Its logical not to go for tyre companies as long term investment as the business model is not very attractive cause:

1. No competitive edge hence no pricing power and high competition

2. ROCE are low

This is where Balkrishna Industry (BKT) stands out. This company has had a spectacular track record of:

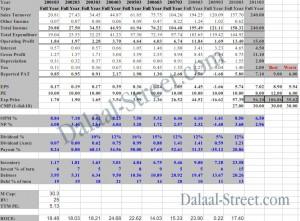

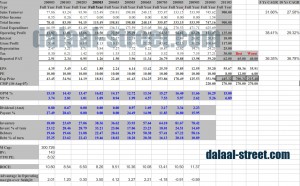

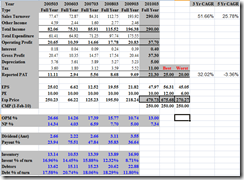

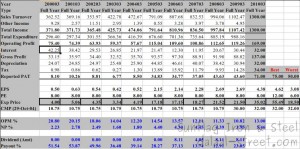

1. Growing at 30.47% CAGR for last 11 years!!! Yes, the company had a turnover of just 98 Cr in 1999 and last year, the company was able to post a turnover of 1407 Cr.

2. Net profits have also grown at the same pace.

3. ROCE has on average remained in the range of 20-25% for last 5 years.

4. Consistent healthy margins

5. Good dividend pay-out.

WHY is the the difference between Balkrishna Ind and other tyre cos so huge?? Reasons:

BKT operates in the OHT (Off Highway tyres) segment i.e.. the tyres find application in the agricultural and construction equipment segments. BKT exports 90% of its production to developed countries and 75% of the sales are to the replacement market.

Globally this industry is leaded by Bridgestone, Good year and Michelin…and as this business involves high customisation and labour, these global companies are unable to maintain their competitiveness. BKT has been able to provide the quality at 30% cheaper prices and hence is gradually gaining market share. As of now, BKT has a market share of 2-3% and the company aims to increase the market share to double digits in next 5 years.

The company has 1900 SKUs – one of the highest in the industry and the company claims to have an expertise in developing the new SKUs in-house in the least time.

Other positives:

During the crisis last year, BKT prudently held back the planned expansions to better the balance sheet. Result – the interest cost has reduced majorly and so has the debt equity ratio. The cash flows are coming in.

Going ahead, I feel the company will be back on growth to gain market share.

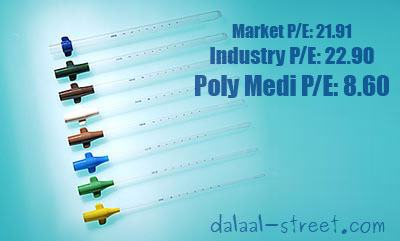

At CMP of 590 and declines, the company is available at attractive valuations for a long term investment perspective.