BSE: 500013 | NSE: ANSALAPI | Market Cap. : ~510 Crore

One asset class where huge wealth creation has happened over last few years is real estate, where the maximum appreciation has happened in Tier 2 & 3 cities over the last 3-5 years. Yet real estate stocks haven’t performed well over last 3 years. The reason is the irrational exuberance the sector had witnessed during the 2007-08 boom. Most of the stocks are down 80-90% from 2008 highs. Lets rewind back to IT boom of 2000 and similar thing had happened but after the circle of extreme optimism and pessimism things came back to normal and genuine good companies were rewarded by the markets. We feel that real estate sector is also going through extreme pessimism and there could be selected winners going forward. One such stock idea might be – Ansal Property. They were one of the first to start the big township concept in these Tier 2 & 3 cities and going by the appreciation in land prices in these cities, they may be perfectly placed to reap the rewards going forward.

Ansal Property is one of the oldest and biggest builder of North India. Some of the landmark buildings constructed by the company are – Ansal Plaza, Ansal Bhawan, Statesman House etc. Following are the major projects being undertaken by the company:

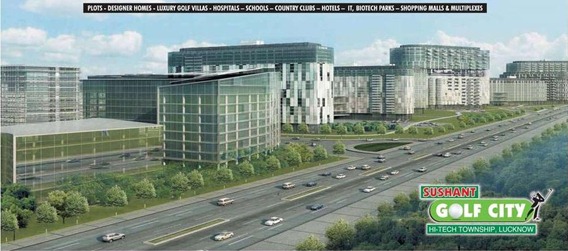

- Sushant Golf City, Lucknow – 3530 acres of theme based township.

- Esencia, Gurgaon- Developable area of 220 Acres.

- Megapolis Dadri, Greater Noida – 2504 acres of township.

- Aquapolis – Ghaziabad (127 acres), Township in Mohali (309 acres), Sushant City – Meerut etc.

Being based out of Lucknow, we are able to see the huge positive response to their biggest project – Sushant Golf City. The selling prices have gone up dramatically by about 5-6 times over in this project over last 4-5 years and it has become a major success and investing option for people in Lucknow. When the project was launched 5-6 years back, it was on the outskirts of the city but now it is one of the most sought after project. If one goes through the company’s investor updates, one will notice that the company has been reporting robust sales and collection numbers over last one year. The numbers are not showing up in the reported profits as the delivery of flats, plots etc will happen over coming years and as per accounting standards, profits are recognized on percentage completion. Also, in the initial years, the company sells the inventory at marginal profits to make the project a success and the major profits/margins come in the later years.

At current price of Rs.32, the valuations seem very attractive and there seems to be a good margin of safety:

- Market Cap is only 510 Cr while the company’s Lucknow project would be worth 10,000 Cr+ as of today. The company has total land reserves of 11,000 acres giving a total developable area of 288 mn. sq ft.

- The Book Value is 100. The stock is trading at 1/3rd of its Book Value.

- The debt position seems quite manageable with debt to equity ratio at less than 0.90. The gross debt is at about 1,350 Cr and has been reducing gradually. The company has been trying to reduce debt and has pledged shares.

- During the year 2010, the company had done preferential placement to some good investors at Rs 82-85 /share.

Risks:

- As the real estate sector is not transparent, it’s tough to get exact details and judge the real value. Many often the policies are not favorable to minority shareholders.

- There was a news item a month back that environmental issues has been raised at company’s Greater Noida township. It’s a major project for the company – covering an area of 2400 acre, in case there is some trouble, it may be a major negative for the company.

We look at this company as a dark horse wherein if nothing major negative happens for the company then this stock has the potential to be a multi-bagger over next 3 years. One needs to have patience for things to take shape. One may allocate 2-3% of portfolio at CMP and then accumulate this stock slowly in SIP mode.

Among other new ideas we are digging on are Mazda, Andhra Petro & Dynemic Products. Views invited.

The biggest worry is Promoters pledges their shares upto 97%. This is clear feed for bears to pounce on it. There are no MF invested in this share due to this risk. Risk is too high . However if it turns around, investor will make the killing.

The good thing is that the pledging is coming down. As per Dec qtr, the pledging has come down to close to 77%.

As per concalls, the promoters intend to bring down the pledging further.

Ayash,

Can you publish the content of Conf call. The number I quoted from Moneycontrol. How well Ansal’s folks are connected to SP (UP ruling party)? What was reason for pledging so big % of their holding? Almost all promoters have pledged more or less shares. What is vision of Ansal’s family about this family? I am afraid it should not turned out to IVRCL.

Don’t think the Govt change should be a major problem for the co. They were awarded the Lko project during SP regime only.

Most of the pledging is towards additional guarantee for the bank loans.

