2014 has been an eventful year. At the macro level, we had a new government, an enthusiastic new leader, a great bull run… and at the personal level, we attended many more AGMs, read more books and met many great intellectual minds in the investing world. We had the highest ever visitors on both Dalal-Street and Screener, together exceeding an average traffic of 1 million page views every month, with a total reading time of over 750 hours each day.

Top performers and learnings:

Last couple of years have been great for a stock picker as the market has well rewarded the companies with niche business models, consistent growth and good corporate governance. Companies with healthy cash flows and a passionate management have been re-rated at an unprecedented pace.

Growth stocks such as Astral Poly, Avanti, Ashiana, Kitex, Shilpa, Atul Auto, Ajanta Pharma, Poly Medicure and Mayur Uniquoters performed exceptionally well. ValuePickr community proved to be an invaluable platform to collaborate with dedicated fellow investors and bring out the best of discussions. It feels great to see Shilpa Medicare and Atul Auto getting mentioned even now as the high potential ideas in the Motilal Wealth creation study.

Value stocks such as Oriental Carbon, MPS, Canfin and Lumax Autotech too performed equally well. These were trading at a sheer undervaluation despite having a good business model with a healthy growth. Reaction to the SEBI’s call auction rule also provided us an opportunity to invest in few micro caps such as Premco Global, Dynemic Product, Freshtrop and Kovai Medical. They were available at throwaway valuations, consequently providing some fantastic returns. Key is to follow value, which is always there, whenever the general mood is dull 🙂 .

Worst performers and learnings:

GRP – A big learning has been that one should learn to detach oneself from their favorite idea. Though the stock hasn’t fallen since quite sometime, one has had to incur a lot of opportunity cost. The company continues to struggle and given the low natural rubber prices and demand, there hasn’t been any material improvement in operations of the company.

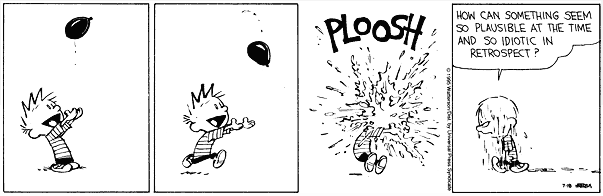

Cairn India – We got attracted by the statistical cheapness of the stock and the huge cash pile the company had been sitting on. It seemed a very safe idea with hardly any downside. But the stock subsequently fell almost 30-35% given the big fall in prices of crude oil. While it could not have been predicted, management’s action on cash also contributed to the fall.

Interesting articles:

Professor Bakshi’s lecture on Relaxo (along with the lecture on paying up) was a superb article which helped us in adding another tool as to how one should try and evaluate a company for a long term perspective. We never used to think like this before these articles.

Ian Cassel’s posts on Conviction to Hold and Averaging Up are also very good reads.

Do go through Charlie Munger’s AGM Notes, where Munger is (as usual) at his best.

We also recommend our readers to watch these movies:

Other People’s Money

Jiro Dreams of Shushi

We wish everyone a Very Happy New Year :).

DISCLAIMER: We are not expressing any opinion on on any of the stocks mentioned in the post. We are only sharing about what we think went right or went wrong in our analyses - it does not translate into a buy or sell call. The only opionion expressed in the above post is for the movies and articles.