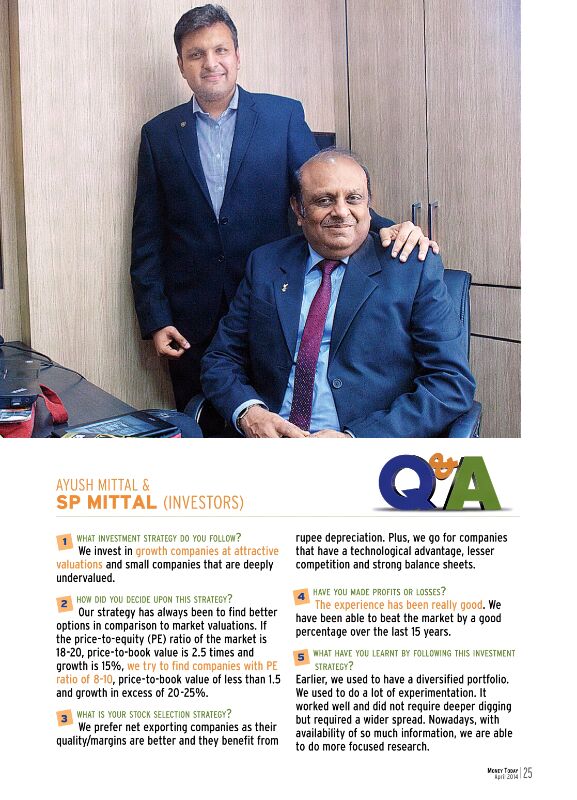

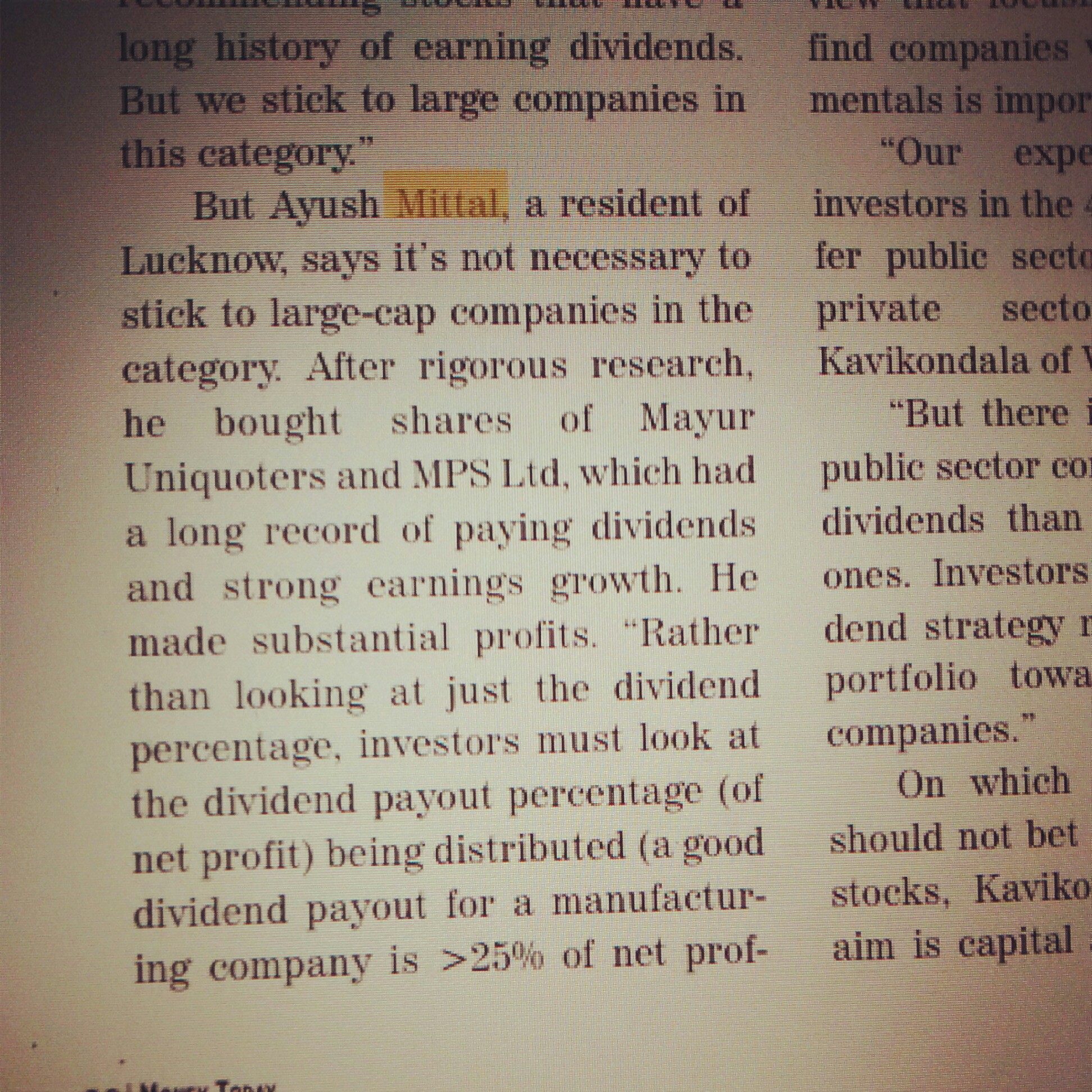

We are happy to share that we have got a mention in the April issue of Money Today Magazine.

The magazine’s cover story is on “Equity Investing: Myths vs Reality.” Its an interesting issue and you might like to get a copy of the magazine :).

The markets have done quite well in the recent months. Many of our stocks such as Astral, Ajanta, Mayur Uniquoters, Atul Auto, Avanti, MPS, Poly Medicure have created new highs.

We haven’t been writing about new ideas over the last two months because most of the companies we have held are quite good and it is better to just sit on them and watch. With the markets getting into action, it is not easy to find many new ideas. Owing to the good returns, it might be a good option to build some liquidity/cash in portfolios (around 15-20%).

Stock Updates

Kitex Garments: The company is one of the first ones to declare the Q4FY14 results. The numbers are fantastic: sales have increased by 56 %, operating profit margins have increased to 24% and the profits have increased by 170 %. Looking at the increase in the gross block in the balance sheet, it seems the expansion has completed and the current performance may sustain. In the whole textile sector, it is one of the rare companies with a differentiated business model and good quality earnings.

Shilpa Medicare: The company posted very good performance in Q3FY14. The stock price has done well too. The interesting thing is that the growth has started coming even when the USFDA approval hasn’t come for the new formulation plant. We continue to be optimistic about the company’s long term prospects. IndiaNivesh has recently published a detailed coverage on the company; we recommend our readers to go through the same.

Ashiana Housing: Prof. Sanjay Bakshi has written some excellent blog posts related to Ashiana Housing. The posts help us understand the reasons for the superior business model of the company. The management interview discusses the company’s vision and highlights the clarity in the management’s processes. We recommend the readers to go through the posts.

New ideas under study