Hi,

How do u comapre Ashiana and Orbit Corp with Ansal?

regards

Sameer

Hi Sameer,

Ashiana is a much better co in terms of transparency, corporate governance and wealth creation for minority shareholders. They excel in affordable housing and are scaling up the model well. Its a good stock to have in ones portfolio and should be a steady compounder. While in the case of Ansal, we fell there is lot of hidden value.

Don’t track Orbit.

Hi Ayush,

Just General comment … nothing specific to AnsalWhenever I see big difference b/w estimated value and market value, hidden value turns out to be fake value.Normally in these cases market turns out to be winnner.

Regards

Sameer

The promoters have shady background. I think, they were involved in the cinema fire incident in Delhi. I believe, this risk overshadows all possible gains from this stock. I would not put in any money in this co. and am ready to commit the error of omission…

Yeah, the cinema accident was unfortunate but something similar has happened with promoters of Emami’s also. The mgmt was not involved in day to day mgmt.

I agree that the promoters haven’t been great in terms of corporate governance etc, but things are improving for sure. The co is now providing quarterly updates and holding concalls etc.

Hi Daya,

Yes, the cinema incident is sad. Will read more into it and analyse the same.

Hi Ayush,

Any idea what is the rating of bank loans. It was BB- by Fitch, but another site shows rating as D. A ‘D’ rating if true would be really bad indicating serious cash flow problems.

Hi,

The last given rating was by FITCH and they had rated the long term debt as B-

The Midas Touch in evidence yet again 🙂 Up approx 10% in a falling market 🙂

Cheers, Ayush !!

lol…stock did pretty well today…hope it does even better in coming times 🙂 Your thoughts on this co? (email me if thats convenient).

Cheers,

Ayush

I’ll e-mail you on Ansal. Awaiting yr views on Mazda & AP. Thanks.

I’ll e-mail you on Ansal. Awaiting yr views on Mazda & AP. Thanks.

I would be interested in your ideas on Mazda and Andhra Petro. Thanks.

hi Ayush,

thanks for your valuable inputs.

Can you please share your inputs on SAB tv.

Hi, Don’t track the same.

any idea on the other 2 ansals – ansal housing and ansal buildwell ?

Had looked into Ansal Buildwell…they are also doing well but perhaps the scalability might not be there. While in the case of Ansal Prop as they have undertaken huge townships, the returns can be big.

Ansal housing is failry under researched. they have some stakes in restaurants and other businesses also..

Thanks for the info. Will read into it.

the analysis done on the company is commendable. gives a fairly good idea . a good job done. this is something that i like about this site. gives knowledge. secondly, now since mkt is sliding down, i stronlgy feel there is good opportuntity for reatil guys to grab some of the gems that are falling due to bad sentiment . created by FM by looking to give sweeping powers to IT officers under GAARP, and tax PN , money coming from Maurutius route etc..so all round confusion. and i strongly feel this is deliberatley created by these politicians , to bring down the mkt, and grab shares at lower rates. this is third time …and everytime after 2-3 weeks some clarification will come, and mkt will go up. but poor investors who cant hold on sell at a loss and regret. i advocate that now go out and in every 200-300 fall in sensex look for these stocks and grab them…..lic hsg, rec , thermax , new stand eng, century text ( must buy…buy ) , idbi , dcb , dhanlaxmi bank , boc , phil carbon , ineabs , thomas cook , novartis etc.etc…just grab them in every fall….keep accumulating.happy investing.

Thanks for appreciation 🙂 Yes, bad sentiment is the best time to accumulate quality shares and build a strong portfolio.

Ayush, I have already invested in Mazda @ 78-79. This is a deep value stock. with 22 Cr. in liquid investments the whole company is available @ less than 37 cr. that effectively means you are buying the co. producing a cash flow of more than 10 cr/yr for @ 15 cr. Its a no-brainer bargain….but would like to know your views on the risks involved in Mazda.

Hi Daya,

Yes, Mazda seems to be safe stock idea. The trigger could be the growth. If they can continue growing at say 20%+ then the stock should do well.

The cash on B/S seems to have reduced to 15 Cr as of Sept, 11.

Don’t see too much of risks here other than temporary slowdowns and slow growth (like over last 2 yrs).

Hi ayush,

Mazda seems to fit Graham’s debt capacity bargain model.Average Operating cash flow for past 4 years around 14 Crs, and assuming interest cover would be 4x, company can have service interest of 3.5 Crs..which say at average borrowing cost of 10% (Including cheaper export finance) would lead to Mcap of 35 crs.

The impact of CAPEX hopefully will start coming now which can give a growth of 15-20% on topline.

Regards,

Hi,

Yes, Mazda seems to be a value pick and hopefully the growth will come now.

Hi, isnt the greater noida environ issue a huge risk considering what happened with Lavasa (HCC)? Is it prudent to take a chance without clarity on that front?

