Shilpa Medicare: The company has got funding from Barring Equity PE Fund. The co will be allotting 5 Lac warrants to promoters and 20 Lac shares to the PE Fund @ Rs 350/share. This is a major positive for the co in the long run and fundamentals will improve majorly.

Harrison Malayalam: We had discussed about the company a few days back. The company has come out with poor nos and the stock is down to 118 levels. We feel the intrinsic value of this company is much higher than the current M Cap of the company. Few reasons to substantiate our view:

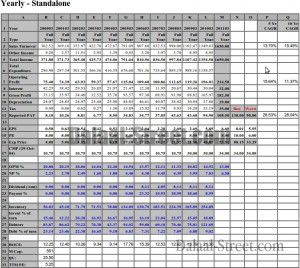

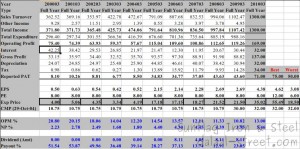

1. The company has 57,800 acres of plantations. The value today would be multiple times higher than the Current MCap of just 210 Cr. Have a look at the 10 yr financial data of the company. in 2005, the co had sold 674 Hectares of one of its Rubber Estate and had got 33 Cr as other income. Similarly in 2006. the co had sold about 916 Hectares of another rubber estate and got 63 Cr as other income.

2. The asset value of the estates must have almost doubled since 2005. As of 2009, the company has about 25,000 Hectares of plantations. So if one extrapolates the above valuation, the real value of their assets would be huge.

3. Over the years the company has been able to reduce the labour and mechanize it’s plantations.

4. As Rubber & Tea prices are rising, logically the co should be making money.

5. The record date for the demerger should be announced in next few days.

Manjushree Technopack: We had earlier recommended MT at about Rs 32 here. The company has posted excellent Q1 numbers. MT is a proxy play to the domestic consumption story and the co should continue doing well. We expect the company co close FY 2011 with 195-200 Cr turnover and close to 15 Cr of NP. The stock should continue to do well.

Gujarat Reclaim Rubber: The co has posted a very good Q1. We expect the company to come out with better nos going ahead and the stock should do very well. The company had been featured in the latest “Tyre Asia” magazine and the article is a must read.

Balkrishna Industries: BKT continues to do well. The company has posted a good Q1 when other tyres cos suffered heavily on the margins side. The reason for good performance is the niche area the company is operating in. As per Q1 con-call of the co, the updates are:

1. The outlook is very positive. The co is already operating at 100% capacity and needs more capacity to fulfill additional demand.

2. Co is witnessing very strong growth in US markets. Share of EU has come down to about 55% from 70% earlier.

3. Co is adding about 20% capacity in next 1 year. At a cost of about 150 Cr

4. Co is undertaking a major expansion of about 900 Cr over the next 2 years. Post this the capacity of the company will get more than doubled.

5. Co wants to be a $ 1 Bln turnover company by 2015.

We feel that BKT is an excellent long term opportunity.

Sunflag Iron: As expected, the co continues to do very well. The promoters have been buying every other day from the open market. The stock is available at less than 5 PE and 1.2 times BV.