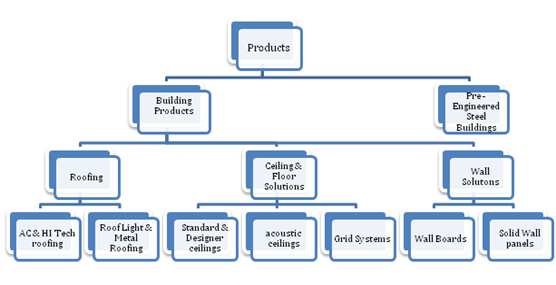

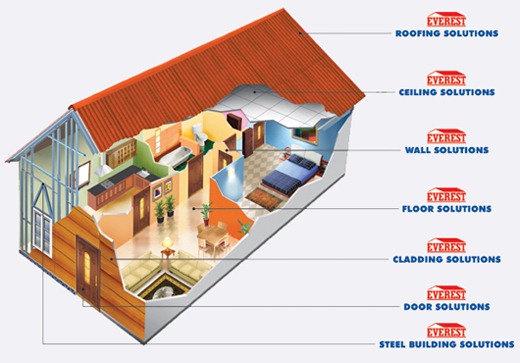

Everest Industries is a 78yrs old company offering building solutions to industrial, commercial, and residential sectors primarily in India.

In addition to the above, its products include asbestos and fiber cement, corrugated sheets, and steel and fiber cement doors.

Roofing: Out of the estimated 25 Cr buildings in India, 46% are considered to have pucca roofs and the rest 54% are made of thatch (kuchcha roofing). The company is into Fibre Cement Roofing which is used for pucca roofing and it costs 1/3rd the cost of an RCC ceiling slab. Everest has a good brand and 17% market share in this business.

Boards and Panels: The company is into producing Fibre Cement Boards. It is increasingly being recommended by architects, interior decorators and contractors as a substitute for plywood and gypsum boards due to energy efficient parameters (good sound & thermal insulation), high strength, dimensional stability in interior & exterior applications, and resistance against termite and moisture. The company also makes Solid Wall Panels which rapids construction, maximizes space utilization with durability. Everest is a major player in this segment.

Steel Building Division (PEB): Started in July, 2008, the growth in this segment has been over 25% and co does about 160 Cr turnover in this segment. Strongly recommended by Architects and Structural Consultants, its major benefits are erection of a strong long-lasting building with minimal on-site work and accelerated speed of construction as compared to conventional structures. It is atleast 50% faster and cheaper also. Increasingly used in infrastructure projects like airports, cargo, metro rails, railways, power plants etc. Everest’s market share in this segment is about 5%.

Why am I interested in this co??

- The company’s turnover growth for last 5 years is about 24% CAGR.

- Its a debt decreasing company.

- Its major clientage for roofing business is RURAL which is growing each day in terms of consumption and pucca roof is the first basic need of any family. This business segment should provide steady growth and earnings.

- Pre- Engineered buildings are the next practical thing. So this business segment may keep growing at about 20-25% for next few years.

- Expansion plan in Orissa for 100,000 MT in roofing business. Everest targets to cross 1000 Cr turnover in FY 2012 and 1300 Cr turnover by FY 2013.

- Over the last few years, Everest has been increasing the range of products to become a complete building solutions provider.

Valuation

- At CMP of 165, the stock is available at 6 times FY 2011 EPS of 27.

- Stock is trading at 1.2 times its BV of approx 138.

- Stock is cum dividend of 4.5 per share

- Company is in expansion mode and is targeting aggressive growth of about 30% for next 2 years. So one is getting a good company with bright outlook at just 6 times earnings.

Financials:

Outstanding Shares- 1,54,84,000

TOTAL DEBT – 111Cr.

Debt/Share – Rs 71.6.

Reserves -193.4Cr

Reserves/Shares-124.9.

Net Current Asstes-96.43Cr.

NCA/Share- 62.77

Hence, Rs 124.9(Reserves/Share) + 62.77(Net current

Assets/Share) – 71.6(Debt/Share) = Rs .116

Worth Buying at Around Rs.116

Hi Mayur,

Definitely Rs.116 would be great price to buy..but.. looking at the CMP the gap is quiet a lot and one should’nt try to time the market too much.

what is the best price to enter into this script. i am waiting for a correction in this stock. but it is incresaing every day

Hi Ravi,

I think if one finds the stock story interesting, then participate at the current levels with 20% – 25% of the desired qty and then gradually accumulate on falls or in SIP mode.