Vinod

Its a risk for sure but not as big as it was for HCC cause its not the single project the co is working on. The co has several projects.

Ayush,

Why you interested in Andhra petro ?improved perfomance or any other reason ?last few qtrs company is on growth track …but that not reflecting the share price. share your thought. performance wise consistency also big problem

Yes the performance has really improved post expansion but the stock price is at same level 2 yrs back. Plus as per Sept qtr, the debt has reduced smartly.

The rates being offered look reasonable as the real sector has been facing the highest cost of borrowing. This rates are cheap for them

Help me understand if i am missing something. They can take money from retail investors at 12%, make a rate of return higher then this ! .. then real estate should be one of the top performers in the stock market….

As per newspapers, real estates cos have been borrowing at about 25% p.a. and with tightening liquidity the rates have been rising.

Hi Ayush,

where can look for total bse+nse turover at real time??

Hi Ayush,

In my opinion Mazda is a good investment as on market cap of 37-38 crores, they have roughly 22-23 crores of cash/liquid investments on balance sheet. If we assume even 8-9 crore PAT, it is 2 years forward. Moreover they are expanding capacity by 15-20% in engineering and food division is also doing well. all in all, it seems to be low risk- high return opportunity.

Completely agree 🙂

Hi Ayush,

I would like to know your view on Ansal Housing, though i am not interested in their small holding in restaurants, i like their core Realt business.

With company having acheived a profit of Rs32 crore last year (FY11), it seems that it should easily beat this number this year(fy12)

Being available at Mcap of Rs90 crore, it seems to me as a bargain.

Would appreciate if you could look into it more deeply and post your view on it.

Kind regards

Aman

Just running a bit busy…will try to.

any price target?

Hi Ayush,

I have been following Maithan alloys..the numbers are impressive. can you share your thoughts on the same?

Hi Daya,

Don’t track it but had a quick glance and the nos are interesting. Did the co do some placement etc last year? (the eq has inc and debt has come down)

On the negative, we dislike this alloy sector as the margins are highly volatile and unpredictable.

Hi Ayush,

This is regarding the Ahlcon Parenterals, the open offer is already announced by B Braun to acquire 26% of the shares from public. Pursuant to which B Braun will exercise the option of acquiring the rest from promoters to make it a total of 75%.

As per current shareholding structure 70.95% of the shares are with promoter. Open offer is for 26% out of 29.25% lying with public.

So, my question is that the only reason, why the share is quoting at 418 and not very close to 460 ?

Or am i missing something ?

Regards

Sorry, not tracking the open offer closely

Ayush,

I read your blog since last one year and getting lots of valuable tip to become value investor. I live in USA and professionally software engineer but would like to invest some money in Indian stocks so I am reading your blogs and other blogs that I got links from your blog.

You are doing great job man.

Kushal

Thanks a lot, Kushal 🙂

Samtex Fashions – Obscure, Ugly but probably one of the cheapest opportunities out there

Samtex FashionsConsolidated Turnover for TTM is around 750 crores and EBITDA is 54 croresThis company has a Garment Business which is listed and owns 100% of a Rice Company whose name is SSA InternationalThe standalone numbers are ugly but the Consolidated Numbers are Mouth WateringAlmost all the Consolidated Debt is tied to the Paddy Inventory that it holdsRun by decent management which is not very open in communicating with fellow shareholders but is competent and knows what it is doingRecently took a Convertible Warrant issue at a big premium over the current stock priceThe market cap is less than half of the EBITDAThis type of a business usually trades at around 15-20% of sales which makes it a market cap of 110-150 crores, all that is required is patience and loads of it

Hi,

Thanks for the idea. Will keep a tab.

http://www.taxmanagementindia.com/visitor/Detail_Case_Laws.asp?ID=212907

came across this too,obviously i cant log in, but maybe you would know what to make of it

Ayush,

Please let me have your view on NILA INFRA

We don’t track the same

Ayush,

Have a copy of Research report from Anand Rathi ( June 11) on Ansal with a Buy recommendation @70.

Pl let me know your interest, I can mail you a copy.

Is Smruthi worth accumulation at this level with a 24 month view ?

Thanks

Rajan

Rajan, If you can please send the report to deep275@gmail.com , thanks

Ayush,

Can one enter Ansal at this price of 22 odd level?

Kushal

We do feel it has lot of hidden value and these prices seem attractive.

Thanks.

Added some yesterday.

Hi Ayush, What’s your current view on Ansal prop? can this be bought at current level. Any other real estate stocks you like? please advise. Thanks. Raj.

Hi Raj,

We do feel that this co has a lot of value but we there are some transparency issues and hence we suggest smaller allocation as of now. One may look at Ashiana Housing for longer term.

is it the right time now??