PTC India Financial Services: The company is promoted by PTC India. It provides financing to energy projects. Earlier the company also had investments in several projects, but divested from them at good profits. Although the company suffers from risks related to power and PSU sectors, it has been increasing its loan book at a brisk pace of 30 to 40%. The growth is expected to accelerate if the sector sees some improvement. At CMP of 14, the stock is trading at about 6 times its normal earnings, half the book value and with an expected dividend yield of over 4%.

Technocraft Industries: Its an interesting company to delve deeper. The company has 3 main segments of which the drum closure division is the primary one. Drum Closure is the lid used to seal the oil and chemical containers. Technocraft is the world’s second largest player in the drum closure business with a market share of 35% . The patented technology and the monopolistic business provide the high margins. The company gets a turnover of around 225 crores and operating profits of around 65 crores from this segment. The market capitalization of the company is 274 crores.

Although the drum closure division is the cash cow, the other two divisions – Scaffolding and Textiles – are low return commodity businesses. These two divisions bring down the overall profitability and return on equity of the company. The company has not been able to utilize the spare funds efficiently and also lost some money in NSEL (booked 50% loss in the December quarter).

If few things can be corrected, the stock has lot of value at CMP of 90.

Freshtrop Fruits: This company is one of the leading exporters of high quality grapes and other fruits from India. In past, the company was one of the earliest and most advanced players with best of the technology to export high quality grapes. Currently the company is supplying to one of the best retailers including ASDA, Tesco, Marks & Spencer, DelHaize and others. Over the last 3 to 5 years, the company has been experiencing a few problems:

1. Europe stopped import of grapes from India due to high pesticide.

2. They had done a major capex for fruit processing plant which has been a drag on the financials.

3. In the current year, there has been a major hailstorm and the results might be poor (we would request our readers to provide the inputs if possible).

