sales growing at 27% CAGR over FY06-12.

Link to company financials – http://www.screener.in/company/?q=532331

Main Generic Brands:

- Ophthalmology (Olopat, Diflucor, Zaha, Unibrom, Nepaflam)

- Dermatology (Melacare, Pacroma, Salicia KT, Sunstop)

- Cardiology (Atorfit CV, Met XL, Rosufit)

- Anti-Malarials (Artefan – Artemether & Lumefentrine)

- Gastroenterology (Lafutax – Lafutidine)

- Male Erectile Dysfunction (Kamagra – Sildenafil Citrate)

In the Dermatology segment, the company ranks 18th and has 34 generic brands – with 4 leading brands and more than 10 first-time products. In the Opthalmalogy segment, the company is ranked 7th and has 30 generic brands – with 9 leading brands and more than 16 first-time products in India. In the Cardiology segment, the company ranks 31st and has 51 generic brands – with 3 leading brands and more than 6 first-time products in India.

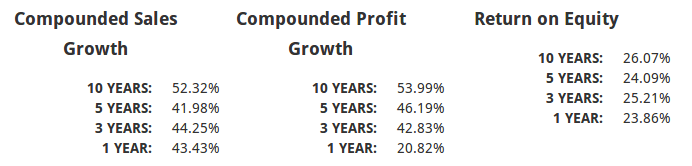

Over last 3 years, things seem to have really changed for the company. Ajanta is growing at about 25% CAGR now and at the same time its improving its operating margins, reducing loans and bringing working capital efficiency. Hence the ROE has improved from about 15-16% in earlier years to about 24% in 2012. The markets have noticed the same and the stock has been re-rated from usual 5-7 times PE multiples to about 10 now. However, we feel that given the strong branded formulation play and good rankings in several segments, the stock is available at a reasonable valuation considering the high multiples enjoyed by the pharma sector (Industry PE 26).