We had discussed Riddhi Siddhi at Rs 285 at our blog here. The company did post much better than expected numbers and the stock had a fantastic run but the stock has been falling since last few weeks. The stock is now at Rs 360. Here is the price graph:

We had mentioned in our earlier post about the possibility of the French Co – Roquette acquiring a majority stake in the listed company. The deal has happened and the details are:

- The French co will be doing a complete takeover of the 3 plants of Riddhi Siddhi.

- The plants have been valued at approx. Enterprise Value of 1250 Crores. Today at CMP of 360, the Market Cap of Riddhi Siddhi is 400 Crore.

- To make the transaction, Riddhi Siddhi will transfer the plants to its subsidiary. Initially the French co will aquire a majority stake with an option of total buy-out.

- For the above arrangement, French co will cancel its existing 15% stake in the listed entity of Riddhi Siddhi.

The deal though looks good but the news hasn’t been welcomed by the market. Reasons:

- Nobody was expecting a total sell out by Riddhi Siddhi’s management. Now the listed entity would be left with just Cash and a power foray.

- The structure of the deal is such that there will be No Open Offer for the shareholders of the listed entity. Hence investors won’t get any major benefit of the takeover by French Company.

- The structure of the deal questions the integrity of the promoters. Had it been a direct take-over, the promoters and minority & small shareholders would have been at same level.

- It would take atleast 9 months to 1 yr for the deal to get fully completed.

- The expected cash on the books would be at the disposal of the promoters.

- Our friend – Neeraj Marathe made a detailed post covering this new method of acquisition and how minority & small shareholders are being “robbed”. As there will be a lot of uncertainty in these cases, the market would continue to value the expected cash on the books at a steep discount in the range of atleast 30-50%. We feel SEBI should come forward and protect the interest of minority and small shareholders.

Conclusion:

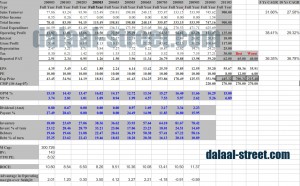

Riddhi Siddhi was an excellent bet on the growing starch business but post acquisition the business is no longer left. The cash expected to come (in the listed company – Riddhi Sidhi) from the deal is around Rs.800 per share.

Like in other cases, market might value the stock at about 50%+ discount till there is enough transparency and comfort from the management. The gap could narrow only if the management is more transparent and shares the cash with the minority & small shareholders in the form of dividend payout, buyback etc.

In the meanwhile, as there has been a good correction in the mid-cap space, we feel there are better opportunities and hence we are switching out from Riddhi Siddhi.