We came across a recent article on the bright prospects of the industry. It might be a turning point for the company over the coming years.

Few other ideas which are cheap on valuations and may fit well into Graham kind of plays are: Damodar Industries and KCP Sugar. Another stock which looks opportunistic is Waterbase Ltd based on the superb run-up in Avanti Feeds.

For the upcoming elections, we would request all our readers to caste your vote – your investment returns might depend on it.

Link to manifestos

AAP: http://www.aamaadmiparty.org/aap-manifesto-2014

BJP: http://www.bjp.org/manifesto2014

Cong: http://inc.in/manifesto/

Congrats for the Money Today article.

Do you guys have any paid service or paid portfolio management ? I was just wondering what is the source of your revenue ..

thanks

Deepak

Hi Deepak,

We are investors ourselves and like to share.

Thanks.

Many congrats on being profiled in Money Today. I will surely pick up a copy.

Way to go – continue the good work being done on dalal-street and screener.in !!

Thanks 🙂

Hi Ayush,

Heartiest Congratulations to team Dalal-Street & Screener! It’s indeed a moment of proud! I am sure this is just the beginning of a journey and many more milestones to cross…

I too find PTC India Financial interesting. First of all they are focused largely on financing renewable energy projects and hence are less affected by the dire state of the power industry. Secondly, they do debt/mezzanine equity/equity financing hence the spread & return they enjoy are much higher than a pure debt financing company. Thirdly, their track record in value creation from equity/quasi equity financing is very decent. They have made good money from almost all the exits that they have made recently. It also has strong parentage and valuations are also attractive. So barring PSU tag (!), all the drivers seems to be in place….

What is your view on NBCC? I find it promising even after recent run up. It has unique business model, access to sustainable “float”, entry into scalable business of “re-development” and access to very valuable land parcels (through partnership with state/central govt). At current valuation, it seems attractive. Again, PSU tag is the dampener (At least for me!)

Best Regards

Dhwanil

Yes, PSU tag is a big dampener and I also prefer to avoid most of the cos. Had looked at NBCC earlier…it did look good but gave it a go for the same reason.

In PTC finance they have some aggressive and ambitious targets of growing the loan book. If it happens…next few years may be good.

Hi Dhwanil,

PSU tag sometimes can be opportunity as well, depends on the timing. Usually PSU do well when a new government is formed. If I am not mistaken, most of the PSUs did well during 2004-2006. If a pro-development government is formed at the centre in May ’14, it could have a rub-on effect on PSUs in general.

Regards,

Roberto

Ayush,

Congrats for getting mentioned in the magazine. As I see it, this is only the beginning and you will go places. When you do things selflessly, many good things comeback to you in multiples. Screener.in and this site is selfless act from your side to benefit the investing community and you will reap great rewards in some form always.

Keep up the great work.

Regards

Ravi

Congrats. You deserve much more than this. Blogs and Screener is really helping a lot and lot. Please add Roto Pump,Fluidomat, Lumax Auto Technologies and DHP India. All four looks like it has value in it. But your eyes are very sharp to find moles in balance sheet and fundas. Once again, Big thanks for bottom line on “VOTE”

We have personally tracked and invested in Fluidomat (exited recently), Lumax Auto & DHP. Thanks.

Just curious, in the past 3-4 sessions the volumes in Fluidomat have gone up significantly. Was it you selling out? 🙂

No, we got out a bit earlier.

Congrads ayush, Credit to you for identifying atul auto for me.

Atul Auto has been a good company. Thanks, Jagan.

Congrats Ayush, way to go.

keep up the good work and keep finding hidden gems for your followers.

Thanks

Thanks, Ashish!

Thanks for the appreciation Ravi.

Hi Ayush,

Congratulations to your father and to you. I know for you sure you will achieve many such wonderful milestone in future. I am regular visitor to screener.in and dalal-street.in. They are great tools. Thanks for sharing them.

Regards,

Roberto

Hi Ayush .. Congratulations !!

Any particular views on Piccardily Agro at current price?

Thanks and Regards

Sudheendra

Hi,

No particular view as such. We are holding and will like to monitor a cpl of qtrs.

Ayush

Thanks, Roberto.

Hi Ayush,

Congrats! Hard work is paying!

What is the story behind Damodar Industries? If we look beyond undervaluation/financials, is there something in the product/promoters/technology/business cycle that market is not taking into account?

