Poly Medicure is one of our favourite small cap stock which has carved out a niche for itself and has grown well over the last few years.

The company is the one of the biggest exporter of IV Safety Cannulae and other healthcare disposable products. This business segment is always growing and with development of better medical facilities, this segment should grow faster.

Few worthy points:

- The company has grown at a CAGR (Compounded annual growth rate) of 30.75% over last 10 years. (From turnover of 10 Cr in FY 2000 to 112.22 Cr turnover in FY 2009)

- The company is expected to grow at 20% YOY (Year on year) for next 2-3 years. This year the company is expected to do a turnover of 135 Cr with a net profit of 15 Cr, thus implying an EPS of 27.

- The CMP of 200 discounts the immediate EPS of 27 by just 7.5 times.

The last two quarters have been very good due to the backward integration efforts of the company done in the last few years and hence the company may be able to sustain operating margins around 20%.

Recent Developments

- The company has won series of patent infringement cases against major B Braun, after which the company is free to sell the advanced IV Safety Cannulae with the inbuild safety feature (http://www.expresshealthcare.in/201002/market26.shtml). This product has potential to sell at a very remunerative price in the developed nations.

- The company has been strengthening its sales network on the domestic front and tying up with major hospitals.

- The company is looking to expand its capacities and targets to double turnover in next 3 years. For they same they are also looking to put up a new factory.

Challenges:

Being a high volume low price product, the scaling up of the business is not easy. The company has been trying to develop new products to overcome the same.

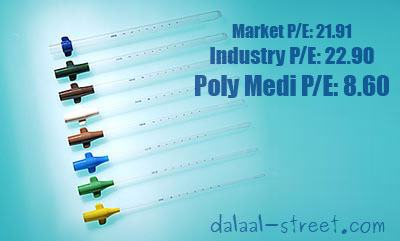

Here is a company with strong financials, good business model, high margins, good return on equity, good cash flow yet available at less than 8 PE.

Hi Ayush,

Execllent pick…..looks like another Opto Circuit in Making.

Please let me know…can it be added @CMP…..and what is the long term target.

Note:I already hold 500 stocks on Polymedicure.

Regards,

Vikas

Dear Vikas,

Yes, Poly Medicure is a good long term bet.

I would request you to go through our other stock ideas also and surely make every stock part of your portfolio.

Regards,

Hi Ayush

1. Can you throw some light on the domestic competitors of this company?

2. Are there any listed domestic competitors?

3. Which companies does it have to compete against when it exports?

4. Export markets are usually trickier than domestic. When it competes with international competitors does it compete on price or VFM or brand?

5. What is the entry barrier in this industry?

any informatiin above would be very helpful to see the long term potential of this stock

Puneet Singhal

Hi Puneet,

1. There is one more similar size co based out of Delhi. (Can’t recall the exact name)

2. No

3. Don’t have the names but yes there are lot many cos in this space. But Polymedicure is one of the best and largest.

4. PolyMed has been competiting both on quality and price. The price is many often cheaper by more than 25-30%. Poly med is also into contract manufacturing for many of the larger brands in this space.

5. Entry barrier is the size, quality over the years, relationship etc. Also the promoters are innovative and keep coming up with something new.

Regards,