Building Products sales are slowing down for the industry as a whole. Even Hyderabad Industries is struggling. Last yrs performance was boosted by the steel products division & some land sale. Otherwise OP were up only around 9-10%. Valuations are reasonable I guess.

The steel products division seems to have good prospects. Another co which is bigger in that field is Pennar Industries. But I guess there are some concerns about management past track record.

~ Alokesh

Hi Alokesh,

Yes, the sector has witnessed a slow down over the last 3-4 qtrs and margins had also taken hit (i think the current margins are more realistic and sustainable). But the march qtr was decent for most of the cos in this sector. The sales seemed to be back with margins at about 10-12%.

Let see how the turnover and margins pan out in June qtr.

We came across an article on Everest’s expansion (available at their website) wherein they talked about crossing 1000 Cr turnover by 2012 and 1300 Cr by 2013. If you will look at the excel sheet, for FY 12 we considered revenue to be 900 Cr and OPM at 10%. If the co is available to achieve that then the co may do an EPS of about 30. Considering the same, the stock looks interesting at these levels.

Please share your views.

Regards,

Yes your estimates are fair… in fact probably conservative. Steel products turned around only in q3 last yr. And utilization levels are still low, so if commercial real estate picks up then growth will be 30-40% in that segment. I was expecting an EPS of around 35(last yr had currency loss of around 5 cr). Everest is on my watchlist for now. Will take a call after June results.

Yes your estimates are fair… in fact probably conservative. Steel products turned around only in q3 last yr. And utilization levels are still low, so if commercial real estate picks up then growth will be 30-40% in that segment. I was expecting an EPS of around 35(last yr had currency loss of around 5 cr). Everest is on my watchlist for now. Will take a call after June results.

Recently Govt was discussing about banning asbestos… not sure when…(or even it will happen)…. how it could impact?

Hi,

Recently there was a judgement by Supreme Court in favour of the asbestos industry in India and clearing all doubts of its environment hazards. The same can be found in the company website for reference.

Might be this is one of the reason because of which this sector has earned low PE till now.This judgement might act as a trigger .

why zero on to everest, why not hyderabad industries or visaka industries?

Hi,

We actually don’t want to invest just into the asbestos roofing business. Everest has a very exciting and fast growing segment – Prefab buildings. This could be the growth driver for the co going ahead.

Regards,

This is the scrip ramesh damani most bullish on. He holds 2.5% of the company.

This is the scrip ramesh damani most bullish on. He holds 2.5% of the company.

Hi Ayush,

i complete agree with your analysis and is of strong view that Everest in the next 5 yrs would be a totally different company. They should be growing atleast by 20% for the next half decade.. my only worry that the management is completely missing on its guidance… earlier they had guided to touch Rs 1000cr in FY11 which they fell off mark ” http://www.dnaindia.com/money/report_everest-industries-sees-rs-1000-cr-sales-by-2010_1134866 ”

http://www.financialexpress.com/news/eil-announces-1st-quarter-results/654516/0

This is by any chance does not mean i have no faith in the management .. i have very strong believer of their potential but all that i am trying to bring forward is that dont base management’s guidance of Rs 1300 by FY13.

Otherwise their new business divisons are on the verge of take off and should reap big profits for all stakeholders.

Happy Investing.

Amit Bagaria

amitsbagaria@gmail.com

Hi Amit,

Thanks for bringing up the old articles. Its important to keep track if the mgmt delivers what it promises.

I think at the time of article there was possibility of Everest signing up orders worth 500 Cr in PEB segment. May be the mgmt was bullish because of that.

Yes, 20-25% is a realistic growth target for this company and if they achieve it for next few years then it will be an altogether different co and should also get much better valuations.

Keep sharing your inputs.

Thanks & Regards,

Hi Ayush

How do you interpret the result of Everest Industries?

We saw a ~11% in price of stock couple of days before the result and now the stock is correcting back?

Thanks.

Hi,

The nos don’t look good…One may reduce or take exit for better entry points.

Regards,

Hi Ayush

Thanks.

So which stock do you suggest from your previous suggestion based on current quarter result and valuation?

Till now very results have been declared. Among our cos, Indag has done very well….smruthi also looks good at these levels and declines, if any.

Hi Ayush,

Whats the update on the strike happened in Nov Month and how its going to affect Q3 nos.

Regards,

Vishal

Hi Vishal,

We had exited the stock and provided the update here – https://dalal-street.in/results-season-hits-and-misses/

Will like to watch this qtr results before taking a call.

Looks like a steal at Rs.130,quoting at around 4X FY12E.

There was an article regarding increasing acceptance of Pre-Fab Buildings.

Is it a good story for 3-5 years?

It has value but we feel that other options being discussed are better business models