Hi Megha,

As of now, our interest has been mainly due to the undervaluation and consistent growth in the co. It like many of the other yarn cos but probably better managed.

Congrats Ayush, Good show. Nice to see a fellow Lucknowite reaching the top.

Please share your views on DHP india ? Do you see value in it ? Any gaps/holes i am missing. Please advice.

Hi Puneet,

Nice to know that you are from Lucknow 🙂

We do like DHP and do own some. It would be better if we have some clarity on scalability and sustenance of margins.

Congrats Ayush!! Much deserved for your selfless service to the community. My best Regards to the Mittal family 🙂 Any specific reasons for exiting Kaveri Seeds? Regards, Vamsi

Thanks Vamshi.

We exited as we couldn’t get comfortable with few things and develop comfort on the quality of nos. As a part of our checklist process, we don’t like cos with low or no tax and this was a key worry point.

As Always – The Best – Ayush Mittal

Thanks

How was Kitex not noticed by big investors till now even after being such a large player in the world?

Congrats Ayush!!

Thanks, Bharath.

Congratulation Ayush ! Thanks for sharing your hard work with community.

I have been looking at PTC Finance for sometime now. Please check their hedging profile. They keep making mess out of it. I don’t think they have hedged all of their exposure and any currency volatility can take away major part of spread they target

( Caution – i may be entirely wrong, as always 🙂

–

Hi Ashish,

Thanks.

Are you talking about the ECB borrowings done and the M2M losses on the same? If not can you plz provide more details.

Thanks,

Yes

Will look more into it. However, it doesn’t seem to be a big concern as of now.

Hi Ayush/Pratyush

Congrats Ayush:-) Wish you reach more heights and conquer new peaks..

mallikarjun

Thanks 🙂

Hi Ayush,

Kitex faces a lot of competition from neighboring Asian countries. Does it possess any competitive advantage. What is the differentiation in its business model?

Hi Vignesh,

Yes, the area is highly competitive but yet if you analyse their nos, they have done pretty well over a long period…..which surely indicates that they have some competitive advantage.

As the information is limited we don’t have detailed answers but thats what we are working on.

Thanks Ayush.

I request youto look into this point – It would be gr8 if a mobile app is designed for screener.in. It ll increase its visibility and ll also help us to utilize it easily

Hi Ayush, is there any specific reason to exit Acrysil?

Hi,

No specific reason – we wanted to raise some cash in portfolio and while comparing with other ideas we own we felt we can sell this one.

Hi ayush

i want to learn how to find good stock for investment

can u help me on this way

i m wting for ur reply and guidance

Hi Rajeev,

I think its a lot about curiosity. One has to be eager to look at new ideas, workings and discussions.

To get new ideas, subscribe to good blogs, read new articles, business magazines and look for cos which are reporting turnaround/good results and yet undervalued.

You may like to subscribe to screens like – growth stocks on screener.in to get new ideas.

Thank you very much sir

technical may help me in this way

Technical is a different thing. I am sure Ayush and Pratyush never look at them. Technical is never for investment but pure trading.

Hi Ayush,

Congratulations for the very nice coverage in “Money Today”, I have read the entire article “Busting Stock Market Myths” twice!! 🙂

Amit Goyal

Thanks, Amit 🙂

Hey Ayush Congrats!! am sure this ll be one more feather in what ll soon become an overcrowded cap …All the very best 🙂

Thanks

Yeah, we have it on mind. To start with, we have made the website friendly for accessing from mobile….give it a try

Congrats and thanks to you for sharing the vital information and analysis with everyone! Regarding Avanti feeds looking at the increasing shrimp prices and lot of countries which were major exportes of shrimps being impacted by EMS do you feel that Avanti will be a good bet when it will be shifted to rolling from T2T?

Hi,

Yes, Avanti has been doing very well and given that India has been resilient to the EMS disease, there is a possibility of good times to continue. If so, the stock still looks good.

Ayush,

I don’t get any updates about new posts/articles on this blog when they are posted?

I think I should be getting alerts on new content that is posted, right?

Could you please help with this.

Thanks,

HR.

You need to out your email id at the subscribe option at the top right of the blog. After that you get a verification email.

Plz try redoing the process, something might have got missed.

Isn’t promoters diluting equity read below,

Freshtrop Fruits Ltd approves issue of 2 lakh shares against warrants

The Board of Directors of Freshtrop Fruits Ltd at its

meeting held on February 08, 2014, has approved the allotment of

2,00,000 Equity Shares of face value of Rs. 10/- each fully paid up

issued at a price of Rs. 14/- per share (Rs. 10/- Face Value + Rs. 4.00

premium) to Mr. Ashok Motiani, pursuant to conversion of 2,00,000

Convertible warrants out of 11,00,000 convertible warrants allotted to

the said person(s) on October 01, 2012.

Shares of FRESHTROP

FRUITS LTD. was last trading in BSE at Rs.20.4 as compared to the

previous close of Rs. 19.5. The total number of shares traded during the

day was 1286 in over 26 trades.

The stock hit an intraday high of Rs. 20.45 and intraday low of 19. The net turnover during the day was Rs. 25155.

Source: Equity Bulls

What’s your take on this ?

Yes, this is a negative for Freshtrop.

Hi Ayush,

Damodar industries reminded me of another stock. I have been tracking a stock called Ambika Cotton Mills. What is your take on the same?

Cheers!!!

Not tracking Ambika.

The financials look attractive. However, it is still what one would call, a “Raw-materials-processor” and likely will never get higher PE.

Congrats Mittals..

Thanks, Rahul 🙂

Get your Home Loan queries answered by the expert.

Join DHFL for the exclusive tweet chat with Mr. Rakesh Makkar, President DHFL and get advice from the finance guru on the best investment decisions.

What about Alembic Pharma results? Any inputs on that?

Results are good but the valuations are rich now at about 25 PE.

Though the pipeline is good but the co needs to maintain 25-30% at these valuations for next 2-3 years. Anything less may lead to disappointment and correction.

Thanks you.. What do you recommend? HOLD or shift to some other pharma co?

One can hold if one has patience for next 2-3 years.

Can switch if one has better ideas.

I had a chance to go through damodar Industries ltd and following are my observations

The company is looking internal operations of the company to bring down the cost

The company has a good relationship with leading textile manufacturers in India

Company enters into derivative contracts with banks to hedge currency risk

Company is run by family which is good and also bad at the same time

Company has taken loans from family members the interest rate for same is not specified

Directors renumeration is very high

No mention about the debt in annual report

Promoters hold around 70% of the company shares

Company has plans to raise further debt by other means for expansion plans.

Since the Debt to Equity is already close to 2 it is better to avoid the company

Hi Ayush,

Thanks for shaing valuable information.

PTC has posted very good result. Do you see any negative in that?

Kitex looks good as i was going through annual report. Management has said that they want to repeat the last year performance and has completed expansion in mar,14. Just thinking, what kind of PE ration is commanded by this kind of company?

Canfin also posted very good result. Do you feel it is good enough to accumulate it somewhere in the range of 210 to 250?..

Thanks for your help

Malthankar

Hi,

Yes, PTC has posted very good nos and it still looks good to us.

Yes, Kitex also looks promising especially after seeing the underlying confidence of the management. If they can maintain the margins like in recent times then, I feel PE of about 10 and below is attractive.

Yes, Canfin has also done very well. As we had bought at lower levels, we are just holding.

Hi Ayush,

I think there would be an investment fund that would be floated by all of you. Do you guys allow people to contribute in that as many people do in mutual funds? or it is not open for all public?

Thanks,

Milind

Hi Milind,

No, we don’t have a common investment fund.

Hi Ayush, Selan has come out with muted results.There were expectations of contributions from the increasing no of drilled wells to the revenue but that has not happened.What’s your view and should it be a hold from here on?

Hi,

Yes, there hasn’t been any concrete insight into the development of new wells so its more of a patience game. Over short term it does looks expensive but if one is ready to wait for 1-2 years, then there is a high chance of good growth in earnings of the co.

Ayush,

Can it double/triple its sales over the next 2 years? As we all know its all about how much can they extract, since the end product is a hot cake in the market. Management / some analysts have commented in the past that it can scale its revenues up to 5 times the ttm over the next 3-5 years. The main showstopper was DGH permission which is resolved now.

Yes, as per some of the discussions with people tracking this co closely, there is an expectation that the revenues can easily double to triple given the progress in drilling of wells.

Hi Sir ji …Hearty Congratulations to team Dalal-Street ..Appreciate your great work … Sir whats ur update if you attended Kitex Agm today ?

Hi,

The AGM was quite good and it seems to be a very good co in terms of business model and potential for next few years.

What about Ashiana Housing PE Ratio which is now nearly 36? I like the business but isn’t valuation too stretched at the moment?

Ashiana had changed the accounting policy and hence the nos are impacted. The true nos should start showing up from the coming year. On normalized earnings, the stock would be trading at less than 15 PE

Hi Ayush,

How good Shilpi Cable technologies look to you? I have done some basic fundamental analysis. Seems to be Ok apart from low tax rate and zero dividend. Also the promoters are issuing shares to FIIs at Rs 30 only. Also the names of those FIIs seem to be suspect. Any Idea about the management quality of the company. At such a low P/E with decent growth in the past 2-3 years, how does it look?

Thanks and Regards,

Amit Goyal

Hi Ayush Sir,

I think you missed replying to my query on Shilpa Cable technologies. Waiting for your reply eagerly. 🙂

Thanks and Regards,

Amit Goyal

Sorry, not tracking the same

Poly Medicure results were declared. How do you find it?

The profitability is below expectations but I understand that the same is due to some one time items of about 4-5 Cr. So the results are ok.

What do you think about the future prospects of the co?

For a very long term investor, I feel its still a good idea.

Waiting to hear your take on the markets post-Modi election. Any general thoughts?

We feel, that its a big positive change everyone had been waiting for long and we are very optimistic for longer term.

Hi Ayush,

What are your views about results that Oriental Carbon and Chemicals have posted?

The results look good.

Ayush,

What’s your outlook on ahmednagar forgings and kitex garments?

are both is a buy at current levels or is any of them overvalued?

or are they overpriced kindly share your view?

and also share what’s there future outlook

ahmednagar has been doubled within 15 days without any reason. Don’t think it is a buy at present level.

Ahmednagar results were good but the stock has run up quite quickly. Also, over longer term the co has had a debt heavy balance sheet and not a very impressive ROCE.

Kitex looks good to us from a long term perspective.

Dear Ayush ji,

Pls suggest some medium risk stocks which turnout to be multibaggers.

Thanks.

KK

Hi Ayush,

WHat is your view on Freshtrop fruits ? Is the business scalable and what is your long term view on the stock , 5+ years ? Pls share insights

Based on the article about the good growth happening in the grapes sector, this co is best suited to benefit. However, we are also looking for more clarity for longer term perspective.

Thanks Ayush. Do you think looking at the potential that i can make a small investment in it or do you think this company is an avoid till more clarity comes.

I feel one can make some investment if one likes the story. For bigger allocation more clarity would be needed.

Hi Ayush,

I was reading about “Plastiblends India Ltd.” on valuepickr and it seems it was one of the good company but in slowdown they could not grow very fast. As hope is coming back after modi government. Could you please share your thoughts on this? is it buy?Hold?…

Thanks,

Milind

Plastiblends looks ok. It was undervalued sometime back but the stock seems to have got the due attention now. We feel Dynemic products is more undervalued.

Dear Sir,

I am extensive user of your website screener.in , I request you to provide option to list all the companies in an Industry e.g. Heavy Electrical Equipment this will help to compare and choose all the companies in an industry. This will be a great value addition to you site.

Thanks & Regards,

CA Manoj Agrawal

Ayush,

Do you track Indag Rubber ? If yes, pls share your insights on this ? Company seems to have a good potential and balace sheet looks good.

Thanks,

Puneet

We have covered the stock earlier on our blog. However, we have exited recently.

Regarding, Indag rubber,Can you please share the reason for exit ? Also what is your long term view on Amara Raja Batteries ?

Indag has benefitted a lot due to some favourable tax advantages it has. These advantages will begin to expire from FY15 & 16 and this could materially impact their margins going forward. So just wanted to be safe.

However, I agree they have a good track record and balance sheet.

Amara Raja is good.

Thanks Ayush. Do you track Kirloskar Oil Engines ? If yes, pls share your views ?

No, I don’t track the same.

Thanks Ayush. How is VST industries looking at current levels for long term ? Stock recently has been down and hasnt participated much this year.

Sorry, not tracking it.

Hi Ayush,

Shilpa has come out with a good set of nos.It looks a good bet and is quoting at attractive valuations. When the rally in the pharma counter comes it will give great returns. Do you feel that one should be looking to buy at cmp?

We feel its a good opportunity. The buy/sell decision rests with you.

Thanks for the reply

Hi Ayush

What’s your views on Alembic Pharma, MT Educare , Fluidomat, Singer India?

Is alembic underperforming despite market rallies?

Alembic looks good for long term. It may be underperforming as it has already done quite well over last 2-3 years and now trades at decent valuations.

Fluidomat is a interesting company. We exited early.

Don’t track others.

Hi Ayush,

Thanks for your suggestions. It is very very valuable. I followed shilpa madicare (your post and valuepickr) and it seems everything is going well. What is your view on Alloting preferretial shares to raise capital and how much dollar weakness would impact company. just wondersing, what could be level when i can buy some shilpa madicare?

Thanks for your help?

I heard you asking question in mayur uniquoter..any views for buy level?

Regards,

Milind

I think preferential allotment once in a while at good valuations is not bad for a growing company like Shilpa. I don’t think we should worry much about the dollar weakness on Shilpa as of now. I think current levels are also good. However, please take your own call.

For fresh buying in Mayur, I think the current valuations are a bit expensive.

Sir Your View on PSL Ltd., Alchemist Ltd and IFB Industries for long term perspective..

Sorry, don’t track them.

hello ayush sir,

i would like to know your view on ansal housing & Construction Ltd also how does Good Luck Steel Tubes Ltd looks to you?

Kindly share your view on the above company i wan to buy them for medium term prospective

Sorry, don’t track them

Hi Ayush,

Thanks for all your great efforts and getting set of excellent tools like screener.in available to investors community. My investment approach always starts with that and taking it to next level of investment study from there.

It will be great to get the updates on dalal-street.in once in a week or fortnight to learnt from your wisdom. Your Twitter updates are helping to learn as well 🙂

Wishing all the great success.

-Muthu

Dear Sir,

Any view on Force motors.

Sree Ajit pulp & Paper: Awesum numbers. Too good but Last year there was audit qualification. There was no consolidation of subsidiaries. This year there was a change in auditors and now they are consolidating? Kind of unusual, no?

Yeah. Plus the recent nos haven’t been good

Hi Ayush,

Do you still hold Mayur Uniquotors ? whats your view on current growth?

Yes, we do hold. The co is really good and if one reads the latest annual report….one can really see the seriousness and commitment of the promoters. Its not easy to find such good cos. Yet, we feel the valuations are quite rich and have done some profit booking in recent times.

is it possible to export the my watchlist to excel

Sorry Manoj, the option to export the watchlist is currently not available.

also one more question can I put my purchase value against each share to see how my returns are calculated

Thanks for the suggestion Manoj, we will consider it in future. In the mean time we recommend creating a portfolio on Google Finance which records the addition date as well as provides a live ticker.

Mr ayush can you have look at ASSOCIATED ALCOHLOL AND BREWERIES LTD. Seems intertestin with 30% CAGR gr and roe of 10% and excuslive supply agreement for Diageo SMIRNOFF. Bottling agreement with mason summer for single malt glen Drummond only player in single malt segment promoter ANUSHMAN KEDIA recently in resided his stake by 6% can you throw some light please

On the face of it, the nos are interesting. However, this is one industry where the things change quickly and hence sustainability of recent nos is very important.

Also the debt level is high.Interest is more than annual profit

Rajesh see the sept qtr they have reduced the debt level and net profit for half year is 6.5 cr

I think there growth in sales and profit and as well the book value and the net block growth and net cash flow indicates that sustainability is already visible as per the historical data.

which one is better for long term Ashiana housing or Poddar Devlopers?

Both look good. However, there is more clarity and comfort on Ashiana

Hi Ayush,

I am long term investor in MPS. Would be very helpful if you could share your views on Repro India.

Hi,

We are not tracking Repro.

Ayush,

Lot has been discussed about MPS after the Q3. Please help us understand your views on current MPS suituation please.

No change in our view. We continue to remain invested

hi ayush, can you please tell us how will you value ashiana housing other than using the pe.. and how does it stand valuation wise.. many thanks!!

Hi Ayush,

what is your view on entering CCL products at currents levels with 2 years time horizon?

Dear Sir, What is your view on DRDATSON

sir, kindly tell me whether i can purchase the shares of waterbase ltd at regular intervals, or do ;;you suggest avanti feeds, which is available at a much higher rate.regards muralidhar

Hi, Ayush

what are your important stock screening parameters. I look for sales growth, ROE, ROCE, dividend yield and positive cash flows.

What is your view on Rain Industries and zee media?